NBR plans to roll back tax benefits for exporters

In a bid to rationalise tax benefits and meet revenue targets set by the International Monetary Fund (IMF), the National Board of Revenue (NBR) is considering reducing tax exemptions for export-oriented sectors in the upcoming national budget, according to a top official.

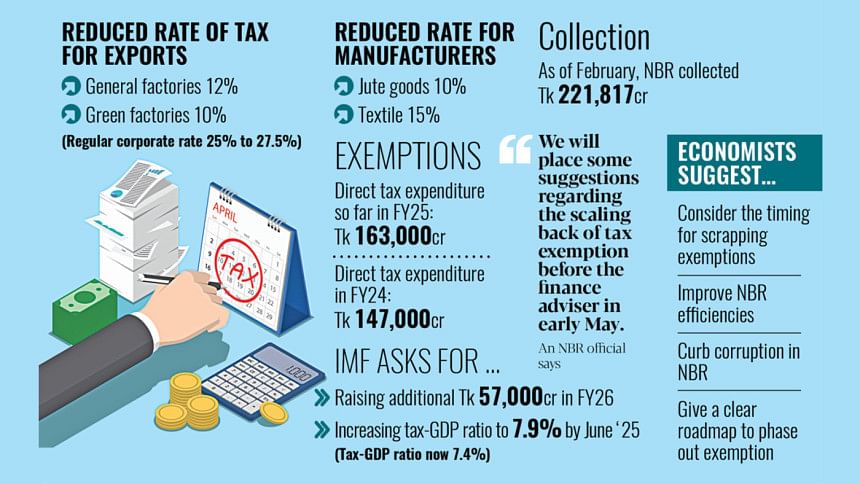

Industries such as readymade garments, footwear and frozen foods currently enjoy lower corporate tax rates — between 10 percent and 15 percent — compared with the 25 percent to 27 percent levied on non-exporting businesses.

Speaking on condition of anonymity, the NBR official confirmed that the plan is now at an early stage.

"To rationalise tax benefits, we will place some suggestions regarding the scaling back before Finance Adviser Salehuddin Ahmed in early May," he said.

The prospect of reduced tax benefits has rattled exporters, already wrestling with shifting global trade dynamics, including fresh US tariffs and Bangladesh's scheduled graduation from the least developed country (LDC) club in 2026.

Economists and policy analysts have also voiced concern, saying abrupt changes could harm the country's export competitiveness. They argue that better revenue collection and anti-corruption measures could yield greater results without hurting the export basket.

According to revenue officials, the planned cutbacks would be rolled out in phases. Some exemptions may be allowed to expire, while others could be curtailed by issuing statutory orders.

For instance, the tax break allowed to textile exporters in 2022 is set to expire this June. This may not be extended, the official said.

The readymade garment sector has been granted exemptions until 2028, which the official said might be cut short.

Apart from exporters, some other industries, such as jute, small textile mills, poultry and fisheries, are now enjoying lower rates. They currently pay between 5 percent and 15 percent, but may see rates gradually increase.

Ultimately, the NBR hopes to unify all exporters under a single tax structure, according to the official.

This fiscal year, the NBR estimates tax exemptions will cost the exchequer around Tk 163,000 crore — up from Tk 147,000 crore in 2023–24, which was equivalent to 2.91 percent of GDP.

Regarding the concerns of the exporters, the NBR official said, "Although the export sectors are under pressure, we have to accelerate revenue collection to meet IMF conditions through rationalisation of tax benefits."

NBR under IMF target pressure

To satisfy IMF requirements, the NBR has been tasked with collecting Tk 4.55 lakh crore in the 2024–25 fiscal year. This translates to monthly collections of more than Tk 60,000 crore over the remaining three months of the current fiscal year ending in June.

Achieving this goal will require a 19 percent increase in revenue compared to the previous year. Yet, by February, revenue growth had crawled to just 1.7 percent.

Internal NBR estimates show that revenue collection stood at around Tk 252,000 crore between July and March — well short of the annual target.

To minimise the gap, the revenue board has already hiked value-added tax (VAT) and supplementary duties (SDs) on nearly 100 goods and services, aiming to raise an additional Tk 12,000 crore this year.

But the IMF wants more.

For the next fiscal year, it has urged the NBR to not only meet the Tk 4.55 lakh crore target but also mobilise an extra Tk 57,000 crore by reducing exemptions and further raising taxes.

One NBR official called the target "high, ambitious, and unrealistic."

Officials told the IMF that scrapping all exemptions by June would be impossible, given the country's current economic challenges.

Of the additional Tk 57,000 crore demanded, the NBR believes it can raise only Tk 8,000 crore — about one-seventh — through new policy measures in FY26.

"We are still negotiating with the IMF officials," said a senior NBR official.

Another official commented that while the board does plan to gradually eliminate reduced tax rates across the board, doing so for the garment sector remains particularly challenging amid the new Trump tariffs, which are currently on a temporary three-month pause.

"The NBR is now facing a double whammy. We need to move very carefully," the official added.

Exporters on edge

Mohammad Abdur Razzaque, chairman of the Research and Policy Integration for Development (RAPID), criticised the move.

"I don't think so. It would be a totally unwise move amid such volatility and uncertainty," he said.

He suggested the NBR should instead remove other exemptions, excluding those given to exporters.

"Our balance of payments is under pressure, and forex reserves have not improved to an expected level," he added.

With Bangladesh set to phase out many tax concessions as part of its LDC graduation next year, Razzaque emphasised caution.

On several occasions, NBR Chairman Md Abdur Rahman Khan reiterated the board's commitment to rationalising tax incentives. But exporters remain apprehensive, pointing to a turbulent business climate and a bleak outlook for global trade.

At a pre-budget discussion at NBR headquarters in Agargaon yesterday, Inamul Haq Khan — a member of the support committee at the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) — said that changing the corporate tax regime could erode business confidence.

"Changing the corporate tax rate will erode the confidence of local and foreign entrepreneurs," he said, adding that the move also contradicts the spirit of the recently concluded investment summit.

Towfiqul Islam Khan, a senior research fellow at local think tank Centre for Policy Dialogue (CPD), urged the NBR to tackle inefficiency and corruption alongside any gradual withdrawal of tax breaks.

"Exemptions must be phased out gradually. But removing them all at once would put immense pressure on the economy," he said.

"A clear roadmap is needed. Even within the garment sector, there is room for diversification that should be explored. Improving efficiency and curbing corruption are key. With proper tax collection, these reforms would be far easier to implement," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments