No scope to cut corporate tax

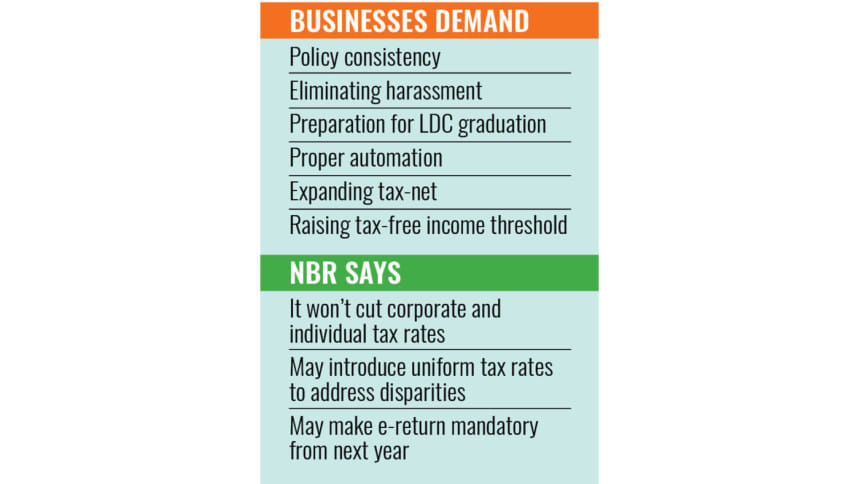

The National Board of Revenue (NBR) yesterday said there was no scope to reduce corporate or individual tax rates in the budget for the upcoming fiscal year, a stance that businesses opposed.

At a pre-budget discussion organised by the Dhaka Chamber of Commerce and Industry (DCCI), Daily Samakal and Channel 24 at the InterContinental Dhaka, NBR Chairman Abdur Rahman Khan said the national debt burden has increased over the past 50 years and those debts need to be repaid.

To do so, Bangladesh needs to collect more revenue from domestic sources, he stated.

"So, there is no scope to further reduce corporate and individual tax rates. If you look at developed countries, you will see that individual tax rates can go as high as 60 percent," he said.

"The mindset that business will happen only if tax exemptions are given should not exist."

At the same event, businesses complained of the harassment they face while seeking services from tax offices. As such, they demanded the automation of tax systems.

In response, Khan said steps are being taken to address challenges faced by businesses, adding that firms would be required to file tax returns online from next year. The NBR chairman also hinted at reducing existing tax exemptions to accelerate tax collection.

"We want a non-discriminatory tax regime. Sectors with long-standing exemptions must now pay the same rate as others," he said.

HOW DID BUSINESSES RESPOND?

Former Bangladesh Garment Manufacturers and Exporters Association director Asif Ashraf said the garment sector currently enjoys a 12 percent corporate tax rate.

"If this rate is changed midway, it will undermine investor and business confidence," he warned, adding that policy consistency was a key commitment highlighted during the recently concluded Bangladesh Investment Summit.

"We need policy support to increase production and strengthen the private sector, which is essential for boosting national output," said Abdul Awal Mintoo, former president of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI).

"We need policies that increase domestic demand. Without increased demand, there's no point in producing more because it won't be profitable," he said.

The business leader also criticised the policy inconsistency between the government and private sector.

"To reduce inflation, we have been following a contractionary monetary policy. But this restricts private sector credit. Businesses are struggling, some entrepreneurs are even selling homes to stay afloat," he said.

"For the private sector, we've imposed tight monetary policies, but for the government, it's still an expansionary stance," he added, referring to the increasing size of the budget year after year.

"This inconsistency is problematic."

Mintoo urged the authorities to frame a revenue and monetary policy that works for both the government and private sector.

"If one side is getting benefits and the other is being squeezed, that's not a real policy," he said.

He also said reducing harassment of taxpayers would help boost the country's tax-GDP ratio, which is among the lowest in the world.

"The low rate of return filing in Bangladesh is largely due to taxpayers' fear of harassment as soon as they submit their documents. So please ease the burden on those who pay taxes and take action against those who don't. We will fully support that."

Echoing those sentiments, former FBCCI president Mir Nasir Hossain urged the government to pay more attention to reducing its expenditure.

Mahbubur Rahman, president of the International Chamber of Commerce (ICC), Bangladesh, urged the government to prepare for the country's graduation from the list of least developed countries (LDCs).

"This transition will also mean the loss of certain benefits, such as duty-free and quota-free export privileges and relaxed conditions on development assistance. It may also potentially lead to a decline in exports," he said.

"In this context, failure to start preparing now could push our export sector out of global competition. To remain competitive in the post-LDC era, we must begin preparing our export-oriented industries and SMEs from now."

Former Commerce Minister Amir Khasru Mahmud Chowdhury urged the authorities to adopt a holistic approach to develop trade-facilitating infrastructure in an integrated way.

"We haven't been able to do that. This is a holistic matter. Development, trade facilitation, financial product innovation and taxation, everything must be integrated," he said.

"If we adopt an investment-centric model, we will return to the right path. Without investment, all this discussion about tax and GDP growth is meaningless. Our entire taxation model should revolve around how to attract investment."

Chowdhury added that the authorities should keep in mind where the country has comparative advantages, such as in manufacturing and other sectors.

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association, said there was scope to reduce the trade gap between Bangladesh and the US.

"Bangladesh can build a warehouse hub for cotton, which is likely to reduce lead time and distances," he suggested.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments