Govt to rationalise tariffs on around 350 items

The government is expected to rationalise tariff rates on numerous items next fiscal year to help Bangladesh prepare for challenges after graduation from least developed country (LDC) status in November 2026.

As part of the exercise, the National Board of Revenue (NBR) is likely to remove minimum import prices — a price it uses to assess duties on imported items — for over 40 items in FY26.

Besides, the revenue administration is also likely to streamline regulatory duties on around 230 tariff lines — the items listed in a country's tariff schedule — and rationalise supplementary duties on over 100 items, finance ministry officials said.

"We are taking preparations to adjust our tariff rates so that we can be compliant with the World Trade Organisation (WTO) rules applicable for developing countries," a senior official said.

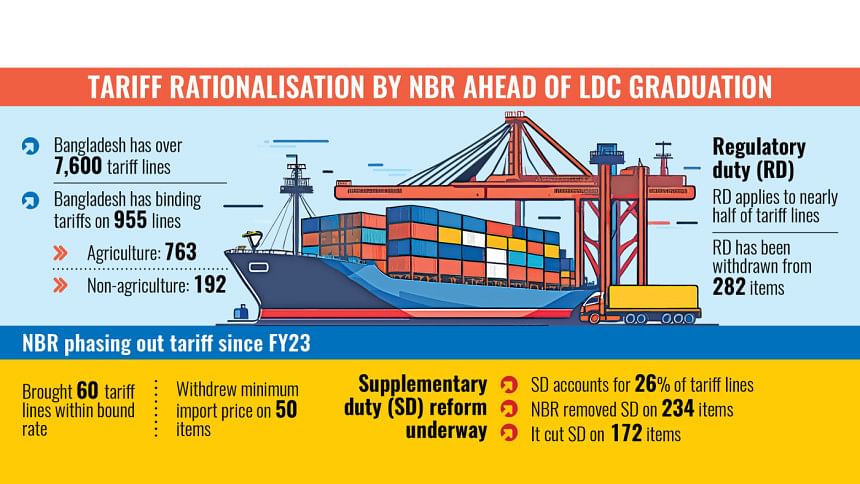

Bangladesh has 7,611 tariff lines. Its binding tariff commitment to the WTO covers 955 tariff lines, with 763 tariff lines for agricultural products and 192 tariff lines for non-agricultural items.

Of those, tariff rates on 60 tariff lines were higher than the binding rates committed by Bangladesh to the WTO when it acceded to the WTO in 1995 as one of its founding members.

The NBR began to rationalise tariffs in phases in FY23, in line with recommendations from a committee that was formed by the previous government in 2021 to prepare for possible challenges stemming from LDC graduation.

In the past two years, the NBR brought down tariffs on 60 items within the bound tariff rates based on the panel's suggestion.

The panel came up with the proposals following a study, which also favoured the rationalisation of supplementary and regulatory duties.

It said rationalisation has become particularly important in light of the country's upcoming graduation from the LDC club, which will require domestic industries to compete without reliance on import protection.

The study found that Bangladesh had imposed regulatory duties (RDs) on 3,565 tariff lines, around 47 percent of the total.

These duties ranged from 3 percent to 35 percent. However, in the fiscal year 2022–23, nearly 95 percent of the revenue from RDs came from just 250 tariff lines.

Following the panel's recommendations, the revenue board scrapped RDs on 282 items between FY23 and FY25. It also abolished the minimum import price on 50 items, a benchmark used for duty assessments.

The study also showed that supplementary duties (SDs) were applied to 1,926 tariff lines, accounting for 26 percent of the total. Most of these lines carried a 20 percent SD.

It was found that 154 items contributed over 85 percent of the revenue collected from SDs.

The panel proposed reducing SDs on items not deemed harmful or socially undesirable, especially those that are not produced locally and are unlikely to strain the foreign currency reserves.

However, it recommended maintaining high SDs on luxury goods such as cars and diamonds.

Acting on these suggestions, the NBR has so far removed SDs on 234 items and reduced them on another 172.

The remaining adjustments are expected to be carried out in the next fiscal year, following a time-bound plan devised to implement the panel's recommendations.

The study said that high levels of tariff protection can discourage domestic industries from pursuing export opportunities, as the local market offers higher profitability under such a regime.

"Therefore, the process of tariff rationalisation will create an opportunity for the policymakers to strike a balance between protecting import-substitute local industry through tariffs and creating a conducive environment for increasing competitiveness of exportable products and increasing the efficiency of local producers," it said.

According to the report, nearly half of Bangladesh's manufacturing sector, in terms of value added, is now export-oriented.

"Therefore, there is a need to focus on the export market along with the domestic markets."

The study also pointed out that efforts to streamline the tariff regime could help promote export diversification — an area where Bangladesh has long sought progress.

The panel said that with LDC graduation scheduled for 2026, Bangladesh will need to gradually lower import-stage tariffs.

It warned that once the country loses its unilateral duty-free market access, signing Free Trade Agreements (FTAs) will become essential to offset the impact.

"As Bangladesh may lose unilateral free market access after graduation, it will be necessary to start preparing for signing Free Trade Agreements (FTAs) to recuperate that loss," the report said.

It added that high customs duties and para-tariffs, such as regulatory and supplementary duties, would pose serious obstacles in securing FTAs.

"The process of tariff rationalisation will therefore help Bangladesh to increase its eligibility as a potential trade partner and engage effectively in trade negotiations," it added.

Local think tank Centre for Policy Dialogue (CPD) last month suggested aligning tax policies with WTO regulations to prepare for LDC graduation.

The independent think tank said Bangladesh has a binding coverage of 17 percent of tariff lines, which means 83 percent of tariff lines remain unbound.

"Bangladesh will continue to enjoy the flexibility related to tariffs on non-bound items even after graduation. NBR should be aware of and take advantage of this."

It said LDC graduation will mean that direct export incentives — 3–4 percent cash incentive for the export-oriented apparel sector, and the 20 percent cash incentive for agricultural exports — will no longer be permissible under the WTO.

"Such export incentives will need to be phased out and WTO-compliance ensured. To support exporters, Bangladesh will need to put in place other supportive measures that do not violate WTO regulations."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments