Krishi Bank to go more commercial

Locally-made sanitary fittings are on display at a shop in Dhaka. Demand for Bangladeshi sanitary accessories is gradually increasing in domestic markets.

Bangladesh Krishi Bank has planned to boost commercial banking from this year in addition to its traditional practice of dealing with farm credit only.

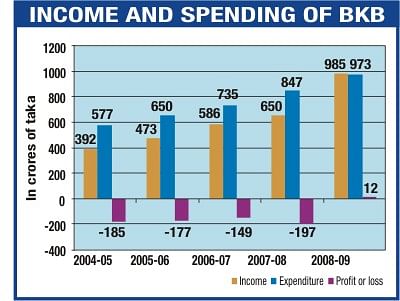

The change in the business model has encouraged the bank to set its profit target at Tk 350 crore for the current fiscal year, an increase of over 2,800 percent from Tk 12 crore last fiscal year.

“The target is achievable if the whole organisation becomes serious to utilise its potential,” said Khondkar Ibrahim Khaled, chairman of the state-owned specialised bank.

He said the bank has a wider network and a huge penetration rate across the country.

“The bank has a great possibility of procuring higher remittances due to its huge presence in rural Bangladesh,” said Ibrahim Khaled, a career banker who served in top positions of different organisations including the central bank as its deputy governor.

The Krishi (agriculture) Bank has also emphasised increasing export-import business from this year, according to the bank's business plan.

The bank was established in 1973 to lend farm credit and help rural people come out of poverty. It has a network of 952 branches, higher than any other banks in the country except state-owned Sonali Bank.

But the bank had been incurring losses since its inception mainly because of poor management and limited business pattern within the farm loan. It could earn Tk 12 crore profit only in fiscal 2008-09.

The bank has set deposit collection target at Tk 1,800 crore for the current fiscal year, over 23 percent more than the previous year. Loan disbursement target has been fixed at Tk 4,600 crore, an increase of nearly 15 percent than a year ago.

Export and import business have been set at Tk 2,000 crore and Tk 3,000 crore, an increase of nearly 50 percent and 30 percent respectively for fiscal 2009-10 than those of the previous year.

The growth of remittance has been estimated at nearly 60 percent to Tk 1,500 crore from only Tk 951 crore in 2008-09.

“The bank will be able to lend and subsidise more farmers if it can earn more from trade and remittances,” the chairman of the bank said.

If necessary, rural savings will be mobilised for export and import trade, he added.

[email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments