Car sales go up on higher demand

Sales of reconditioned cars rose in fiscal 2015-16 amid increasing demand from the middle-class, sellers said.

“The market improved further last fiscal year. It appears that political stability has played a big role in boosting the demand for cars,” said MA Hamid Sharif, president of Bangladesh Reconditioned Vehicles Importers & Dealers Association (Barvida).

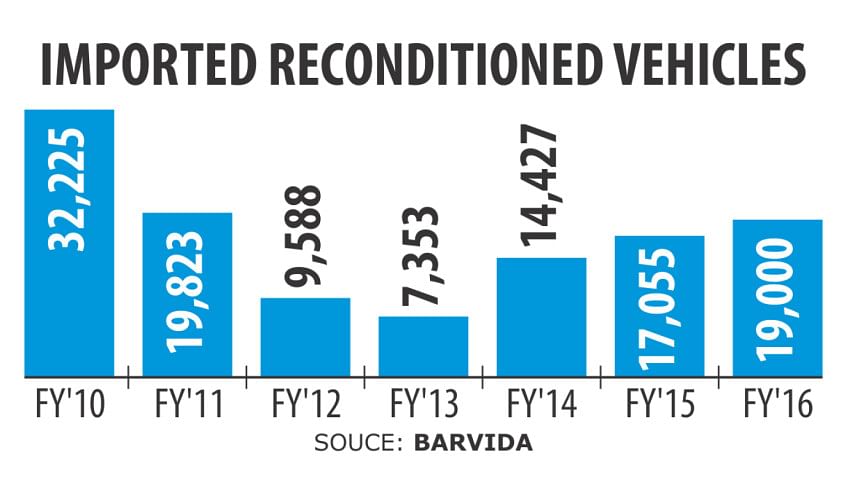

While no official annual sales data is available, the import data compiled by Barvida shows an 11 percent spike to 19,000 units in fiscal 2015-16 from a year earlier.

This was the third consecutive year in which import of reconditioned cars from Japan -- which makes up the majority of Bangladesh's car market -- increased on the back of the car loan facility for officials of public and private sector firms, Sharif said.

The depreciation of Japan's currency against the US dollar in the past and a consistent duty and tax policy have also enabled the old car sellers to log in higher sales, said the Barvida president.

“Cars became affordable to many because of the devaluation of Japanese yen last year.”

However, the demand for vehicles from industrial and trading sectors remained sluggish. “We see a similar trend from the real estate sector.”

A Board of Investment paper says that Bangladesh has a huge demand for automobiles for the increasing population, with a sales forecast of as much as $2.5 billion a year.

The country has to import cars from abroad in the absence of local manufacturing, with more than 80 percent coming in from Japan. The rest are imported from South Korea, China, Germany, India and other countries, according to BoI.

BoI said the demand for vehicles is rising as the economy of the country is growing.

“Over the last few years, the unemployment rate went down and foreign investment increased. As a result, many individuals now afford personal transportation facility,” BoI said. Political stability helped people do business easily, although private investment remained sluggish, said Abdul Haque, managing director of Haq's Bay, a car importer.

He said middle-class families were the main buyers of reconditioned cars. “Many middle-class families bought cars in their quest for safe travel in the absence of good public transport facility.”

Bangladesh has about 12 million of middle- and affluent-class people, accounting for 7 percent of the country's total population, according to a report by Boston Consulting Group, a global management consulting firm.

Two million Bangladeshis join the ranks of middle- and affluent-class every year, it said. Individuals with annual household income of $5,000 or more fall in the class.

The BoI paper said the demand for cars, motorcycles and commercial vehicles is higher in Dhaka and Chittagong.

However, both Sharif and Haque said the demand for vehicles, especially cars, will depend largely on the overall political situation this fiscal year.

“Things were good. But the terror attack in Gulshan seems to have impacted the market. Uncertainty and fear appear to have gripped many. People have become cautious about investing,” Haque added. Sharif said the market will grow if the overall investment scenario remains favourable.

But there is uncertainty about the future political situation, especially from the security point of view, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments