Revised budget for FY25: Ambitious revenue target in the works

The government has set an ambitious revenue growth target in this fiscal year's revised budget given that three major multilateral development partners are stressing ramping up domestic resource mobilisation.

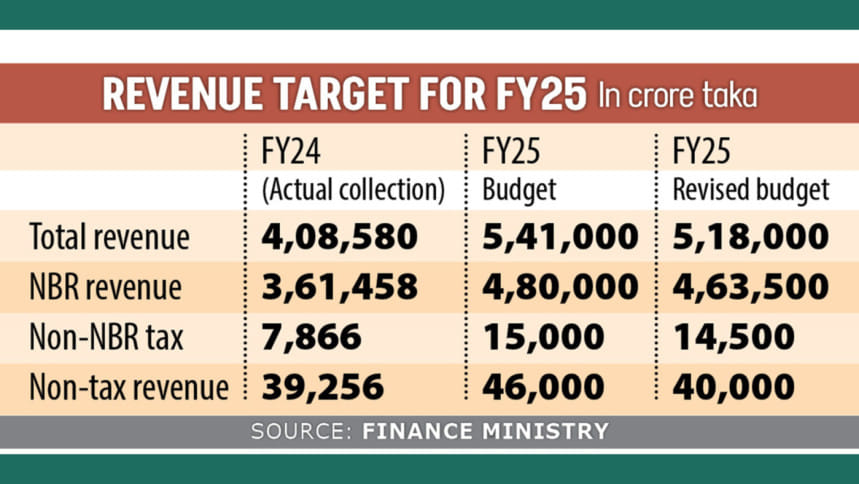

The revenue collection target for fiscal 2024-25 is likely to be set at Tk 5,18,000 crore, which is the floor set for tax revenue collection by the International Monetary Fund under its $4.7 billion loan programme.

The original revenue collection target for this fiscal year is Tk 5,41,000 crore.

For the revised target, revenue collection would have to increase by 26 percent from last fiscal year's collections.

In the first four months of the fiscal year, the revenue collection growth was 3.68 percent.

Of the revised revenue target, the National Board of Revenue (NBR) has been tasked with collecting Tk 4,63,500 crore.

To achieve the target, the NBR has to increase its collection by almost 28 percent from the previous fiscal year's actual collection although in the first six months, its revenue collection declined by 0.98 percent.

The World Bank, the IMF and the Asian Development Bank have all set higher revenue collection as their conditions for providing budget support, said a finance ministry official with direct knowledge of the discussions.

The three major lenders want Bangladesh to increase its tax-to-GDP ratio by 0.5 percent of GDP this fiscal year, he said.

The government is expecting that revenue collection will increase in the coming months due to its various measures, said another finance ministry official.

The measures include mandatory online submission of income tax returns by government officials and some other taxpayers, introducing a-chalan and making e-payment mandatory for depositing VAT of more than Tk 10 lakh.

Besides, the government has reduced the tax exemption facility, imposed 15 percent VAT on various goods and services and also introduced an online platform for electronic tax deduction at source, the official added.

However, due to high inflation, contractionary monetary policy, austerity measures in the financial sector and the sluggish annual development programme implementation, the NBR's revenue collection target might not be fulfilled, said an NBR official.

As a result, the NBR has requested the finance ministry to further reduce the revenue target in the revised budget, he added.

"In the context of the present macroeconomic situation, it will be difficult to achieve the revenue growth target," said Nasiruddin Ahmed, a member of the finance ministry's advisory committee on NBR reform.

There is a correlation between revenue collection and economic growth.

"Revenue collection will increase if the economy expands. If businesses expand and import grows, tax collection will automatically increase. Revenue collection cannot be viewed in isolation from the macroeconomic situation."

Proper enforcement of measures can also bump up revenue collection, said Ahmed, also a former NBR chairman.

"However, there is a significant deficit to this end as automation in revenue collection is not functioning properly while the existing laws were not amended adequately."

The advisory committee has made some proposals for major reforms including separation of VAT policy and administration.

"We are hopeful that the government will take a concrete step to this end by June. However, even if the proposed reform measures are implemented soon, its result may not come overnight," Ahmed added.

Development partners, including the IMF, are pressing for reforms, including the separation of VAT policy and administration, reducing tax exemptions and automation in tax administration and collection.

They have stipulated an ordinance that separates the VAT policy from the administration before releasing budget support or loan tranche.

Furthermore, they want to see specific steps for reduced tax exemption.

For this, the government has raised the VAT rates to 15 percent on nearly 100 goods and services. However, in the face of criticism, the government later rolled back the VAT rate hike from some of the goods and services.

"Raising the VAT rates suddenly on an ad hoc basis was not the right decision," Ahmed said.

The NBR's operation of VAT policy and administration under one institution is the main problem.

"They should be separated -- we don't want to see any compromised decision," he added.

According to the IMF's recent documents, the reforms that the lender wants to see in fiscal 2024-25's budget include reducing corporate income tax exemptions and depletion allowances and raising previously reduced VAT rates on several products to the full 15 percent statutory rate.

Besides, it also wants to see the introduction of an additional personal income tax bracket for high income earners and the increase in tax rates on tobacco and select products.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments