20 NBFIs may lose licence

Twenty non-bank financial institutions (NBFIs) with high levels of defaulted loans and an inability to repay depositors may lose their licences.

The NBFIs are: CVC Finance, Bay Leasing, Islamic Finance, Meridian Finance, GSP Finance, Hajj Finance, National Finance, IIDFC, Premier Leasing, Prime Finance, Uttara Finance, Aviva Finance, Phoenix Finance, Peoples Leasing, First Finance, Union Capital, International Leasing, BIFC, Fareast Finance, and FAS Finance.

The central bank recently sent letters to these institutions, asking them to explain why their licences should not be cancelled.

They have been asked to respond within 15 working days, according to central bank officials who spoke on condition of anonymity.

The officials said necessary actions would be taken after reviewing the responses, which may include mergers or liquidation of the institutions.

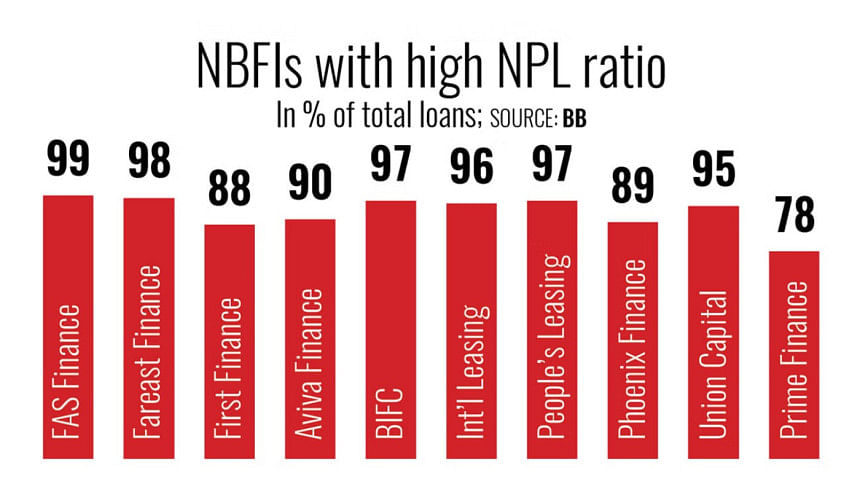

As of December last year, defaulted loans at 35 NBFIs stood at Tk 25,089 crore, or 33.25 per cent of their total disbursed loans, according to Bangladesh Bank data.

The data also showed that 12 of the 35 NBFIs held nearly 73.5 per cent of the sector's total bad loans.

At seven of the institutions, defaulted loans exceeded 90 per cent of their total disbursed loans.

For example, FAS Finance's default rate stood at 99 per cent, Fareast Finance at 98 per cent and Aviva Finance at 90 per cent. Bad loans at BIFC were 97 per cent, International Leasing at 96 per cent, Peoples Leasing at 97 per cent, and Union Capital at 95 per cent at the end of December last year, according to the data.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments