Engine oil market grows on high demand

The market for engine oils, known as lubricants, is growing rapidly, driven by an increasing number of motor vehicles in Bangladesh.

Of the Tk 1,000 crore lubricant retail market in 2009, the automobile industry consumed 77 percent, while the manufacturing sector consumed the rest, market data shows.

A study by Mobil Jamuna Ltd, a leader in engine oil blending and sales in Bangladesh, has projected lubricant consumption at 62,600 tonnes for 2010. Such consumption was over 60,000 tonnes in 2009 and 58,300 tonnes in 2007.

The study shows the engine oil market, which grows at 3 to 3.5 percent a year, has more potential to grow as thousands of new motor vehicles are plying the roads every year. World demand for lubricants is forecasted to advance 2.3 percent a year to 41.7 million tonnes in 2010.

However, a disruption in manufacturing and industrial activity because of the energy crunch has reduced the potential for further growth of the product.

“Engine oil consumption could easily grow by 5 to 6 percent annually, if there was a constant supply of gas and electricity,” Sanaul Haque, chief executive officer of Mobil Jamuna, told The Daily Star yesterday.

Mobil Jamuna, a joint venture of state-owned Jamuna Oil Company and Mobil Asia Pacific, set up its own blending plant in 2003 to blend and market quality lubricants for the growing Bangladeshi market. The company imports all ingredients, including base oil and additives to make lubricants.

Mobil Jamuna is also the first Bangladeshi company that is exporting lubricants. It exports to countries like Nepal and Bhutan. The company has exported lube oil worth more than $ 450,000 to Nepal in 2009. The export target for this year has been set at a million dollars.

Engine oil, also known as motor oil, is a liquid product used to lubricate various types of internal combustion engines, such as automobile and industrial engines. It is also used in marine, agricultural, train and aeroplane engines. The key function of the oil is to lubricate and clean the moving parts of machines or engines. It also prevents corrosion and rust and keeps the engines cool by carrying away the heat from the sliding parts.

The lubricant business in Bangladesh in the private sector is less than a decade-old. Until 2000, only the state-owned oil companies were allowed to import, blend and distribute lubricants here. At that time, majority lube oils (65 percent) contained no additives.

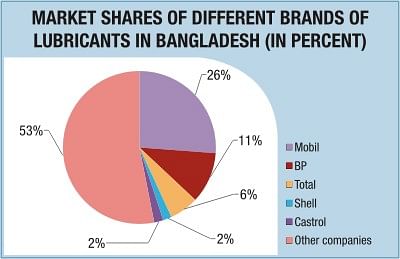

The government liberalised the market and banned non-additised lubricants in 2001, to ensure minimum standards. Since then, more than 50 brands of lubricants, including renowned multinationals, have entered the market. But half a dozen brands account for nearly 50 percent of the total business.

Mobil Jamuna's brand, Mobil, is by far the market leader with a 26 percent stake worth Tk 350 crore, followed by BP with 11 percent, Total 6 percent, Shell 2 percent and Castrol 2 percent. The rest 53 percent is dominated by low quality, low cost brands.

According to Azam J Chowdhury, chairman of Mobil Jamuna Limited, low-quality engine oil has become a concern, as it destroys an engine. “The industry needs government intervention to ensure the quality of engine oils."

A litre of low-quality lubricant costs only Tk 120 to Tk 130, whereas the price of a litre of oil by Bangladesh Petroleum Corporation is over Tk 150 and a minimum of Tk 240 by Mobil.

“A section of unscrupulous businessmen import used lubricants from Dubai by mis-declarations and recycle those for sale at a lower price,” Mobil Jamuna's CEO said.

[email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments