IMF talks end without deal on next loan tranches

Talks between the International Monetary Fund (IMF) and Bangladesh have ended in Washington, without any agreement over the release of the next fourth and fifth tranches of a $4.7 billion loan package.

"Good progress is being made, but I won't put a timeline on when we can reach agreement," said Krishna Srinivasan, director of the IMF's Asia and Pacific Department, during a press briefing held on the sidelines of the World Bank-IMF Spring Meetings.

"We have not reached a consensus but we are not far away," Bangladesh Bank Governor Ahsan H Mansur told reporters after meeting IMF officials on April 25 regarding the loan programme.

Led by Finance Adviser Salehuddin Ahmed, the Bangladesh delegation held a series of meetings with IMF representatives in Washington.

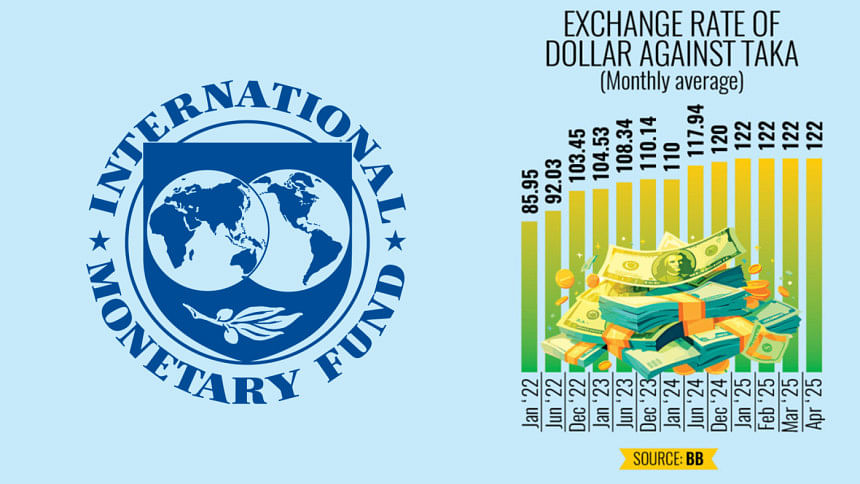

Prior to the delegation's visit, an IMF team concluded a two-week mission to Dhaka on April 17 without a staff-level agreement. Disagreements persisted over the flexibility of the exchange rate and measures to improve the country's revenue-to-GDP ratio.

We are under no compulsion to accept all their terms, as we are not in a situation like Sri Lanka or Pakistan

During the mission, IMF team chief Chris Papageorgiou said discussions were ongoing with the objective of reaching a staff-level agreement in the near term, possibly during the Spring Meetings in Washington.

An official of the Bangladesh delegation in the US said that, while progress had been made on measures to increase revenue collection, disagreements remained over the issue of exchange rate flexibility.

Speaking at the press briefing, Srinivasan said that two key areas, exchange rate reform and greater flexibility, still require further discussions. "On exchange rate reform, the IMF has long called for greater flexibility as part of its supported programme in Bangladesh," he said.

Srinivasan added that the IMF needed to see "more action and a clear timeframe" to ensure that policies were being properly implemented.

He also highlighted revenue mobilisation, describing it as "on the lower side' for Bangladesh, and essential for funding development priorities and investment.

Good progress is being made, but I won't put a timeline on when we can reach an agreement

"In addition to these areas, there are some questions about the health of the financial sector," added the IMF official.

Central bank Governor Mansur said, "We have reached consensus on the revenue issue. However, on the exchange rate issue, we think there is no problem. The market is stable. We have not sold a single dollar, nor have we intervened."

He made the comments in a media briefing posted on Facebook by Golam Mortoza, press minister at Bangladesh embassy in the United States.

"If we follow the IMF and the exchange rate becomes unstable, whether that is acceptable is our question," Mansur said.

"We will accept those conditions which are suitable for us. We are under no compulsion to accept all their terms, as we are not in a situation like Sri Lanka or Pakistan," he added.

"Six months ago, perhaps we were closer to that, but today our circumstances are much improved," said the Bangladesh Bank governor.

During the Washington meetings, the IMF proposed that Bangladesh maintain the crawling peg mechanism for Taka-dollar exchange rates, under which the central bank would intervene if the exchange rate fluctuated by more than 8 to 10 percent.

However, the Bangladesh Bank argued it must retain tighter control over the exchange market, citing manipulation and stubbornly high high inflation.

Officials said they do not think the time is right to introduce greater exchange rate flexibility right now.

However, after the Dhaka mission, Papageorgiou said, "This is, in fact, the right time to move towards greater flexibility."

"From the IMF's perspective, and based on the history of the reform process, we have been discussing this crawling peg for at least one or two years," he said.

A crawling peg allows a currency to fluctuate within a predetermined band, offering gradual adjustments rather than sudden shifts.

Referring to the implementation of the greater flexibility now, BB Governor Mansur said, "If the exchange rate rises to Tk 135 or beyond, what would happen to our macroeconomic stability, to the prices of oil and gas?"

Mansur, who worked at the IMF in his early career, commented that Bangladesh would compromise only where it found it acceptable.

"If we do not receive the IMF's loan, it will not derail us. We will continue with a tight monetary policy and tight fiscal policy, with or without IMF support."

He insisted Bangladesh's economy is not fragile and that reforms, especially in the banking sector, must continue to stabilise the exchange rate through broader macroeconomic stability.

"The IMF can play a supportive role, but if some of its recommendations are not suitable for us, we will not accept them," he said.

"Discussions are ongoing. If we get the funds, it will be good, but if not, it is not critical. Our main focus remains on implementing reforms, while financing is secondary."

"We know what is happening within the country," said the governor, pointing to a surge in exports, with apparel exporters reportedly booked through to next Christmas.

"We are optimistic about our export earnings, although the IMF appears to fear a slowdown similar to other economies," he said.

"Frankly, we have no problem if we do not get the IMF's financial support, which was meant to cover the balance of payments deficit."

Describing the IMF loan as merely a "sweetener", he said its absence would not impact the country significantly.

"Our reserves are stable, we are not selling dollars, and exports are rising. We are hopeful of achieving double-digit export growth, so there is no crisis in the balance of payments."

He said that discussions with the IMF are largely centred on reforms in the financial and revenue sectors, and that Bangladesh values the IMF's attention to these areas.

"Ensuring the autonomy of the Bangladesh Bank is far more important than securing funding. A strong, independent central bank will protect the financial sector from political interference," Mansur said.

He commented that Bangladesh should be cautious about relying on budget support loans, as they must be repaid and do not contribute to long-term investment.

"We must move away from this approach," he said.

In December 2024, an IMF mission visited Dhaka to review Bangladesh's progress in meeting conditions for the fourth tranche of the loan, initially scheduled for a board decision on 5 February this year.

However, delays occurred as Bangladesh fell short of prior conditions related to revenue collection and exchange rate flexibility.

The government was later informed that the matter would be placed before the IMF board in March.

Subsequently, it was decided that the fourth and fifth tranches would be combined, prompting the review mission that visited this month.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments