Sales of trucks rebound on pent-up demand

Even amid a business slowdown, sales of heavy-duty trucks and covered vans showed a year-on-year increase last year, according to company and vehicle registration data, as commercial vehicle distributors attribute this rise to pent-up demand since the pandemic.

Industry insiders also link this resurgence to the usual fleet replacement cycle, as transport operators upgraded their ageing vehicles rather than expanding their fleets amid economic uncertainties.

According to them, while economic challenges cloud business activities, the demand for commercial vehicles remains steady, driven by essential sectors such as logistics, e-commerce, and manufacturing.

Key players in the local market include Indian brands Ashok Leyland, Tata, and Eicher, Japanese brand Hino, and Chinese brand Foton.

Local distributors of these vehicles forecast that the need for trucks and covered vans will also remain strong in the coming years.

Trucks and covered vans are essential for local goods transportation, supporting industries such as garments, pharmaceuticals, fast-moving consumer goods, agriculture, and e-commerce.

Sales of these vehicles—a rough proxy for gauging the country's business activity and economic performance—had been sluggish since the Covid outbreak.

The situation worsened with the Russia-Ukraine war breaking out in 2022 and the country facing a severe dollar shortage due to higher import bills, according to Hafizur Rahman Khan, chairman of Runner Group, the local distributor of Indian Eicher trucks.

Faced with dwindling dollar stocks, the government imposed restrictions on opening letters of credit (LCs), which hampered sales, Khan said.

"Besides, the weakening taka against the US dollar saw vehicle prices go up, discouraging potential buyers from making purchases."

Now, as the interim government has eased some of the LC restrictions and allowed vehicle imports, sales picked up in the last quarter of last year, Khan said.

"The overall sales recovery last year was due largely to sales improvement in the October-December quarter," he added.

However, Taskeen Ahmed, vice-chairman of IFAD Group, the local distributor of Ashok Leyland, said the market showed signs of recovery as commercial vehicle operators began replacing their ageing fleets.

"The increase in sales of covered vans and trucks is linked to regular fleet replacement rather than overall economic growth," he commented.

Ahmed pointed out that the commercial vehicle market in the country is relatively small, with only a few key players. This makes it easier to analyse market trends and predict demand shifts.

"While new purchases may not be driven by business expansion, the necessity of fleet renewal ensures steady demand," he added.

ACI Motors, the distributor of Chinese commercial vehicle giant Foton, recorded 82 percent growth in 2024 compared to the previous year, according to Subrata Ranjan Das, deputy managing director of ACI Motors.

He said that misconceptions about Chinese products are now being cleared, which is positively impacting sales. Besides, the fuel efficiency of Foton trucks and covered vans has boosted buyer confidence.

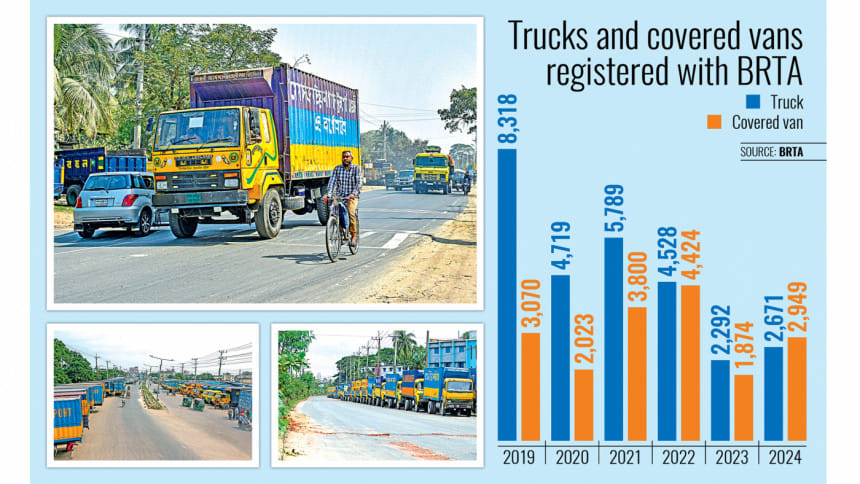

In 2023, 1,874 new covered vans were registered, while in 2024, 2,949 were added, according to the latest data from the Bangladesh Road Transport Authority (BRTA). This indicates a 57 percent increase in new registrations.

On the other hand, truck registrations in 2024 stood at 2,671, whereas in 2023, it was 2,292, according to BRTA data. This represents 16.5 percent growth.

Das said that this does not reflect the actual sales data, as there is scope to register vehicles after purchase.

Suvenkar Gosh, general secretary of the Bangladesh Bus Truck Owners Association, said the number of covered vans and new trucks on the road has increased.

Although sales of covered vans and trucks grew last year, the actual transport business declined by around 40 percent, he commented.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments