Financial statement fabrication a big influence on market volatility

Fabricated financial statements is one of the main causes behind the volatility of Bangladesh's stock market, according to industry analysts.

When an analyst or potential investor evaluates fabricated or misleading data, then he or she will not be able to make a proper forecast.

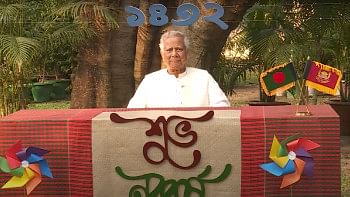

"This is how they lose money and in turn, the market becomes volatile," said M Khairul Hossain, chairman of the Bangladesh Securities and Exchange Commission (BSEC).

Hossain made these comments during a seminar titled, 'Financial Statements Analysis and Detection of Fraud', which was organised by the Bangladesh Academy for Securities Market (BASM) at the BSEC headquarters in Dhaka yesterday.

Globally, most companies provide factual information on their financial statements so that interested parties can effectively decide whether to invest or not. However, the case is opposite in Bangladesh.

BSEC, the regulator of the Dhaka Stock Exchange and Chittagong Stock Exchange, oversees both listed and non-listed companies and many market intermediaries. However, the organisation has only 84 officers to run their operations.

On the other hand, Bangladesh Bank, which solely regulates the banking sector, have seven to eight thousand people in employment.

"So, we are powerful but helpless as a regulator," Hossain said.

To ensure accountability and trust on financial statements, BSEC recently realised its long-standing plan to form a Financial Regulatory Council (FRC), he added.

The government established the FRC in 2016 under the Financial Reporting Act with the intention to ensure transparency in financial reports submitted by listed and non-listed companies.

A company's financial statements reflects how well the business is doing but seeing as most companies in the country provide false information, investors do not trust their statements.

The FRC is trying to find out why companies continue this malpractice and how to fix the situation. Since auditors are appointed by the companies, the chairmen of those firms can dictate the report.

"So, we are trying to have auditors appointed by the FRC so that they can work freely," said Mohammad Mohiuddin Ahmed, executive director of the Financial Reports Monitoring Division at the FRC.

Farhad Ahmed, executive director of the BSEC, echoed the same, saying that if listed companies provide good financial reports, it reflects how well the country's stock market is doing.

"That is why there is no alternative to the truth for trustworthy financial reports," he said. At the event, the BSEC chairman also revealed the statistics page of the Customer Complaint Address Module (CCAM), an online portal for stock investors to share their grievances, so that people could see how many issues had been resolved.

In the last six months (September to February), 206 complaints were submitted, of which 94.7 per cent, or 195 complaints, have been addressed.

The average amount of time required to settle each complaint is about 15 days.

Mahbubul Alam, director general of BASM, Shuvra Kanti Choudhury, managing director of Central Depository Bangladesh, Hasan Imam Rubel, president of Capital Market Journalists Forum, Mohammad Salahuddin Chowdhury, Assistant professor Finance Department of Dhaka University, also spoke at the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments