Culture of impunity the main scourge of stock market

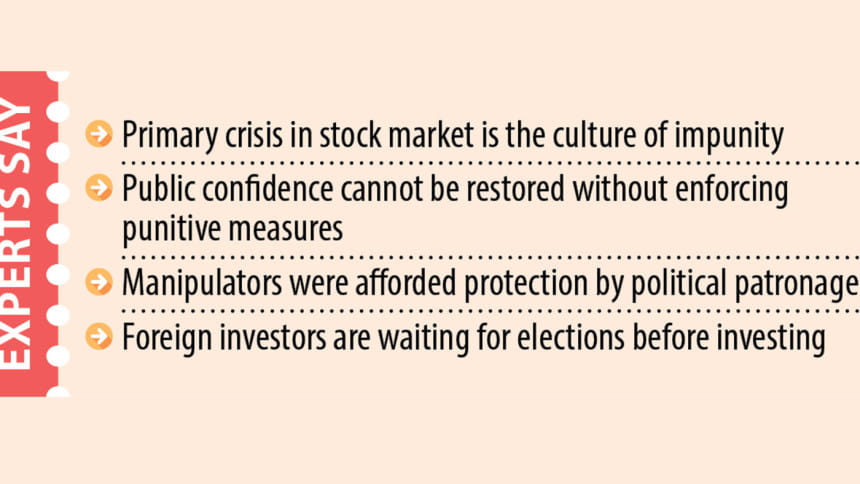

The primary crisis plaguing the stock market is a culture of impunity, which has severely affected numerous investors. As such, public confidence cannot be restored without enforcing punitive measures against manipulators and ensuring good governance, said Debapriya Bhattacharya, a distinguished fellow at the Centre for Policy Dialogue (CPD).

When the stock market crashed in 2010-2011, around Tk 20,000 crore exited the market. Of that, Tk 15,000 crore was laundered, he said while presenting the keynote presentation at an event titled "Capital Market in Bangladesh's Political Discourse: Philosophy and Practice," organised by the DSE Brokers Association of Bangladesh (DBA) at the DSE Building in Nikunja yesterday.

"This led to thousands of people becoming destitute, but no justice was served. Without punishment, wrongdoing and corruption cannot be prevented," Bhattacharya said.

Irregularities were first unearthed in the modern capital market in 1996, but manipulators shielded themselves using the protection afforded by political patronage. Due to a lack of justice then, a similar scenario arose again in 2010.

Similarly, many companies whose performance is not up to the mark got listed on the market. "Moreover, stocks of these companies were manipulated," Bhattacharya added.

However, most of these companies did not face the music either.

Without fixing these problems and ensuring proper punitive steps, any "quack remedy" of reform will not work in reviving investors' confidence, the noted economist said.

BNP Standing Committee member Amir Khasru Mahmud Chowdhury said foreign investors want to invest in Bangladesh's stock market, especially in the manufacturing sector, service sector, and even in bonds, but they are waiting for the national elections.

"I have connections with many fund managers who want to invest in Bangladesh considering its potential, but they are waiting for elections. Some of them manage $10 billion, and some $20 billion," he said.

"Globally, trillions of dollars—most of which come from nations' sovereign funds, insurance companies, and institutional investors—are channelled to stock markets across the world," he said.

"Of that, Vietnam gets $300 billion. If Bangladesh can get $100–$200 billion, it will change the capital market," he added.

He also said that Bangladesh's stock market is completely disconnected from the economy, meaning it may not do well even if the economy is booming, since the government did not "own it".

Instead, the stock market became more akin to a casino over the last 15 years, he said.

M Masrur Reaz, chairman & CEO of the Policy Exchange of Bangladesh, said there are three reasons for the present situation of the stock market.

The chief reason is that the banking sector got priority in every sphere due to the political nexus formed by owners. Policy and regulatory failures in the capital market and the absence of the stock market from national economic strategies were the other key reasons.

Chowdhury, also a former commerce minister, said all the intermediaries should run on a self-regulatory basis while the BSEC should provide oversight only.

Bhattacharya stressed that the regulator must be smarter than the market. He also emphasised self-regulation.

Md Mohsin Chowdhury, a commissioner of the BSEC; Sayema Haque Bidisha, pro-vice chancellor of the University of Dhaka; Mominul Islam, chairman of the DSE; Md Mubarak Hossain, a member of the central executive council of Bangladesh Jamaat-e-Islami; Tajnuva Jabeen, joint convener of the National Citizen Party; and AKM Habibur Rahman, chairman of the Chittagong Stock Exchange, spoke as panelists.

Prof Mushtaq Hussain Khan, a member of the interim government's Anti-Corruption Reform Commission; Mahtab Uddin Ahmed, president of the Institute of Cost and Management Accountants of Bangladesh; and Ifty Islam, chairman of Asian Tiger Capital Partners, also spoke at the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments