Budget should draw clear roadmap for smooth LDC GRADUATION

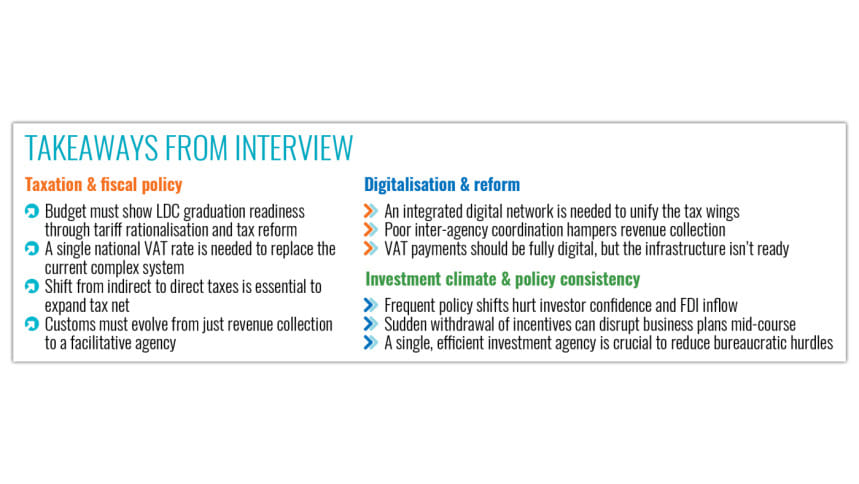

The upcoming national budget must outline a comprehensive roadmap to prepare for the country's graduation from the least developed country (LDC) club in 2026, prioritising tariff rationalisation, tax reform, and sustainable fiscal policies, according to a leading business leader.

"As Bangladesh approaches LDC graduation, the budget must demonstrate our readiness through tariff rationalisation and tax reforms," said Zaved Akhtar, president of the Foreign Investors' Chamber of Commerce and Industry (FICCI).

In an interview with The Daily Star, Zaved emphasised fiscal measures that support compliant labour practices, sustainable business models, and alignment with environmental, social, and governance (ESG) standards -- key considerations for the post-LDC landscape.

First and foremost, he said that Bangladesh's tax system must be simplified by introducing a unified national value-added tax (VAT) rate.

"Our tax structure is complex, with multiple VAT rates across sectors. We need to simplify it by adopting a single national VAT rate, akin to the goods and services tax (GST) model used in other countries," said the FICCI president.

The existing system, fragmented by varying rates, creates confusion and compliance issues, according to the business leader. The question now, he said, is how effectively this transition can be implemented.

"We cannot impose a unified VAT nationwide overnight. Instead, we should pilot it in a specific region, assess its impact on revenue collection, and then gradually expand to other areas and sectors," suggested Zaved, who is also the chairman and managing director of Unilever Bangladesh Ltd.

He advocated for reducing reliance on indirect taxes by broadening the direct tax base.

"We need to focus on expanding the tax net to capture more taxpayers, instead of over-relying on regulatory and supplementary duties," he said.

Zaved also called for transforming customs from a revenue-centric body to a facilitative agency.

"There's a misconception that customs only exist for revenue collection. It must also act as a facilitator," he said, adding, "We need an integrated digital information network that connects all tax departments."

Currently, these departments rarely communicate, hindering effective revenue collection, he commented.

"Better coordination with other government agencies could unlock significant revenue potential. If such interconnection is enabled, different government verticals could synchronise their services," Zaved said.

On the National Board of Revenue's (NBR) push towards cashless transactions, he said, "We talk about a cashless society, yet the infrastructure is far from ready. So how can we realistically transition to it?"

Sharing a personal experience, the Unilever Bangladesh chairman said, "Despite all the talk of a 'cashless market', when I pay VAT to the government, it can't be done digitally. I have to withdraw cash and pay the relevant officials. Why can't it go through the system directly?"

Therefore, he urged the authorities to raise the Tk 36 lakh cap on annual cash transactions to qualify for the reduced 25 percent corporate tax rate.

"We are hopeful that the NBR will introduce a forward-thinking, investor-friendly revenue policy -- one that curbs leakages while encouraging a competitive tax environment," he said.

'POLICY CONSISTENCY A MUST FOR ATTRACTING FDIs'

Foreign direct investment (FDI) in Bangladesh has remained persistently low, hovering below 1 percent of gross domestic product (GDP).

"We're even trailing behind Pakistan in attracting FDI," Zaved said.

But Bangladesh holds huge potential to draw foreign investment in sectors such as leather and agricultural processing, from farm-level operations to the full supply chain.

"To tap into this potential, policy consistency is crucial. One of our biggest weaknesses is the frequent and abrupt policy shifts," he said.

The business leader cited a recent example of an incentive scheme for electronics products that was withdrawn without prior notice last year.

"I understand the government had its reasons, but you can't just pull an incentive mid-flight. Investors might have already set up factories based on that incentive. At the very least, you should announce a future termination date rather than a retroactive withdrawal," he said.

Reflecting on the recent Bangladesh Investment Summit, Zaved said, "The summit helped restore some credibility for Bangladesh. It sent a positive signal that the country remains on track despite recent political changes."

'REFORM TO RETAIN INVESTORS'

The FICCI president identified two major reforms to increase investment. First, the separation of the NBR's policy and administrative functions, a process that is already underway.

Secondly, he sought the consolidation of investment facilitation agencies.

At present, investors navigate multiple agencies, such as Bangladesh Export Processing Zones Authority (Bepza), Bangladesh Investment Development Authority (Bida), Bangladesh Economic Zones Authority (Beza), Hi-Tech Park Authority, which he said "creates unnecessary confusion".

Zaved urged the government to set up a single investment authority to simplify the services.

"Investors shouldn't be running between 141 departments to get approvals. We need a genuine one-stop service that handles everything from licences to utilities -- like a relationship manager in banking," he said.

"If Bangladesh remains complicated while other countries simplify their systems, we'll keep losing out," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments