Banks’ deposit growth contracts in anticipation of interest rate cap

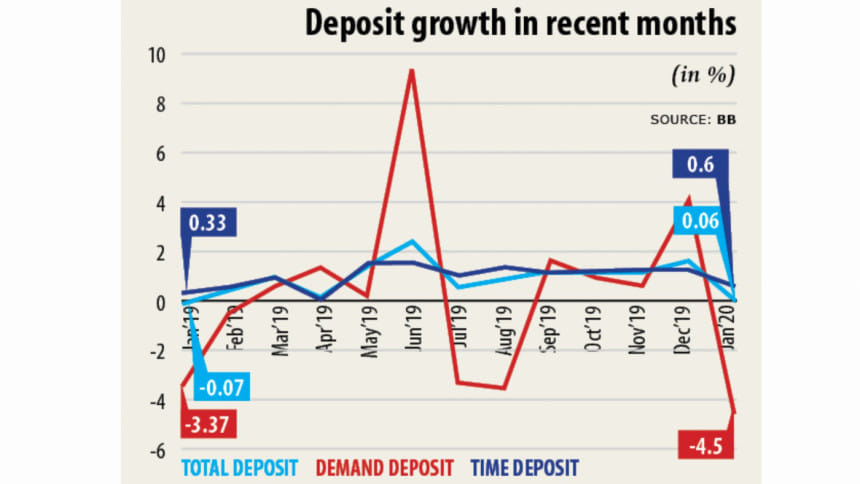

Deposit growth in banks saw a steep decline in January, in a development that can be viewed as the direct impact of the capping of interest rate on savings to 6 per cent.

Earlier on December 30 last year, the government announced capping of interest rates on deposits at 6 per cent and on loans at 9 per cent.

Many banks started to implement the 6 per cent interest rate on their fixed deposit schemes from the third week of January as part of their preparation to provide loans at 9 per cent interest from April 1.

The Association of Bankers, Bangladesh (ABB), a forum of managing directors of banks, though took the decision to provide not more than 6 per cent for FDRs from February 1.

In January, banks' deposits stood at Tk 1,138,632 crore, up 0.06 per cent from the previous month, according to data from the central bank. January's deposit growth is the lowest since February last year.

However, in January last year the deposit growth was 0.07 per cent in the negative. Between February and December last year, deposit growth hovered between 0.46 per cent and 2.38 per cent.

The Daily Star spoke with least 10 officials of both the central bank and banks to unearth the reasons behind the downward trend of the deposit growth.

Banks will have to wait another two-three months to gauge the impact of the 6 per cent interest cap on deposits, said a portion of the bankers with a direct link to mobilising funds and analysing the deposit trend as well.

"We should spend more time to understand the impact of the 6 per cent interest cap on deposits," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

Lenders usually try to show a strong balance sheet in December given the year end, so they take it easy in the new year.

"Banks expedite their drive for mobilisation of fund during the period, which widens their deposit volume," said Rahman, also a former chairman of the Association of Bankers, Bangladesh, a forum of managing directors of banks.

But Dhaka Bank Managing Director Emranul Huq said that the 6 per cent cap had an adverse impact on his bank's deposit volume.

Between January and February this year, customers withdrew about Tk 600 crore from the bank because of the lower interest rate.

"Some government organisations have also withdrawn their deposits," Huq said.

A good number of the depositors might have started to shift their funds from banks to government savings tools to enjoy a good return, he said.

Trust Bank Managing Director Faruq Mainuddin Ahmed echoed the same.

"There is no reason for the declining deposit growth other than the 6 per cent interest cap," he said.

Standard Bank has not allowed its customers to keep their fixed deposits at more than six per cent interest, said its Managing Director Khondoker Rashed Maqsood.

Deposit growth may decline in January as banks take some time to set their annual target, he said.

"We should take more time to realise the impact of the 6 per cent interest rate on deposits," he said.

Banks have also taken a cautious stance towards disbursing fresh loans as they think that deposit growth may decline in the coming months.

This has resulted in a massive fall in private sector credit growth in January.

In January, the year-on-year credit growth stood at 9.20 per cent, down from 9.83 per cent from recorded for the previous month, according to data from the central bank.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments