Bangladesh has potential to become digital powerhouse

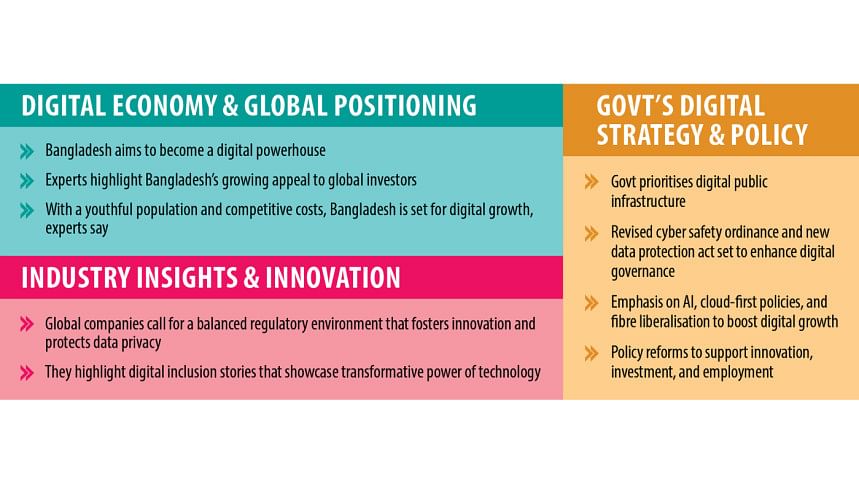

Bangladesh has all the potential to position itself as a rising digital powerhouse through the development of one of the top-tier e-governments and by increasing ICT exports and cultivating a tech-savvy workforce, said experts yesterday.

They said backed by a youthful population, competitive costs, and ongoing progressive policy reforms, the country is drawing increased attention from global investors in sectors ranging from fintech and semiconductors to digital services.

The remarks came at a session on "Digital Economy" on the sidelines of Bangladesh Investment Summit 2025 organised by Citi in partnership with Bangladesh Investment Development Authority (Bida) and United Nations Development Programme (UNDP) in Dhaka.

Faiz Ahmad Taiyeb, special assistant to the chief adviser with executive authority of posts, telecom and ICT, said the government was prioritising "Digital Public Infrastructure" (DPI) by first establishing a strong legal and regulatory foundation.

He said a revised "Cyber Safety Ordinance"—focused on protecting democratic values and human rights—was set to be published soon, alongside a new "Personal Data Protection Act" under a data governance authority.

Emphasis is being placed on AI and cloud-first policies, fibre liberalisation, internet cost reduction, and flexible licensing to remove barriers to digital growth. The government also plans to introduce a national electronic ID system for authentication, he said.

He said committed to supporting innovation and investment, the government seeks employment creation from businesses in return. All policy support—electricity, internet, land, and tax reforms—will be provided to foster a thriving digital economy, he said.

Ruzan Sarwar, head of public policy for Bangladesh and Nepal at Meta, emphasised the importance of creating a balanced regulatory environment that encourages innovation while safeguarding data privacy.

She underscored Meta's support for smart regulation, urging governments to engage with tech industry experts when drafting legislation.

Highlighting the drawbacks of Bangladesh's past punitive "stick" approach, she called for a more attractive, incentive-based "carrot" model to draw in global companies.

Grameenphone CEO Yasir Azman, reflecting on the mobile company's 28-year journey, emphasised how Telenor's first Asian investment has grown into Bangladesh's leading telecom company.

The company has contributed over Tk 1.3 trillion to the national exchequer in direct and indirect taxes since inception and empowered millions, he said.

He highlighted real-life stories—from a young girl in a tea garden continuing her education with shared digital access, to a rural designer using YouTube to run a micro-business, and a mango farmer now exporting to Germany.

These stories, he argued, embody the transformative power of digital inclusion.

Azman stressed that true return on investment comes when businesses empower communities through connectivity, innovation, and responsible practices.

He also said the government's commitment was to make policies more business-friendly, which would invite global investors to join Bangladesh's journey of transformation.

Emphasising the youth potential, demographic strength, and regulatory reforms, he urged investors to look beyond challenges and believe in the possibilities.

Kamal Quadir, founder and CEO of bKash, reflected on the company's 15-year journey, emphasising its impact on 80 million customers.

He also spoke about Bangladesh's vibrant spirit and social mobilisation, noting that despite many challenges, people here remain hopeful and driven. This energy fuels bKash's mission daily, he said.

He said bKash leveraged mobile connectivity to deliver inclusive financial services.

Traditional banking models, he argued, were not designed for the unbanked to adopt banking services easily, but mobile infrastructure allowed for personalised, low-cost financial solutions.

He also highlighted the central bank's pivotal role in enabling bKash through forward-thinking regulation, ensuring the protection of customers' money and the viability of the fund.

With 350,000 agents nationwide, bKash has built a grassroots network where 77 percent of revenue is shared with local agents and distributors, incentivising their commitment, he said.

Quadir acknowledged the challenges of managing vast cash flows and said bKash was confident in its mission to bring secure, accessible financial services to every corner of Bangladesh—turning a simple idea into a transformative force.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments