Agent banking drives rural remittance boom

Bangladesh's agent banking network is continuing to play a transformative role in the country's financial system, especially through the channelling of remittances through agent outlets.

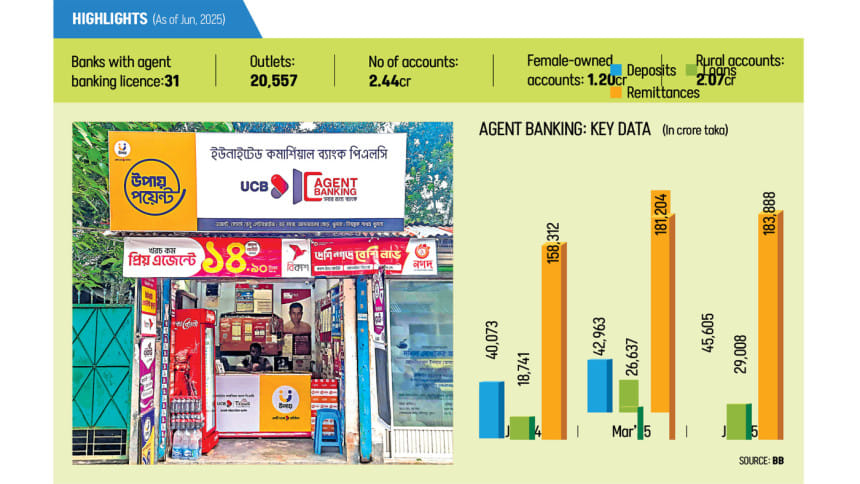

Remittance amounting to Tk 1,83,888 crore was routed through the agent outlets in the April-June period of fiscal year 2024-25, according to Bangladesh Bank's latest quarterly report.

This was a year-on-year growth of 16.15 percent.

Moreover, an overwhelming 90 percent of the remittance reached rural recipients.

According to the central bank data, three banks accounted for more than 90 percent of the total agent-based remittance disbursement. This highlights growing concentration in the segment.

Islami Bank topped remittance distribution via agent outlets in April-June. Dutch-Bangla Bank ranked 2nd, followed by Bank Asia

Industry experts believe agent banking has quietly emerged as one of the most effective, yet underreported, channels for remittance distribution, particularly for reaching rural and previously unbanked populations.

Introduced in 2013, agent banking was designed to serve as a secure and alternative delivery channel for financial services in remote areas beyond the reach of traditional bank branches.

"This milestone is not just a number; it reflects a fundamental shift in how financial services are being extended to the furthest corners of the country," said Arief Hossain Khan, spokesperson of the Bangladesh Bank.

"Agent banking is no longer a pilot initiative. It has evolved into a mainstream distribution channel for remittances, empowering families and promoting inclusive finance," he added.

He further noted that the expansion of agent banking is "revolutionising the financial ecosystem in rural Bangladesh" and complements the government's efforts in channelling remittances through legal and secure means.

According to the report, Islami Bank Bangladesh PLC accounted for the highest share of remittances distributed through agent outlets, with over Tk 1.01 lakh crore or 55.08 percent of the total volume of the April-June quarter.

It was followed by Dutch-Bangla Bank PLC with nearly Tk 51,143 crore and Bank Asia PLC with Tk 14,253 crore.

Anis A Khan, former chairman of the Association of Bankers, Bangladesh (ABB), said Dutch-Bangla Bank's technological integration and deep rural reach have positioned it as a dominant force in agent banking.

"Meanwhile, Islami Bank's longstanding trust among migrant workers has given it a consistent edge," he said.

Khan noted that the implications of this growth go far beyond financial metrics.

"Remittance remains the financial backbone of many rural families. Faster, easier access through agent banking means quicker investment in education, healthcare, and small enterprises," he said.

"This model has now become a vital driver of financial inclusion," he added.

Agent banking outlets, operated by local representatives using point-of-sale (POS) devices and mobile connectivity, allow beneficiaries to receive remittances within minutes of being sent.

These outlets ensure transaction security, eliminate the need for middlemen, and reduce reliance on informal channels.

CASH AT THE DOORSTEP

"The government provides a 2.5 percent cash incentive on remittances, and I don't have to visit the bank branch," said Bibi Hazra, a 60-year-old resident of Shamergaon village in Senbagh upazila of Noakhali.

Her three sons, who work in Qatar, Dubai, and Oman, send money through official banking channels.

Once she receives the PIN by phone, she presents it to the local agent banking agent and receives the money, including the cash incentive, within minutes.

"I no longer have to travel long distances or wait in queues," she added.

According to the central bank report, banks leading in remittance distribution have heavily invested in digital infrastructure to power their agent banking networks.

Many now offer mobile apps for both remitters and recipients, while biometric authentication ensures secure and swift transactions, it said.

Outlets are typically equipped with tablets, biometric scanners, and safes -- making them fully capable mini-branches in areas where traditional banking is not viable.

The recipients' transaction details, such as the number, name, and amount, are entered into the respective bank's server before cash is disbursed, said Asma Akter, a staff member of Bank Asia's agent banking outlet in Dharkhar, Akhaura upazila of Brahmanbaria.

After signing a receipt, the transaction is marked "completed" in the system. For each remittance transaction, the agent outlet earns Tk 53 in service fees, she added.

Officials from Bank Asia and Dutch-Bangla outlets in the area say they handle Tk 5 lakh to Tk 6 lakh daily. Despite the rapid growth, the sector faces structural challenges.

According to the BB data, 30 banks are licensed to operate agent banking services, but only a few dominate the remittance disbursement landscape.

Moreover, the report highlighted a gender gap, noting that female recipients continue to account for a disproportionately small share of loans and financial services accessed via agents.

The loan-to-deposit ratio in agent banking stood at 63.61 percent in the reporting quarter, indicating a deposit-heavy ecosystem with untapped potential for credit expansion, the report mentioned.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments