Eid spurs record remittance surge

Bangladesh received a record $2.94 billion in remittances during the first 26 days of March, driven by Eid-ul-Fitr, one of the largest festivals for Muslims.

The inflow was 82.46 percent higher than the same period last year, according to industry insiders. Central bank data showed that expatriate Bangladeshis sent $1.61 billion during this period in 2024.

Remittance receipts are expected to exceed $3 billion by the end of the month, marking a historic high for a single month.

From July to March 26 of the current fiscal year, the country received $21.43 billion in remittances, up from $16.69 billion during the same period in the previous fiscal year, according to Bangladesh Bank data.

Industry insiders noted that remittance inflows typically increase during Ramadan, as Bangladeshi expatriates send more money to their families ahead of Eid.

Additionally, the demands for hundi and hawala -- illegal cross-border money transfer channels -- have declined following a crackdown on operators after the political changeover, said Mirza Elias Uddin Ahmed, managing director and CEO of Jamuna Bank.

"This has diverted more remittances through formal banking channels," he added.

He also mentioned that the forex market had stabilised in recent months due to higher dollar inflows driven by increased remittances.

Central bank officials also noted that remittances began to rise following the political changeover in August last year.

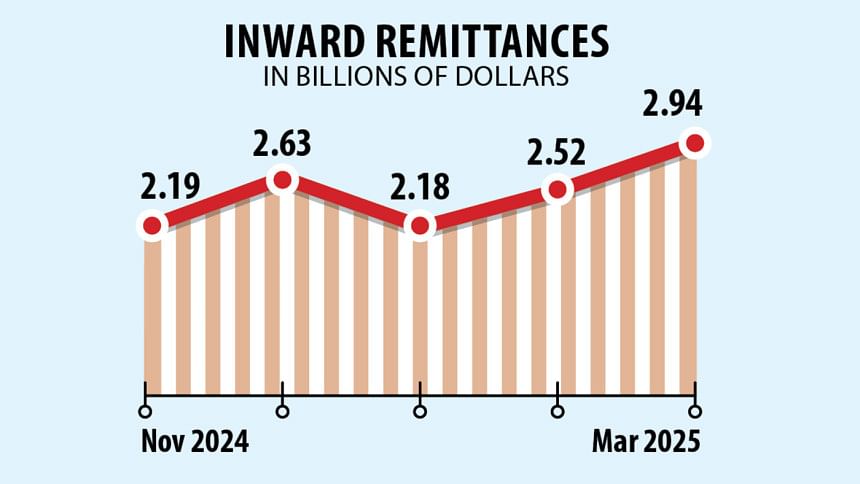

In September, remittances surged 80.28 percent year-on-year to $2.4 billion, according to central bank data. This momentum continued, with inflows of $2.39 billion in October, $2.19 billion in November, $2.63 billion in December, $2.18 billion in January, and $2.52 billion in February.

Due to the growing trend in remittance inflows, liquidity in the forex market has improved, as reflected in banks' net open positions (NOP) -- the difference between their foreign currency assets and liabilities.

Banks' NOPs reached $550 million as of March 20, up from around $150 million earlier in the month, according to Bangladesh Bank data. Over the past few months, the NOP had fluctuated between $250 million and $300 million, central bank officials said.

Industry insiders attributed the increase in NOP to a rise in the inflow of US dollars, indicating that the foreign exchange market is steadily gaining stability.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments