Why is the stock market rebounding now?

The stock market has bounced back strongly within two months of falling to its lowest in the past five years, thanks to some macroeconomic-level recoveries, including a drop in inflation and the strengthening of the local currency against the greenback.

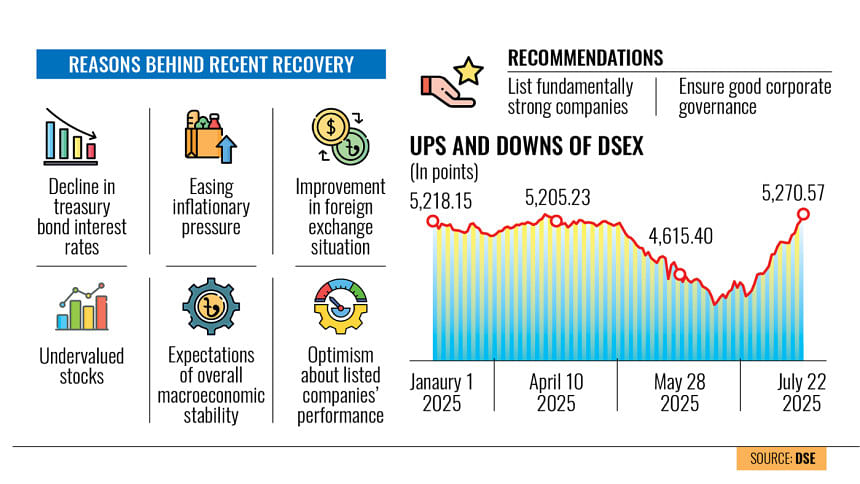

The DSEX, the benchmark index of the Dhaka Stock Exchange, soared to 5,270 points yesterday, the highest in the last eight months since November 18, 2024, when it was at 5,300, according to DSE data.

In less than two months since last June, the DSEX rose by more than 650 points, or around 14 percent.

During this time, the DSE's market capitalisation soared by Tk 60,907 crore, or 9 percent, to Tk 702,898 crore.

"I would not say the rise of the index is a bull run, it is just a long-overdue recovery which is still underpriced," said Shahidul Islam, chief executive officer of VIPB Asset Management.

In the one and a half months till May 28 of this year, the index had dropped by 590 points, or 11 percent, to 4,615 points, which was the lowest in the past five years.

Regarding the reasons behind the recent market recovery, Islam, who manages funds and invests in the stock market, said the prime one was the lowering of the interest rate of 10-year tenure treasury bonds.

It was close to 13 percent just a few months ago, and now it has dropped to 10.48 percent, he said.

As the interest rate is falling, large investors are choosing stocks to retain their funds, he said.

"Macroeconomic stability is also clear, and this is another factor to invest in stocks," said Islam.

When the forex market cools in a country like Bangladesh, many other economic problems are resolved, he said.

Not too long ago, there was a scarcity of the US dollar in the country, whereas now the central bank is purchasing the greenback to halt the appreciation of the taka, he said.

Last week, Bangladesh Bank purchased $484 million from commercial banks as the exchange rate fell by more than Tk 2 in five days, dropping to Tk 120 against each US dollar.

Following this intervention, the rate for interbank sales climbed back to Tk 121.20, according to Bangladesh Bank data.

The contrast to one year ago is just as night is to day, he said.

So, the improvement in the macroeconomic situation has contributed to the recovery of the index, he added.

Moreover, inflation in Bangladesh eased to 8.48 percent in June.

This is the first time in 27 months that inflation has dipped below the 9 percent mark, according to the latest data by the Bangladesh Bureau of Statistics (BBS).

Saiful Islam, president of the DSE Brokers' Association (DBA), and Shekh Mohammad Rashedul Hasan, managing director and CEO of UCB Asset Management, echoed Islam.

They said macroeconomic stability, undervalued stocks, and a drop in inflation were the main reasons behind the recent recovery.

On whether the rise in stocks could be sustained, Saiful Islam said it was "a million-dollar question".

The actual financial state of some banks will soon be revealed as they are now following a reporting system of international standard, he said.

Quoting the Bangladesh Bank governor, he said some non-bank financial institutions were in "a red list".

If the performance of the financial institutions drops significantly, it will ultimately impact stock market shareholders and then the market will get its "fingers burnt", said Saiful Islam.

At the end of the day, the number of good stocks and investors is limited in the Bangladesh stock market. So, when some banks and NBFIs get hurt, it impacts the whole market, he said.

In the interest of market sustainability, the government should immediately work towards listing more companies with sound financial backgrounds, he said.

Regarding foreign investors, Saiful Islam hopes that some will come to the market as the currency is now stable.

On the other hand, there could be a departure of some investors whose funds had remained stuck for several years due to the imposition of the floor price, which is the lowest price at which a stock can be traded, he said.

If the market remains active and trade volume remains high, it will not be a problem, and so the government should focus on bringing good stocks so that investors are attracted to the market, he added.

A top analyst, preferring anonymity, said if the government suddenly lifts the floor price on Beximco Ltd, it may result in a heavy impact on the index as it is a large capital-based company. So, it should be careful about this, he said.

Rashedul Hasan said foreign exchange stability is a major influencer of portfolio investment and it is improving day by day on the back of an increase in the flow of inward remittance.

He believes that portfolio investment will rise further and investors realise it, which is why companies with strong financial records are rising.

The market has realised that there would be improvements in the macroeconomy, and the stock market is giving off signals, he said, hoping for inflation to drop to 6 percent within October.

With improvements in the macroeconomy, listed firms will also start to generate a good amount of revenue. The recent rise of the index is an "early sign of strong recovery of the market," said the asset manager.

On whether the market may drop again to its previous levels, he said, "I believe the worst is over."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments