CA rolls out five-step plan to bolster stock market

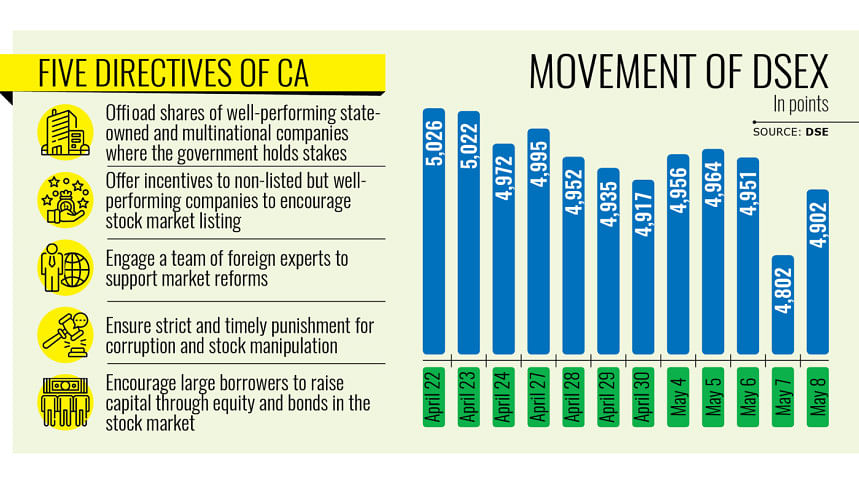

Chief Adviser Muhammad Yunus has issued five key directives, including the offloading of government stakes in state-run and multinational companies, to increase the availability of quality scrips in the market.

He gave the directives yesterday during a meeting titled "Development and Strengthening of the Capital Market" at the State Guest House Jamuna.

Finance Adviser Salehuddin Ahmed, Special Assistant to the Chief Adviser Anisuzzaman Chowdhury, Financial Institutions Division (FID) Secretary Nazma Mobarek, and Bangladesh Securities and Exchange Commission (BSEC) Chairman Khondoker Rashed Maqsood attended the meeting.

The meeting was held amid growing protests by general investors, who have been agitating against market instability as they continue to lose money due to fragile investor confidence.

After the meeting, Shafiqul Alam, press secretary to the chief adviser, told journalists that the CA had instructed authorities to offload shares held by the government in well-performing state-run and multinational firms.

"For instance, the government has a stake in Unilever. He has ordered steps to bring such companies to the stock market through initial public offerings (IPOs) soon," Alam said.

The second directive is about offering incentives to well-performing, non-listed companies to encourage them to enter the stock market.

"There are many non-listed firms with turnover above $2-$3 billion. Incentives could help bring them to the market," Alam said, citing City Group and Meghna Group as examples.

A persistent absence of quality stocks has plagued the market, with only 10 to 12 companies attracting significant foreign investment. Meanwhile, more than 60 percent of listed firms have no foreign investors.

Market analysts hope that the inclusion of promising stocks could attract both foreign and institutional investors to the bourse.

The Investment Corporation of Bangladesh (ICB) has already identified 38 potential entities, including state-run, multinational, and local pharmaceutical companies, that could go for IPOs.

Of these, 12 are state-run firms, 24 are multinational companies, and 38 are pharmaceutical entities.

The chief adviser's third directive calls for engaging "a group of foreign experts" to carry out comprehensive reforms in the stock market within three months.

The fourth directive involves ensuring strict and immediate punitive measures against those involved in corruption and manipulation in the market, so that a strong message is delivered that malpractice will not be tolerated.

Lastly, the chief adviser urged large borrowers to consider raising capital from the stock market through equity and bonds rather than relying solely on bank loans.

"The five directives are aimed at restoring investor confidence through swift and effective reforms, ensuring that all stakeholders benefit from a stronger market," Alam said.

The DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), has been on a downward trend for several months amid disappointing earnings reports from several large companies.

In recent weeks, a group of investors staged protests demanding the resignation of the BSEC chairman, accusing the commission of failing to stabilise the market.

However, the index surged by 100 points, or 2.07 percent, last Thursday after news broke that the chief adviser had convened a high-level meeting with finance officials and the BSEC chairman to discuss the market situation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments