Half of Japanese firms optimistic about profit growth in 2025: survey

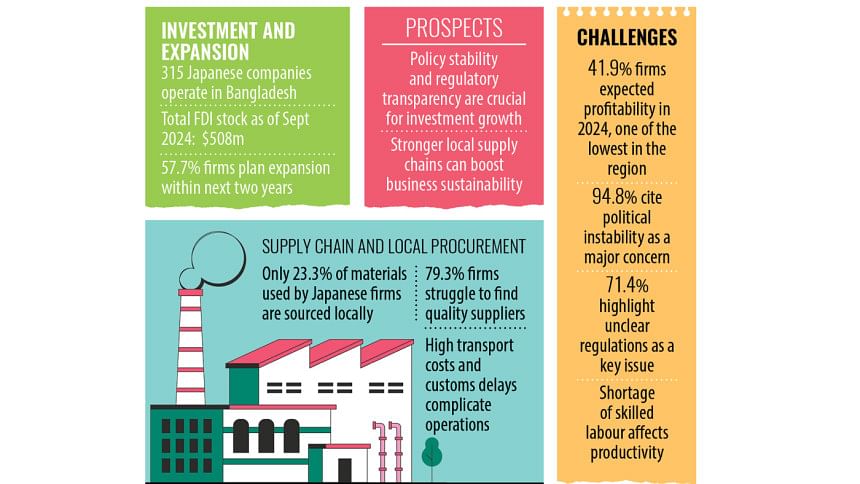

After a challenging year, Japanese companies in Bangladesh are eyeing 2025 with cautious optimism, as 50 percent anticipate a rise in operating profits despite persistent hurdles.

However, political instability, unclear regulatory policies, and difficulties in local procurement continue to hinder smooth business operations, according to findings of the latest Japan External Trade Organisation (Jetro) survey 2024, which will be released today.

The report also highlighted both optimism and concerns among Japanese firms navigating these obstacles.

As of 2024, nearly 315 Japanese companies are operating in Bangladesh, with cumulative investments exceeding $508 million.

Despite the interest from Japanese businesses, the percentage of companies expecting profitability in Bangladesh in 2024 remains among the lowest in Asia and Oceania, standing at just 37.4 percent, according to the Jetro survey.

However, looking ahead to 2025, 50 percent of these companies anticipate a rise in operating profits, indicating cautious optimism.

Bangladesh has consistently ranked as one of the top investment destinations in South Asia for Japanese firms, with 57.7 percent of surveyed companies planning to expand their business activities in the next one to two years.

"The local market demand is a significant factor driving this expansion," said Yuji Ando, country representative of the Jetro in Dhaka.

"However, a combination of structural inefficiencies and policy uncertainties pose serious challenges," he said.

Among the major concerns highlighted in the survey are political and social instability, unpredictable regulatory policies, and insufficient infrastructure.

Notably, 94.8 percent of Japanese firms cited political uncertainty as a key risk while 75.3 percent pointed to unclear government policy management.

Moreover, Bangladesh's legal and administrative processes, including delays in obtaining permits and tax-related complexities, were identified as significant hurdles to smooth business operations.

Further challenges are posed by a shortage of skilled labour, which impacts productivity and efficiency.

Japanese companies have noted that while Bangladesh has a growing workforce, gaps in technical training and professional expertise create barriers to scaling up operations.

Investing in workforce development, Ando suggested, would significantly improve the investment climate and increase the competitiveness of the local industry.

A key area where Bangladesh struggles is in local procurement, which remains significantly lower than in other regional economies.

Only 23.3 percent of materials and parts used by Japanese companies are sourced locally, compared to higher rates in Vietnam, Indonesia, and India.

"The lack of reliable suppliers meeting international quality and technical standards remains a major obstacle," Ando noted.

The survey found that 79.3 percent of Japanese companies in Bangladesh faced difficulties in finding suppliers who met their quality requirements while 55.2 percent reported challenges in securing necessary raw materials.

To mitigate this, Japanese businesses are calling for more investment in the backward linkage industries and increased government support to strengthen local supply chains.

"Improving the local supplier ecosystem is critical to reducing dependency on imports and ensuring cost efficiency in production," Ando emphasised.

Additionally, logistical inefficiencies, such as delays at ports and high transportation costs, further complicate supply chain operations.

Japanese firms have called for streamlined customs procedures and improved transport infrastructure to ensure a more seamless movement of goods, which would reduce costs and enhance profitability.

Despite these obstacles, Japanese firms see long-term potential in Bangladesh, given its growing consumer base and strategic location.

The Jetro report suggests that expansion of business activities in Bangladesh remains a priority, particularly in sectors such as high-value manufacturing, consumer goods, and technology.

Ando emphasised that while Bangladesh presents numerous investment opportunities, addressing regulatory transparency and policy consistency would be essential in sustaining investor confidence.

"A stable and predictable business environment is crucial for attracting more Japanese investments," he noted.

One promising development is an increase in economic cooperation between Japan and Bangladesh.

Large-scale infrastructure projects supported by Japanese investment, such as the ongoing construction of the Matarbari deep-sea port and various road and energy projects, demonstrate Japan's commitment to enhancing Bangladesh's business environment.

These improvements could alleviate some of the logistical constraints currently affecting foreign businesses.

With Japan being one of Bangladesh's largest development partners, continued collaboration between the two nations could help overcome these challenges and pave the way for stronger economic ties.

Experts believe that a combination of government policy reforms, infrastructure advancements, and skilled workforce development will be key to ensuring long-term success for Japanese investors in Bangladesh.

While risks persist, the overall sentiment remains one of cautious optimism as Bangladesh works towards becoming a more favourable investment destination.

If the country can successfully address its regulatory and infrastructure shortcomings, it has the potential to emerge as a premier hub for Japanese investment in South Asia.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments