'Gas, dollar crises halt business expansion'

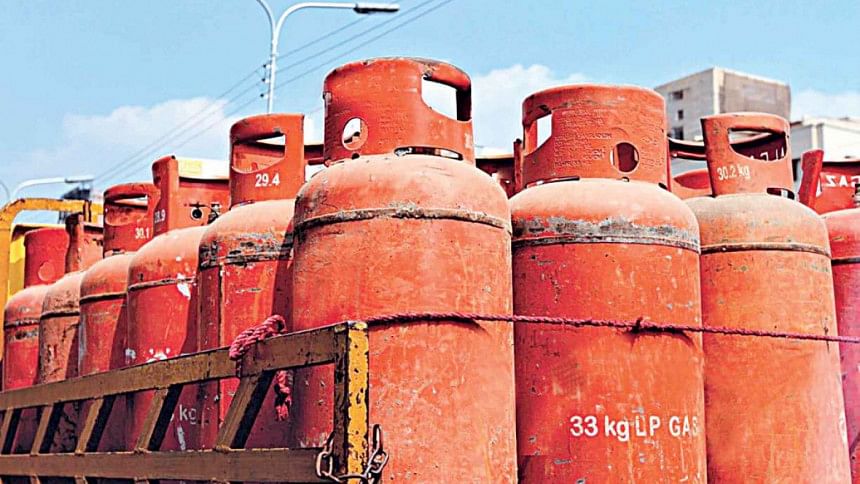

Demand for credit has not increased as businesses have had to suspend their investment and expansion drives for the natural gas and dollar crises.

"Expansion is difficult without energy security," said Mir Nasir Hossain, managing director of Mir Akhter Hossain Ltd, one of the major construction companies in Bangladesh.

"Another problem is the US dollar shortage for which we are facing difficulties to import spare parts and capital machinery," he told The Daily Star in an interview yesterday.

Dealing with civil and building construction works including five-star hotels, roads, bridges, flyovers, power plants and rail lines, Mir Akhter Hossain Ltd generated a revenue of nearly Tk 312 crore as of June 30 last year, states its annual report.

Businesses accepted a gas price hike last year on expectations that the supply of the energy to their factories will be smooth and increased, he said, adding that this did not come about as of yet as problems continue to persist.

And apart from the US dollar crisis, liquidity crunch in banks is affecting businesses, said Nasir, a former president of the Federation of Bangladesh Chambers of Commerce and Industry.

Banks are unable to provide the required funds as they do not get repayment from borrowers on time while some have to reschedule loans, he said.

The rising interest rate is also affecting businesses, he said.

Many businesses established industries at the 9 percent interest rate which banks had to offer in order to comply with the interest rate cap imposed by the authorities, said Nasir.

As interest rises, their cost goes up, he said, adding that the increasing interest rate has affected credit flow too.

Yet, growth of credit to the private sector still remained below the projected level of 10.9 percent at the end of December 2023.

In November, credit flow to private businesses grew 9.9 percent year-on-year, according to data from Bangladesh Bank.

Despite sluggish demand for credit among businesses, the next monetary policy, which the central bank is likely to unveil soon, will be contractionary, believes Nasir.

Businesses in every country see blooms and glooms but those in Bangladesh stand out for the resilience of their entrepreneurs, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments