Ambitious budget causes high debt: NBR chairman

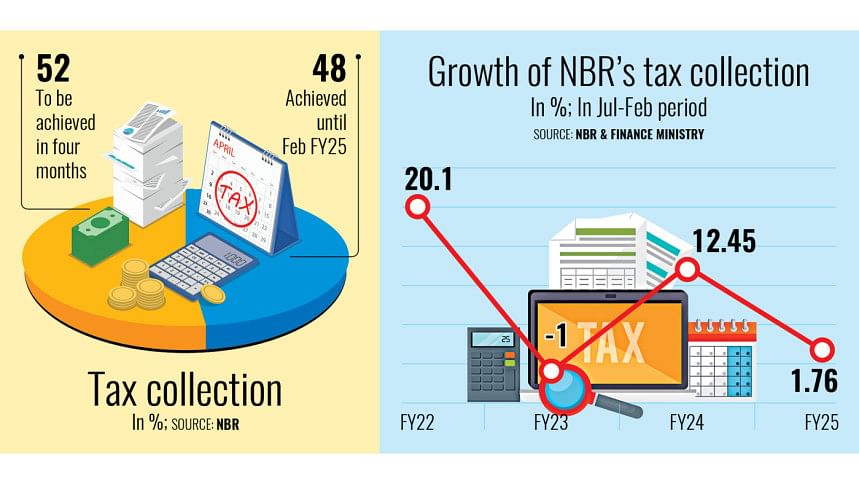

The National Board of Revenue (NBR) has set tax collection targets year after year based on the national budget's ambitious spending goals rather than using scientific methods or considering current realities, NBR Chairman Abdur Rahman Khan said yesterday.

As a result, the tax authority is never able to meet the target, and the government has to borrow continuously to cover spending, increasing the country's debt burden, he said.

Khan was addressing a seminar on domestic revenue mobilisation organised by the Economic Reporters' Forum (ERF) and Research and Policy Integration for Development (RAPID).

"Historically, the government has relied on high tax collection targets to finance ambitious spending plans, often exceeding the realistic revenue-generating capacity of the economy," he said.

He further explained that reliance on foreign loans meant the country had to abide by stringent conditions, some of which were challenging to fulfil.

This, Khan warned, is "a side effect" of creating oversized budgets year after year without aligning them with the economy's actual strength.

Although the tax policy is "aggressive," its implementation remains inadequate, Khan said, admitting that there is no scope to introduce harsher tax measures.

Instead, the tax regime needs to be more business-friendly to attract higher investments from both local and foreign entrepreneurs, he said.

"We want higher investment to create more jobs. For this, the tax system should be competitive. The upcoming budget will be business-friendly and focused on people's welfare," Khan assured.

Addressing concerns over indirect taxation, the NBR chairman highlighted that indirect tax collection remains significantly higher than direct taxes.

This indicates governance issues, as the burden falls disproportionately on the poor, who pay taxes unknowingly through daily transactions, he said.

"This is not a sign of a civilised tax system," he remarked.

He also stated his intention to eliminate the provision allowing black money to be whitened through the next budget.

However, if the provision remains, the tax rate for such disclosures will be significantly increased, he said.

Over the past decade, the number of registered taxpayers in the country has surged from 15 lakh to over 1.14 crore. Despite this increase, the number of tax returns filed remains disproportionately low, Khan said.

Last fiscal year, only 45 lakh individuals and entities submitted tax returns, revealing a glaring gap in compliance. A significant portion reported incomes below the taxable threshold, meaning they did not contribute to revenue collection, he said.

This raises questions about the effectiveness of the government's tax net expansion efforts and whether they are translating into actual revenue generation, he added.

The issue is compounded by the burden placed on compliant taxpayers, who face increasing pressure, while those operating outside the tax system remain largely unchecked, Khan said.

Business communities have expressed frustration over what they perceive as "disproportionate scrutiny" on compliant entities, while tax evaders continue to exploit loopholes with little consequence, he said.

The lack of strict enforcement mechanisms has only exacerbated the problem, with authorities struggling to ensure widespread compliance, he added.

The NBR initially introduced electronic fiscal devices (EFDs) to monitor transactions and curb tax evasion, Khan said.

However, these devices remain largely ineffective, with reports indicating that many businesses either do not use them or keep them non-functional. "EFDs have not been effective in increasing tax compliance," he admitted.

M Abu Eusuf, executive director of RAPID, stressed the need to broaden the tax base, improve compliance, modernise tax administration, and reduce human interaction to minimise corruption risks.

He recommended linking national identification (NID) numbers to tax systems and running nationwide campaigns targeting SMEs and rural businesses.

He further suggested that the NBR enhance audits and legal measures to combat tax fraud effectively.

ERF President Doulot Akter Mala and Prothom Alo Online Head Shawkat Hossain also spoke at the seminar, emphasising the need for greater transparency and efficiency in tax administration.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments