FY26 Budget: Subsidy spending to hold steady

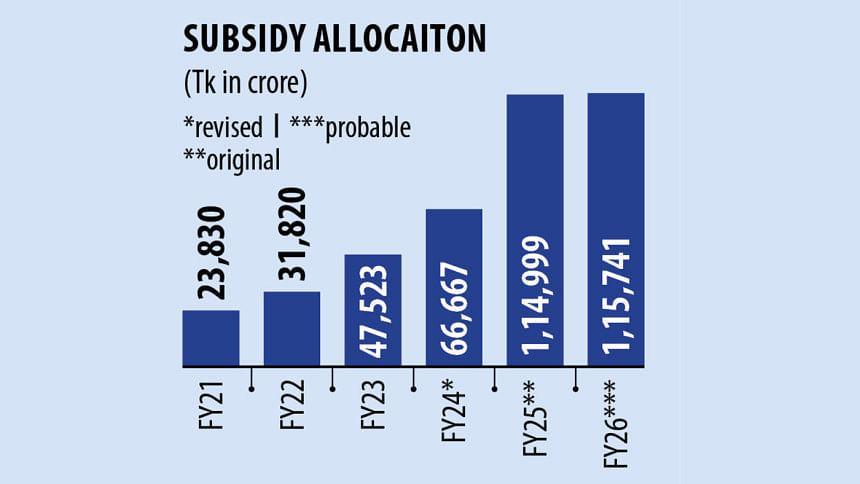

The budget for fiscal 2025-26 is likely to be smaller than the current year's outlay, but subsidy spending is expected to remain almost unchanged at Tk 1,15,741 crore.

The original subsidy allocation for the current fiscal was Tk 1,15,000 crore, but it rose to Tk 1,33,000 crore as the interim government cleared most overdue payments across several sectors.

Most of the upcoming subsidy allocation will go to the power, fertiliser, and food sectors, according to a draft outline by the finance ministry.

Subsidy expenditure has steadily increased in recent years, driven by costly power generation, rising global fuel prices, inflation-induced food support for the poor, and the devaluation of the taka against the dollar.

In 2017-18, subsidies amounted to just Tk 12,120 crore. By 2021-22, they had jumped to Tk 31,000 crore.

The lion's share of FY26 subsidies -- Tk 37,000 crore -- is likely to go to the power sector, slightly down from Tk 40,000 crore in the original budget for the current fiscal year. However, the revised budget raised this year's power subsidy to Tk 62,000 crore, reflecting payments of arrears accrued over several fiscal years.

Power subsidies stood at around Tk 9,000 crore in FY2020-21 but climbed as the previous government approved large power plants without phasing out older ones. This led to underutilisation and hefty capacity payments.

The post-Ukraine war spike in fuel and LNG prices further pushed up power generation costs, while the weakening taka compounded the subsidy burden.

The previous government's failure to make timely payments left power companies with mounting arrears, which are now being cleared. Officials said that although a large portion has been paid, some may carry over into FY26. "If arrears spill into the next fiscal year, the allocation may rise beyond Tk 37,000 crore," a finance ministry official told The Daily Star.

Prof Selim Raihan of Dhaka University said the government lacks a "quick-fix" policy for curbing power sector costs within a single fiscal year. Instead, he suggested a clear medium-term roadmap to gradually reduce subsidies.

He said that subsidy reduction could have been achieved through improved efficiency, renegotiation of contracts, and trimming capacity charges. He also called for a review of the interim government's actions over the last nine months.

Finance ministry officials said the interim government has refrained from renewing old power plant contracts, which could ease future burdens. They also expect the Rooppur Nuclear Power Plant and the Matarbari coal-fired plant to become fully operational, enabling a Tk 3,000 crore reduction in the upcoming power subsidy allocation.

Meanwhile, subsidies for LNG imports are set to rise from Tk 6,000 crore in the current fiscal year to Tk 9,000 crore in FY26. According to Petrobangla, the gap between LNG purchase and sale is Tk 17,676 per unit, with Tk 6,500 crore currently covered by subsidies.

To support poor and low-income households, the government plans to increase the food subsidy by 31 percent to Tk 9,500 crore in the upcoming fiscal year. The number of beneficiaries of food-friendly schemes, including Open Market Sales (OMS) and Trading Corporation of Bangladesh (TCB) programmes, will rise to 55 lakh families from 50 lakh.

Additionally, each family will receive 30kg of rice per month at Tk 15 per kg for six months, an extension from the current five-month duration.

Agriculture subsidy is expected to remain unchanged at Tk 17,000 crore, but officials indicated the final figure may increase. "Reducing subsidy allocation is not possible in some cases, like the agricultural sector. … We need modernisation of agriculture to get rid of this," said Prof Raihan, who is also executive director of the South Asian Network on Economic Modelling.

Export and remittance incentives are likely to remain unchanged at Tk 7,825 crore and Tk 6,200 crore, respectively. In total, the government plans to allocate Tk 32,025 crore for incentives and Tk 12,000 crore in cash loans to certain institutions under subsidy expenditures.

Prof Raihan, however, said export incentives should be phased out. After Bangladesh's graduation from the Least Developed Country category in 2026, cash incentives in the export sector will no longer be permitted under World Trade Organization rules.

"We need a clear roadmap on how to face the new reality in the garment sector when the cash incentives will be withdrawn," he said.

He also questioned the need for remittance incentives as the country is adopting a market-driven exchange rate. "We must instead address the barriers to sending remittances through official channels."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments