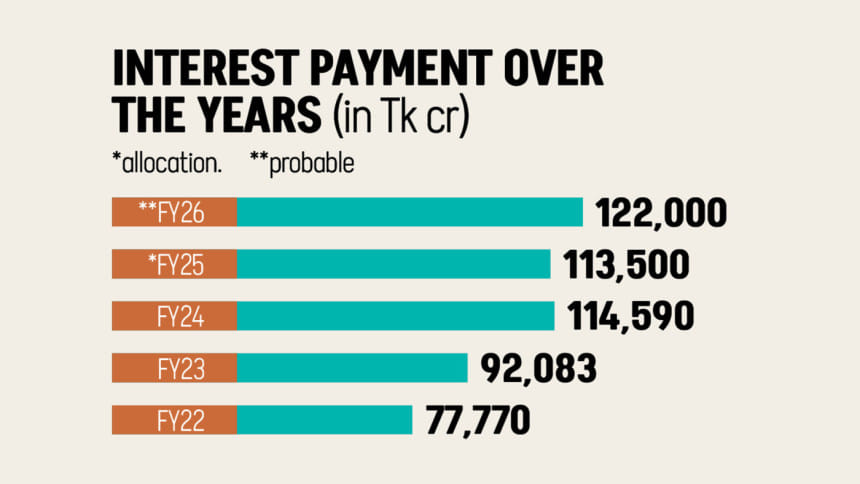

FY26 budget: 22% of revenue to go towards interest payment

As much as Tk 122,000 crore is expected to be allocated for interest payment in the budget for the upcoming fiscal year, which is about 22 percent of the total revenue budget.

The revenue budget is likely to be Tk 560,000 crore, according to the draft estimation by the finance ministry.

Not only in the upcoming budget, the interest payment against local and foreign loans would increase in this fiscal year's revised budget too as a result of a large number of outstanding debts, interest rate hikes and the devaluation of taka against the dollar.

The allocation for interest payment is likely to be revised upwards by about 7 percent to Tk 121,500 crore this fiscal year, according to the draft estimation.

In the first six months of fiscal 2024-25, the interest payment rose 27 percent year-on-year to Tk 75,902 crore.

Interest payments against external loans would continue to soar in the coming years thanks to Bangladesh's graduation from the least-developed country bracket and elevated benchmark interest rates in advanced economies, according to the finance division's Medium-Term Macroeconomic Policy Statement.

Usually, interest payments commence once the loan is utilised. But after the pandemic, the government has been taking large amounts of budget support every year, which is disbursed immediately and the repayments kick in.

Many mega projects have been completed and some are nearing completion. The principal amount of the loans for those projects are yet to be repaid but the interest payments have been paid.

As the per capita income has increased in recent years, the multilateral and bilateral lenders have increased the interest rate. Many of them have been lending at a market-based interest rate, which is high enough.

Take the case of Japan, which once provided loans at less than 1 percent interest rate. Now, loans from Japan come at nearly 2 percent interest rate.

Besides, the World Bank and the Asian Development Bank are now providing a portion of their loans at market-based interest rates.

As the taka depreciated against the US dollar in the past three years, the interest burden against foreign loans soared in terms of taka.

The average exchange rate rose more than Tk 120 per dollar this fiscal year, up from Tk 111 last fiscal year.

The Bangladesh Bank's recent policy rate increases have contributed to rising interest payments on domestic loans.

The interest rate for the government's domestic borrowing from banks and non-bank sources through treasury bonds and bills also increased between 10 and 12 percent, which was 8 percent until 2023.

The country's interest payments soared as the government borrowed heavily, particularly for mega projects, often without proper research, said Mustafa K Mujeri, executive director at the Institute for Inclusive Finance and Development.

This borrowing was justified by the relatively safe debt-to-GDP ratio at the time, which led to a significant increase in debt, he said.

"Borrowing was often driven by political decisions without proper feasibility studies being conducted, leading to widespread corruption. Consequently, the loans were not utilised effectively or efficiently."

As a result, these projects are not generating sufficient returns to repay the loans, which ultimately becomes a burden on the budget.

Some of the loans taken in recent years have short repayment periods, further exacerbating the financial strain and due to high interest payments, the government's fiscal space has been severely constrained, he added.

"Our objective is to avoid falling into a debt trap, where a significant portion of the budget is consumed by loan repayments -- be it operating costs or interest payments," said Planning Adviser Wahiduddin Mahmud last week.

A key objective of the interim government is to reduce the country's debt risk from "moderate" to "lower", Finance Adviser Salehuddin Ahmed told The Daily Star last week.

"It's not that we won't borrow from foreign and local sources, but we will bring the amount down," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments