Bangladesh’s Cosmetics Industry on the rise

Once reserved for special occasions and elite circles, beauty and personal care in Bangladesh are now everyday essentials for millions. From bustling city malls to quiet village shops, cosmetics and toiletries have woven themselves into the fabric of daily life. As consumer aspirations evolve and the thirst for self-expression grows, Bangladesh's beauty market is undergoing a fascinating transformation—bursting with innovation, variety, and promise. Local brands are rising, global names are expanding, and a once modest industry is now flourishing into a vibrant landscape of skincare, haircare, and wellness.

Yet, alongside the glamour and growth, the industry also faces challenges that will define its future journey.

Malik Mohammed Sayeed, CEO of Square Toiletries, shares, "Local brands are the key driving force of the growth of the FMCG market in Bangladesh. Square Toiletries is a front-runner in this progress. The FMCG industry is ever-changing due to the varied demands of consumers and, as brand owners, we hold the responsibility to cater to such needs. To meet these evolving demands, Square Toiletries Limited focuses on 360-degree innovation across products, processes, packaging, and supply chains."

"At ACI Consumer Brands, our current market focus centres around delivering high-quality, innovative, and trustworthy products that cater to the everyday needs of Bangladeshi households. We operate across multiple categories such as personal care, home care, baby care, hygiene and wellness with a strong commitment to health, safety, and environmental sustainability," says Md. Quamrul Hassan, Chief Business Officer, ACI Consumer Brands.

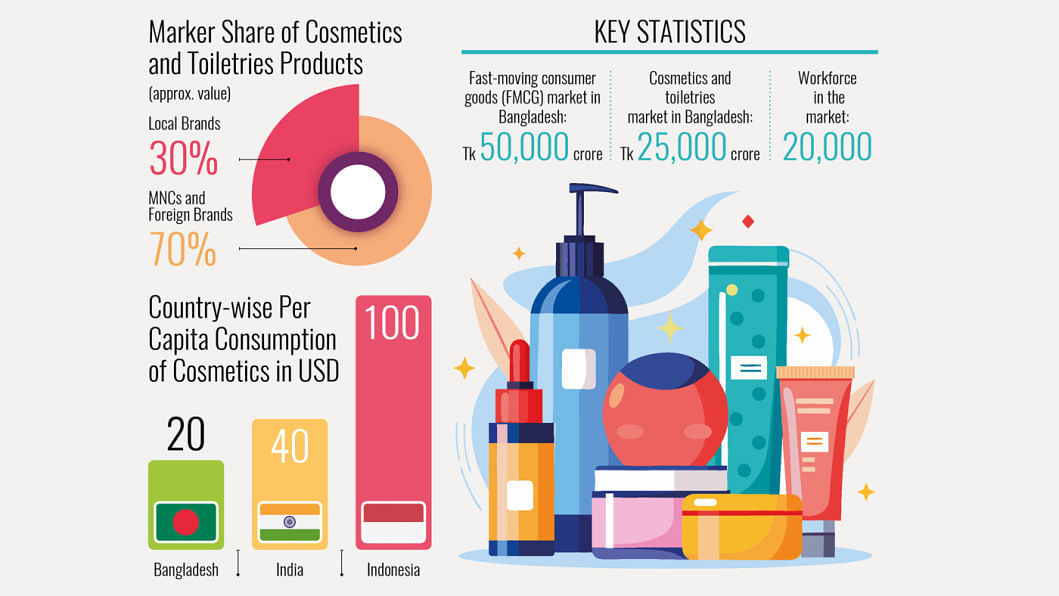

According to market insiders, Bangladesh's fast-moving consumer goods (FMCG) market is valued at around Tk 50,000 crore annually, with toiletries and cosmetics accounting for approximately Tk 25,000 crore. The market is experiencing a value growth trend of about five percent per year. This industry employs approximately 20,000 workers — a number that continues to grow. Currently, multinational and foreign brands account for approximately 70 percent of Bangladesh's cosmetics and toiletries market, while local brands hold the remaining 30 percent.

Previously, Bangladesh's premium cosmetics market was almost entirely dependent on imports. However, local brands are now making inroads with their own premium offerings, alongside basic cosmetic products, aiming to better understand and cater to local needs, preferences, and price sensitivities. Consumers, in turn, are increasingly relying on both local and international brands to meet their personal care demands.

At present, per capita consumption of cosmetics in Bangladesh stands at Tk 2,400 —lower than that of neighbouring countries. Nonetheless, experts predict a rise in spending as cosmetics continue to gain popularity for both essential use and luxury appeal. If navigated carefully, the industry holds significant potential for further growth.

Bangladesh's cosmetics market has yet to make a significant mark in exports. However, industry insiders believe that with consistent and adequate support, the sector holds strong potential for entering international markets. Some local companies have already begun receiving orders from abroad, indicating growing interest in Bangladeshi cosmetic products.

Remark HB Limited has secured several export orders for their colour cosmetics, skincare, and medicated skincare products. Recently, at an international dermatology fair held in Dubai, the company confirmed orders worth over USD 2 billion for the Middle Eastern and Indian markets.

"Beyond domestic growth, we are actively exploring cross-border business opportunities to introduce our trusted Bangladeshi brands to international markets, further strengthening KCCL's presence beyond national boundaries," says Rezaul Karim, Managing Director at Kohinoor Chemical Co (BD) Ltd.

In terms of market size for cosmetics and toiletries, urban areas currently account for about one-third of total consumption. However, this scenario is gradually shifting. With rural areas receiving significant inflows of remittances, the purchasing power in these regions is rising. According to business insiders, the rural market holds strong potential, prompting companies to develop targeted strategies for this growing segment.

While the rural market presents promising opportunities, rising costs across the sector are simultaneously straining consumer purchasing power nationwide. Recent price hikes in toiletries and homecare products have placed additional pressure on consumers. Over the past six months, prices of soaps, shampoos, toothpastes, detergents, and toilet cleaners have risen by 10–27%, driven largely by increased import costs and the devaluation of the taka.

In the post-COVID era, economic hardships, supply chain disruptions, and persistent inflation have constrained consumer spending on cosmetics and toiletries. Even so, business insiders remain optimistic as the demand for essential care products shows signs of recovery.

Rezaul Karim, Managing Director at Kohinoor Chemical Co (BD) Ltd, shares, "Despite various challenges, Kohinoor Chemical Co. (BD) Ltd. (KCCL) has consistently maintained reasonable product prices, prioritising affordability for Bangladeshi consumers. Upholding customer satisfaction as a core value, we remain committed to delivering superior products with strong value propositions at accessible price points."

Innovation is seen as a key factor in attracting consumers, with companies investing in research and insights to align with changing customer behaviour along with their product quality and customer trust.

"We continuously innovate to enhance product performance, functionality, and design, ensuring they meet evolving consumer expectations. As a company with a proud 70-year heritage, KCCL is recognised as one of Bangladesh's most prestigious companies," notes Rezaul Karim.

The cosmetics industry in Bangladesh relies heavily on imported raw materials, primarily from countries like China, South Korea, Thailand, the USA, and various European countries. However, rising import costs and the ongoing dollar crisis have posed significant challenges for companies, making it difficult to sustain operations without passing the burden of price hikes onto consumers.

"Since the majority of necessary components are not made domestically, the industry's significant reliance on imported raw materials is one of its main problems. Due to this, the industry is extremely subjected to changes in the USD exchange rate, which have an immediate effect on import prices and costs," notes Md. Quamrul Hassan.

To address these challenges, some companies have started exploring local alternatives for certain raw materials. However, many essential ingredients—such as minerals and palm oil, which are key components in toiletries—cannot be produced locally due to the country's limited natural resources, aside from salt and water. For example, Square has begun sourcing aloe vera through contract farming in Natore, a northwestern district, to extract specific components for its products.

In addition, the cosmetics market grapples with several challenges, including the illegal entry of products through various channels and the widespread circulation of adulterated and counterfeit items—both foreign and local—which pose serious risks to public health. Consumers are often misled by these fake products, undermining trust across the industry. Business insiders argue that the BSTI should implement stricter testing standards and conduct regular market inspections to ensure product authenticity, thereby safeguarding consumers and supporting legitimate companies.

"Counterfeit products remain an enduring problem in this industry, affecting the entire ecosystem. Moreover, fake and low-quality products available in the informal grey market undermine brand equity and erode consumer trust," mentions Malik Mohammed Sayeed.

"The cosmetics and toiletries industry is currently facing regulatory uncertainty, with no clear decision on whether oversight will remain with BSTI or shift to the Drug Administration Authority of Bangladesh," adds Rezaul Karim.

In short, government incentives and effective monitoring are crucial to sustaining the industry's growth, maintaining quality standards, and building the capacity needed for successful export.

"Compared to neighbouring countries, there is less government support for the export of cosmetics and personal care products from Bangladesh. The cosmetics industry in Bangladesh is facing several challenges in entering the international market. To be competitive in the global market, the simplification of the export process and government policy support are essential," says Jamal Uddin, General Secretary of the Association of Skin Care and Beauty Products Manufacturers & Exporters of Bangladesh (ASBMEB).

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments