The impact of US tariffs on our economy

International trade is supposed to offer numerous benefits to countries. Trade between countries takes place because different countries have cost advantages in the production of certain goods and services, which they use to produce more than what they need for internal consumption and export the surplus to other countries.

Trade creates opportunities for additional production, employment and foreign currency income. However, speaking from the perspective of developed and developing country trade patterns, we observe that trade may not equally benefit all countries. A global analysis of trading patterns reveals the following:

i) The highly industrialised developed nations mainly export manufactured goods, whereas developing countries export more raw materials, agricultural goods and low value-added products.

ii) Developed economies export not only goods but also various services and technology.

iii) Most developed countries enjoy trade surpluses, while it is the opposite for developing nations.

iv) The agricultural exports from developing countries, like coffee, tea, cocoa and sugar, are too demand-sensitive and the prices fluctuate a lot.

v) Cheaper imports may harm domestic producers because they cannot compete with imported products.

vi) Trade barriers such as tariffs and quotas harm low-income exporting countries.

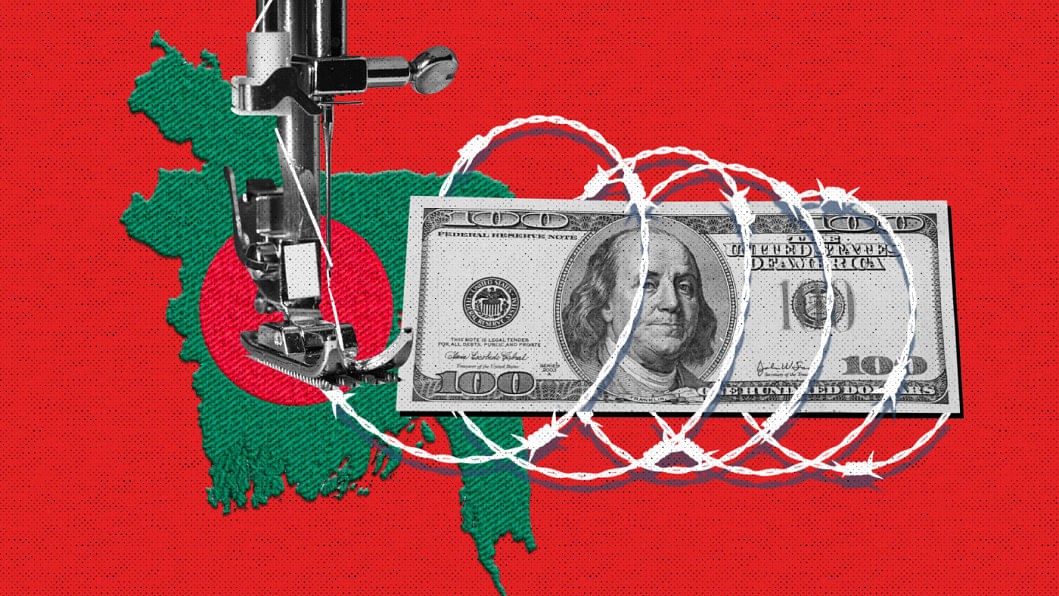

Along with a more general analysis of trade patterns in the world, there have been sectoral studies on labour-intensive exports like readymade garments (RMG), the mainstay of Bangladesh's exports, earning about 85 percent of the total exports of the country. The decision by the US administration to impose reciprocal tariffs on Bangladeshi export items to the US, of which RMG figures at the top, has resulted in increased concerns among the exporters. The US has imposed a reciprocal tariff of 37 percent on Bangladeshi exports, announced on April 2, which is likely to impact the volume of exports and reduce foreign exchange earnings for us. Bangladesh already pays a 15.62 percent tariff on RMG exports to the US. If Bangladesh has to pay an additional 37 percent tariff on exports to the US, the total tariff rate will stand at over 52 percent, which is a high rate.

Higher tariffs on Bangladeshi exports will cost more for American consumers, resulting in reduced demand. This may discourage many Bangladeshi investors, who may decide to close down factories or scale down production, the consequence of which will be reduced employment. Although the US quickly announced a 90-day suspension of this decision on April 9, the uncertainty surrounding exports to the US still looms on the horizon. Besides RMG, there are other products like leather goods, home textiles, fish and pharmaceutical products that Bangladesh exports to the US. Many analysts think it is a revival of protectionist policy to promote domestic industries and create more jobs in the US, but it may not prove feasible in reality. The world has seen a post-Second World War period of trade promotion where the US pushed for free trade. However, less developed economies were mostly following protectionist policies to promote domestic production and industrialise their countries.

The RMG sector in Bangladesh has been producing quality products at the lowest possible price and has been able to maintain its edge in the global market for the last four decades. The industry plays a crucial role in its ability to employ four million people, of whom 60 percent are women, contributing to economic growth and foreign exchange earnings, which amounted to $38.48 billion in 2024. The country achieved 7.23 percent growth in RMG exports in 2024.

Bangladesh is now the second-largest RMG exporter, behind only China. The country has an ambitious target of exporting a total of $100 billion from the textile and garments sector by 2030. This is not an easy task in the face of steep global competition, rising transport and shipping costs, and pressure from international buyers to bring down production costs.

The average unit price of garments exported to the US declined by 2.20 percent in January 2025. The price of garments exported to the European Union declined even more, by 4.84 percent during January to December 2024. This is resulting in lower profit margins for producers, especially smaller RMG industries, which are having a hard time continuing production and paying increased minimum wages, rising bank interest rates, and higher electricity and gas prices. On the one hand, there is international pressure to enhance minimum wages, and on the other, there is pressure from buyers to lower costs. This balancing act puts industry owners in a tight position.

Under these circumstances, the raising of tariffs by the US is surely going to affect the garment sector and put industrialists and workers in jeopardy. It is not easy to estimate the import tax-induced price elasticity of demand for Bangladeshi products in the US if a sharp rise in taxes is imposed, given the fact that the proposed tax rates vary from country to country for similar products, like textiles and apparel products. And there is the possibility of potential substitution efforts by US consumers. A robust economic analysis would be able to estimate the global impact of higher tariffs on imports for both the importing and exporting countries, which can be carried out only when such a situation arises in reality. But initial assessments indicate the likelihood of global economic contraction as a consequence of imposing high import tariffs. The policy suggestion is obvious: limiting international trade by imposing higher tariffs should be avoided.

The World Bank published its "Macro Poverty Outlook" on April 23, as part of its South Asia Development Update, which includes economic growth forecasts. Bangladesh is predicted to achieve only 3.3 percent GDP growth in FY 2024-2025, the lowest rate in the last 36 years. This is an unexpectedly low growth rate for the country and may result in three million people sliding into extreme poverty (living on less than $2.15 per day), increasing the extreme poverty rate from 7.7 percent in FY24 to 9.3 percent in FY25. This prediction is based on a low rate of investment, domestic political uncertainty and global risk, especially international trade policy uncertainty affecting exports from Bangladesh.

To mitigate the looming economic uncertainty, the government, with the cooperation of the private sector, should make all efforts to sustain export growth through improvement of infrastructure, adoption of innovation, continuous capacity building, stimulating private investment and improving foreign exchange reserves. To deal with increasing poverty, the government should focus more on strengthening public works programmes and correcting beneficiary targeting errors in existing social safety net programmes, along with increasing the budget allocation in the upcoming national budget. About 120 social safety net programmes in Bangladesh absorb about 17 percent of the annual budget, the efficacy of which is generally unknown because of the poor evaluation culture in the country. Therefore, in-depth evaluation of safety net programmes should be routinely conducted by the government.

Dr Nawshad Ahmed, a retired UN official, is an economist and urban planner. He can be reached at [email protected].

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments