Premier Bank wants to remain people’s ‘bank of choice’

Premier Bank has established a brand that incorporates trust, innovation and exceptional customer service in its 25 years of operation, said Mohammad Abu Jafar, managing director and the chief executive officer of the private commercial lender.

"As we embark on its next chapter, we aim to maintain our position as the 'bank of choice' for people," Jafar said in an interview with The Daily Star on the silver jubilee of the bank yesterday.

While sharing insights on the bank's journey, he highlighted some milestones achieved over the years, including the introduction of real-time online banking, the launch of Islamic banking services, the development of the Premier Agent Banking network and the innovative smart banking app "pmoney".

He said the bank now looks to double its business and market share in the coming years. "We envision increasing our loan portfolio to Tk 60,000 to Tk 80,000 crore within the next five years, with a special focus on agriculture and SMEs."

Jafar said their core strengths lie in its strong brand value, experienced board and capable workforce.

"With a comprehensive network of branches, sub-branches, agent banking outlets, and a competitive product portfolio, Premier Bank is well-positioned to lead the market," he added.

And to attain the place, the CEO identified resilience, technological innovation and a customer-centric approach as the core elements of their strategic plan.

While distinguishing the bank's credit portfolio from its market peers, he said a distinctive aspect of their loan book is its diversity across various sectors -- such as ready-made garments, small and medium enterprises (SMEs), agriculture and housing.

In alignment with national financial inclusion goals, Premier Bank has actively expanded its reach into rural and underserved areas through agent banking and sub-branches, thus bringing more individuals into the formal financial system, Jafar added.

He said the commercial lender dedicates over 25 percent of its loan portfolio to supporting the cottage, micro, small and medium enterprises, which are crucial for the country's economic development.

The bank has a clear plan to increase this share to 50 percent within the next three to five years, with a special focus on women entrepreneurs and underserved markets, he said.

The CEO said Premier Bank's growth strategy includes expanding its presence in underserved regions and focusing on digital capabilities to meet the evolving needs of customers.

In the realm of digital banking, the bank has launched its "pmoney" mobile app, which allows customers to access banking services round the clock, he said.

Jafar said the bank is continuously investing in its digital infrastructure to enhance both convenience and security.

Recent innovations like the "Premier Bank Quick Account" and the "Green PIN" service highlight their focus on making banking simpler and more accessible, he added.

Besides, the introduction of exclusive credit cards like Visa Signature and MasterCard World showcases their commitment to catering to the needs of their elite customers, he said.

"We are planning to introduce more innovative services, such as AI-driven customer support, improved digital payments and broader access through mobile and internet banking."

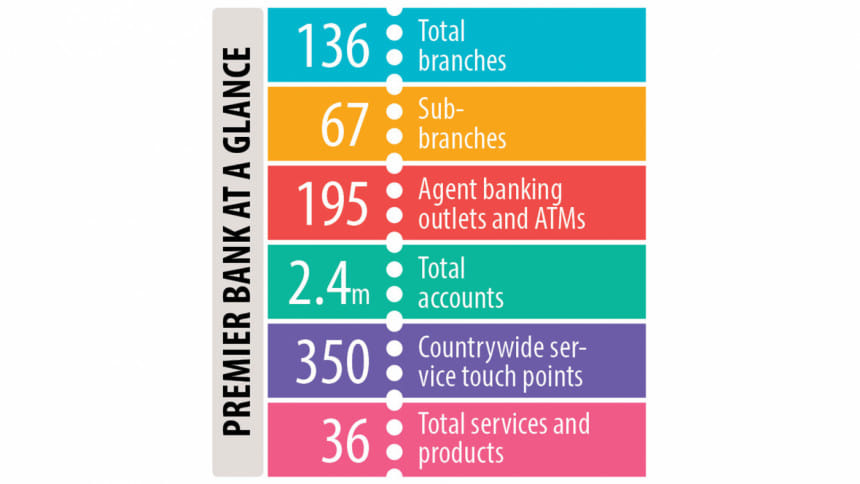

The bank currently operates 136 branches, 67 sub-branches and 195 agent banking outlets across Bangladesh.

Serving a client base of 2 million, the bank has established over 350 service touchpoints nationwide to ensure comprehensive access to banking services.

Speaking on the challenges currently facing the banking sector, he identified rising inflation and currency volatility, which may push up non-performing loans.

"Robust risk management practices, diversified portfolios and technological investments will be vital in navigating these challenges," he said, advocating for stringent pre-loan assessments and enhanced monitoring systems to identify potential risks early.

He said that as the banking sector evolves, trust remains a significant concern. Maintaining transparency, strengthening risk management and improving customer service are essential to regaining public trust.

"Premier Bank's dedication to integrity and customer-centricity aims to foster long-term relationships based on trust."

Jafar said they are also committed to corporate social responsibility, focusing on education, healthcare and disaster relief initiatives.

He also highlighted the bank's recent donation of Tk 1 crore to aid flood victims in the north-eastern region of Bangladesh.

Premier Bank began its journey in 1999 under the leadership of Dr HBM Iqbal with a goal to contribute meaningfully to the sustainable development of Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments