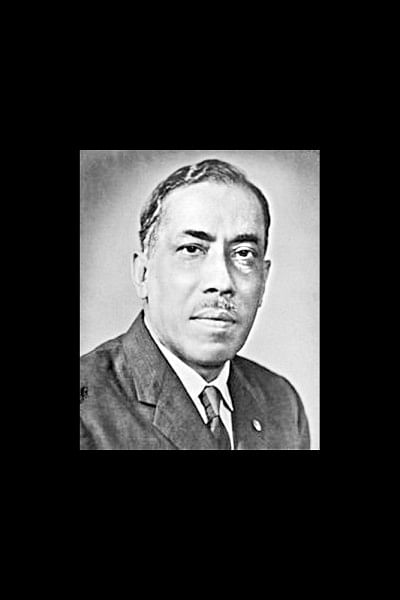

Khuda Buksh: A giant in life insurance

Insurance giant, Khuda Buksh singlehandedly popularised life insurance among Bangali Muslims. His name itself represents an institution, and he became a legendary figure in his own lifetime.

Buksh was an eminent Bengali life insurance salesman from the 1930s to 1970s in the Indian subcontinent. For four decades, he represented the "life and soul of the insurance industry throughout the region." He gained fame in the 1940s for his salesmanship in East India. From the 1950s to 1960s, he helped a top Pakistani insurance company attain global status. He was a pioneer in augmenting the life insurance industry in Bangladesh – today he is known as the "father of insurance" in the country.

Born on February 1, 1912, Buksh was raised in a middle class family in Damodya, Shariatpur, India. After passing his entrance examination in first division, he went to Calcutta and studied at Islamia College (now known as Maulana Azad College) and Presidency College. With a desire to serve humanity, Buksh joined the Oriental Government Security Life Assurance Company (OGSLAC) as an agent. During that time, insurance was considered un-Islamic and the dominant view was that worthless people worked for insurance. Buksh disregarded such criticism and hostility and vowed to change this negative perception of the industry. With his indomitable spirit, he sold policies door-to-door. His diligence made him popular among Muslims and Hindus, and established him as a first-class insurer.

In 1946, OGSLAC promoted him to the rank of an inspector. After 17 years of field experience, Buksh returned to Dhaka in 1952 as a life insurance manager of Eastern Federal Union (EFU), East Pakistan. There he motivated, recruited, trained and helped countless people in the insurance field, and developed a large number of field organisations across the country at grassroots level. His leadership, along with his vision, energy, competence, commitment and compassion played a significant role in cultivating the potential of sales agents to meet every challenge. He established a strong field force of about 5,000 across East Pakistan and became a local champion for life insurance, writing more insurance policies in East Pakistan than in West Pakistan. To spread life insurance awareness, he cultivated a strong brand and mastered public relations, connecting with high government officials, insurance executives, industrialists, politicians, journalists, educators and many others from all walks of life. He also interacted with middle-and lower-income people to spread awareness about saving, thereby transforming lives through his hard work. His persuasive power played a significant role in convincing economically solvent and uninterested people to purchase insurance. His public relations skills helped create a strong, positive brand image, sparking interest among customers and fulfilling his marketing efforts. He was recognised as the driving force in making EFU the top insurance company in the country.

He strongly believed in Bangali nationalism. ARAG Limited of West

Pakistan owned majority of shares of EFU. In the 1960's, all insurance premiums earned in East Pakistan were transferred to and invested in West Pakistan. As a long time insurance manager of EFU (1960–1968), Buksh witnessed this transfer and understood its negative impact on Bangladesh's economy. He coaxed Roushan Ali Bhimjee, Managing Director of EFU, to resolve this investment disparity. Bhimjee understood Buksh's position and eventually agreed to create two investment boards, one for East Pakistan and another for West Pakistan.

Buksh was a real patriot and advocated the reinvestment of insurance premiums in East Pakistan. To make insurance facilities available in his homeland, Buksh also took the initiative to construct a 24-story EFU building in Dhaka. He was instrumental in purchasing the land, selecting the architect and gaining approval from the government of East Pakistan for the design and construction of the building. Buksh planned to utilise manpower and building materials from East Pakistan. However, Buksh and Bhimjee had major disagreements about the company's investment policies. Buksh "was not a political person, but he was a man of principle, and his love of justice, along with his fairness and advocacy for the interest of Bangalis, brought him into conflict with EFU management." Following his conscience, idealism and patriotism, he resigned from EFU in April 1969. The Bangladeshi government later completed the EFU building in Dhaka, now known as Jiban Bima Tower, signifying Buksh's "vision and spirit of nationalism." Shortly after his resignation, Buksh launched an insurance company called Federal Life with ten influential Bangali industrialists.

Buksh's leadership and tireless work was instrumental in creating the foundation for the Bangladeshi life insurance industry. This elevated industry baseline was clearly evident when Buksh became the managing director of Jiban Bima Corporation (JBC) for all 37 nationalised life insurance companies in 1973. JBC opened two branches and began business with the infrastructure and labour resources already in place. JBC inherited 71 branches as well as the services of 9,335 agents across Bangladesh. It is clear that the majority of the insurance industry's development occurred during this pre-independence period.

Insurance was Buksh's passion. He earned a reputation as the "wizard of insurance." Through his dynamic leadership, he created jobs for thousands of young people while also inducting the leaders of the insurance industry. The emergence of the insurance industry in urban and rural areas resulted in the creation of a new class of insurance workers in demarcated social groups. The profession of insurance sales that emerged from Buksh's vision in the 1950s to 1960s eventually helped the industry develop and progress. Buksh died on May 13, 1974.

Buksh can be remembered in many ways – as a patriot, a humanitarian, a visionary. His love for his country, people and justice, his integrity, commitment and devotion to society, and his lifelong mission to establish an insurance industry in this region will always remain with us.

The writer is Executive Director, Khuda Buksh Memorial Trust and Foundation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments