Private sector credit growth continues to rise

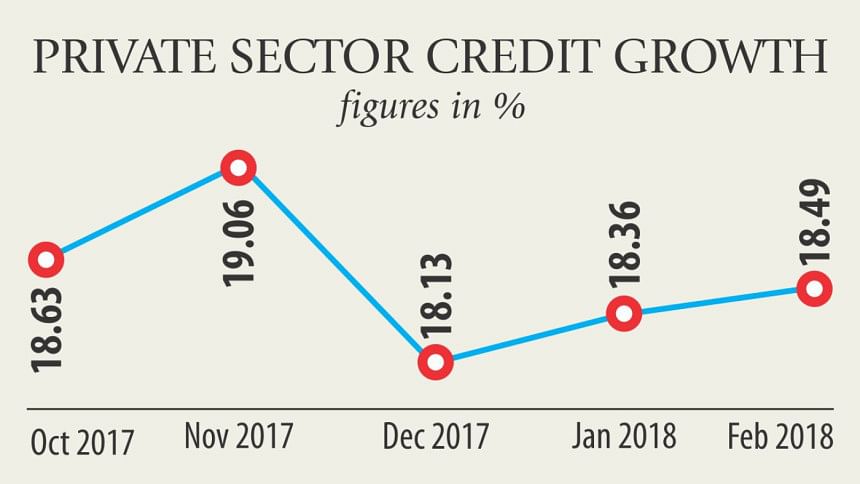

Private sector credit grew 18.49 percent in February, up from 18.36 percent a month earlier and way past the central bank's target of 16.3 percent, dispelling the notion of an ongoing liquidity crisis in the banking sector.

For the best part of 2017 the private sector credit growth has been on the rise, prompting the Bangladesh Bank in January this year to lower the banks' loan-deposit ratio ceiling to 83.5 percent from 85 percent.

Bankers insisted that the move created a severe liquidity crisis but the latest data from the BB suggests otherwise.

In the name of the liquidity crisis, private banks, by way of its directors, particularly those who are politically linked, managed to persuade the BB to lower the cash reserve ratio by one percentage point to 5.5 percent.

The move would give the banks additional Tk 10,000 crore of liquidity. A senior BB official wishing not to be named said the liquidity position is normal in the money market and the upward movement of interest rates is also usual as it is rising in other countries also.

The London Inter-Bank Offered Rate (LIBOR), which is the global benchmark interest rate, has increased about 2 percent in recent months.

Some banks are creating artificial crisis in the market to go for aggressive lending, said the BB official.

“Credit growth of 14 to 16 percent is enough to support 7 percent plus GDP growth. More credit without ensuring quality would push up bad loans further,” he added.

The central bank supplies money to banks through repo when there is a shortage and mops up through the reverse repo when the market is flush with liquidity.

Though banks are crying about a liquidity crisis, they did not take money through the repo from the central bank.

In fact, the BB did not need to supply money through repo in the last three years as the call money market has been liquid enough, said another senior official of the central bank.

The call money rate hovered between 4 and 4.5 percent in last three months, with average transaction being Tk 7,000 crore to Tk 8,000 crore, according to the BB. As of December last year, the excess liquidity in the banking sector was Tk 86,000 crore.

The weighted average interest rate on deposits increased slowly in the last several months to hit 5.18 percent in February, but it remained below the inflation rate of 5.72 percent.

In contrast, the weighted average interest rate on lending increased slightly to 9.55 percent in February from 9.35 percent in December last year.

Only some banks are going through a liquidity crisis due to problems of their own making, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

Most of the banks are in a sound position liquidity-wise.

“Expansion of liquidity will open up windows to abuse money and go for aggressive lending in the election year,” he said.

Moreover, the local currency will depreciate.

“The monetary policy was supposed to tighten as the exchange rate is on the rise but the central bank could not do it in the face of bankers,” he added.

The structural imbalance in liquidity management has led to the rise in lending rate, said Md Arfan Ali, managing director of Bank Asia.

“Few banks are liquid and few are not causing structural imbalance.”

The state banks are liquid enough due to limited lending activities for their high non-performing loan ratio. On the other hand, private banks are under pressure to meet the rising credit demand.

“In this perspective, some private banks fell in to liquidity crisis due to over-lending,” he added.

Only private banks are under pressure, which has impacted the whole market, said Faruq Mainuddin Ahmed, managing director of Trust Bank.

Some banks are offering 9 to 10 percent interest rate to attract deposits, which was 6 to 7 percent several months back, according to Ahmed.

The total credit to the private sector stood at Tk 8.62 lakh crore at the end of February, up from Tk 8.51 lakh crore, according to central bank data.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments