Economy to stay stable

Standard Chartered yesterday attached a relatively stable outlook to Bangladesh for 2017, saying the country is positioned to be one of the fastest growing Asian economies in the year amid a volatile global scenario.

The Asia-focused British lender said it thinks the global economic landscape this year will be very different from that in the previous years.

The US economy's potential reflation -- which is a fiscal or monetary policy designed to expand a country's output and curb the effects of deflation -- is fuelling optimism, but this is overdone as tightening financial conditions may stunt growth before fiscal stimulus takes root.

Tighter conditions are also likely to unleash further volatility, leading to re-pricing of risk in many emerging markets.

"2017 is shaping up to be an exciting but volatile year. In this context, the outlook for Bangladesh is relatively stable," Standard Chartered said in its year-end commentary.

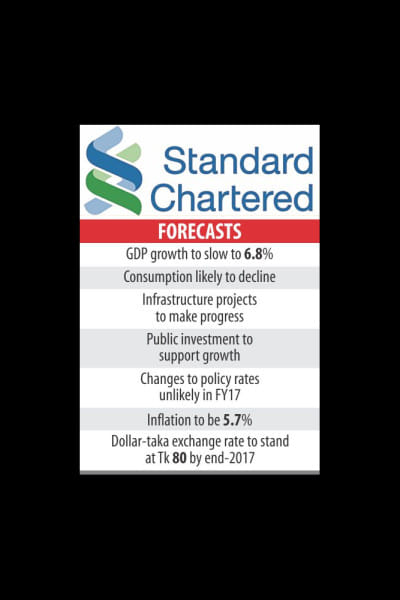

However, the bank expects Bangladesh's gross domestic product growth to slow down to 6.8 percent in the current fiscal year from 7.1 percent a year earlier, owing to the fading impact on consumption of public sector wage hikes, and a decline in remittance inflow.

The government's target of GDP growth for the current year is 7.2 percent.

Standard Chartered sees greater risks to both consumption and external sector in 2017, two important growth determinants.

Consumption is likely to decline in 2017 on the implementation of a uniform VAT rate (effectively raising tax rates) and slower exports.

Risks to the external sector include weaker-than-expected global trade and tightening global financial conditions.

Trade with the UK, Bangladesh's biggest export market after the US and Germany, may suffer due to the medium-term impact of Brexit and 20 percent appreciation of the taka against the British pound in the past year.

The bank said public investment is likely to propel growth this year, climbing steadily as Bangladesh seeks to address its infrastructure deficit.

Public investment increased 15 percent annually in the past five years, with a focus on infrastructure projects.

To meet infrastructure development needs, the seventh Five-Year Plan envisages a financing requirement of about $410 billion -- twice the size of Bangladesh's GDP.

Standard Chartered said the progress in easing investment constraints has been slow, but there have been some positive developments in the past year.

Padma bridge progress is broadly on track, it said, adding that the recent completion of two critical road projects -- Dhaka-Chittagong and Dhaka-Mymensingh highways -- could potentially reduce travel time and transport costs, boosting productivity and trade.

The government has increased its annual development spending target to $14 billion in fiscal 2016-17, with the transport and energy sectors receiving the bulk of the allocation.

The bank expects no change to policy rates in fiscal 2016-17 as inflation remains close to Bangladesh Bank's target and growth is expected to hold up well.

The bank forecasts average inflation in fiscal 2016-17 to be 5.7 percent, marginally lower than BB's target, on lower commodity prices and tight monetary policy.

On the foreign exchange front, fundamental drivers of the taka still argue for an adjustment higher in dollar-taka rate in the coming years.

The currency is overvalued on a real effective exchange rate basis, inward remittances are slowing, trade deficit is likely to widen and Bangladesh's exports are losing competitiveness, Standard Chartered said.

However, given the continued balance of payments surplus, the adjustment is likely to be slower than previously thought, it said.

"As such, we adjust our dollar-taka forecasts slightly lower. We now forecast dollar-taka at 80 by end-2017."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments