Grameenphone expands its market footprints

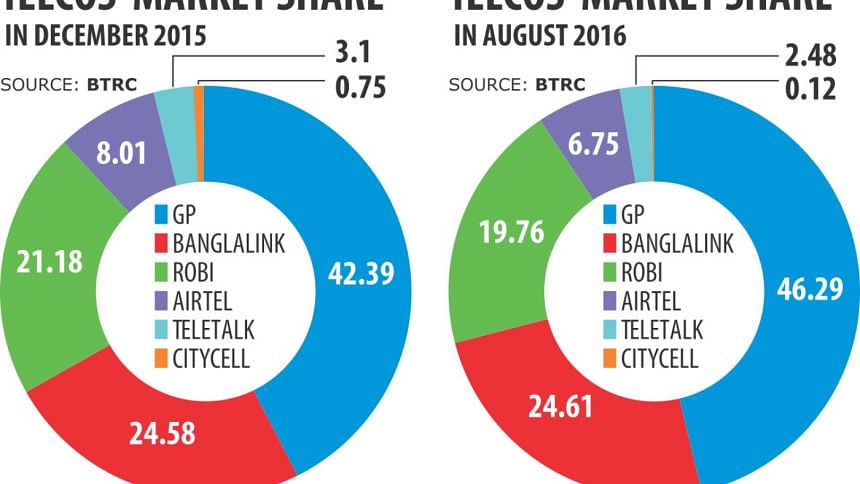

Grameenphone's share of active subscribers has expanded by 4 percentage points after biometric re-registration, cementing its position as the market leader.

Between January and August this year, the market saw active subscribers drop by 11.89 percent to 11.78 crore.

Out of the six operators, Grameen-phone lost the lowest number of subscribers, according to data from Bangladesh Telecommunication Regulatory Commission.

It lost 21.72 lakh active connections, but its market share widened to 46.29 percent in August from 42.39 percent in January.

"Our customers put their confidence in the strength of our network and we are striving to remain relevant through affordable prices and easy to use services," said Yesir Azman, chief marketing officer at Grameenphone.

Grameenphone started the year with 5.67 crore active SIMs, which stood at 5.45 crore in August.

"We have invested heavily to expand the 3G network around the country and on complementing that network with useful digital services. All these efforts help us retain customers and encourage more to choose Grameenphone as their communication provider," Azman added.

Banglalink, the second largest operator in terms of connections, holds a 24.61 percent market share, although it lost 38.88 lakh active connections over eight months.

As the third largest operator, Robi lost 1.42 percent of its subscribers and its market share shrank to 19.76 percent.

Airtel, in the process of merging with Robi, lost 1.26 percent of market shares in the eight months, according to BTRC data. Robi started the year with 2.83 crore connections and reached 2.33 crore at the end of August. The two operators lost 78.21 lakh connections jointly.

Airtel started with 1.07 crore active SIMs, which fell to 79.43 lakh.

The biometric re-registration process also shook the lone state owned operator Teletalk as it had to block 12.18 lakh active connections. Currently, its market share stands at 2.48 percent, which was 3.1 percent before the re-registration process started in December last year.

Citycell, the oldest mobile operator in this region, consistently lost customers every month, and ended up with 1.42 lakh customers after re-registration. The operator said it had 10.07 lakh active SIMs before re-registration.

At the start of the year, Citycell has a market share of 0.75 percent, which fell to 0.12 percent, according to BTRC's customer data.

Some officials of operators other than Grameenphone and Banglalink said the registration process destroyed the level-playing field, and strengthened the position of the top operators.

The process also brought about a shift in operators' revenue earnings, they added.

Grameenphone and Banglalink saw 11.2 percent and 4 percent revenue growth in the third quarter respectively.

Robi's quarterly report is yet to be published, while Airtel and the operators never made it public.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments