SIM re-registration takes toll on mobile money accounts

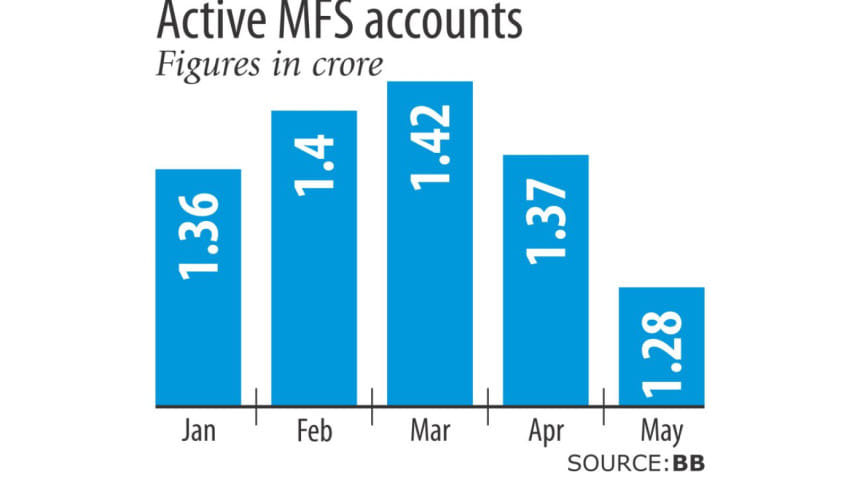

The number of active accounts of mobile financial service (MFS) declined about 6.56 percent in May compared to the previous month, according to a report by the central bank.

Mobile phone operators and an official of Bangladesh Bank blamed the fall on biometric verification of SIMs.

There are 1.28 crore active MFS accounts as of May, which is the lowest in the first five months of this year. The total number of registered MFS accounts -- both active and inactive -- was 3.55 crore at the end of May, which was 3.56 crore in April.

However, the number of agents stands at 5.93 lakh as of May, up from 5.77 lakh a month ago, according to the BB report.

Due to the biometric verification, a large number of unregistered SIMs were blocked during January-May, said industry insiders.

Subhankar Saha, spokesperson for BB, said they found three reasons behind the decline in the number of active MFS accounts -- re-registration of SIMs played the major role.

"Though the number of active accounts fell, transaction volumes were not affected. It means the accounts that were dropped from our list were unwanted," said Saha, who is also an executive director of the central bank.

According to Saha, they also have increased surveillance on unwanted accounts and transactions, and have advised banks to do the same.

The six mobile phone operators in the country were able to re-register 11.6 crore SIMs out of 13.26 crore active connections by May 31.

The industry was forced to suspend around 1.5 crore active connections, which also negatively impacted related sectors like MFS, said an official of a leading telecom operator.

"Here we are not a major stakeholder so we can't comment officially, but as an active technology provider of this service, we know the situation," said the official. "We had to block several SIMs that had active MFS accounts."

An official of another operator said the issue was brought up before the accounts were suspended, but it was ignored.

Statistics on MFS accounts from June will be even grimmer as more than one crore active SIMs have been blocked since the deadline, said mobile operators.

Earlier, different banks that run MFS services said they will get a fresh and clean user database after the SIM re-registrations process, which will also help the market mature.

BB data showed although the number of active MFS accounts dropped, the total account number and even the number of MFS agents are increasing every month.

Currently around two-thirds of all mobile money accounts have gone inactive, with the number rising every month, according to BB data.

Though the number of active accounts declined, it did not affect the value of the transactions. In May, the daily average transaction amount was Tk 616.05 crore, which was Tk 606.9 crore in April.

Abul Kashem Md Shirin, deputy managing director of Dutch-Bangla Bank, earlier said agents usually get Tk 30-Tk 50 from the bank for opening a new MFS account, which is why they opened so many new accounts. However, those accounts were not used in recent times.

In Bangladesh, e-commerce and other related services do not have a strong footprint yet, although banks and other service providers are trying to increase the number of active accounts, he said.

However, the scenario may be different in June for Eid shopping, said market insiders. Ahead of Eid, some provided offers like cash back and discounts which may help increase the number of active MFS accounts.

Above all, transactions through mobile phones rose 64.67 percent year-on-year to Tk 18,481.56 crore in May, riding on the back of increased economic activities, BB said in the report.

The monthly average transaction against every active account stood at Tk 14,385 in May from Tk 11,270 in the same month last year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments