India’s forex reserves at 20-month low, currently $572bn

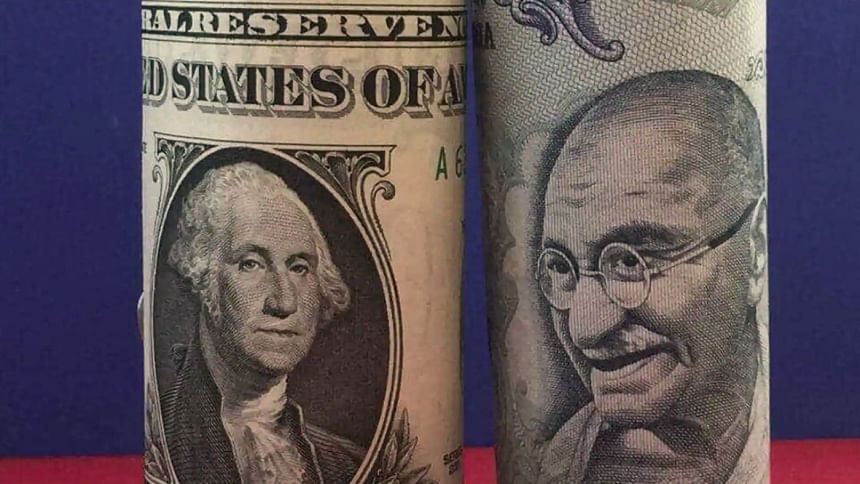

India's forex reserves fell by $7.5 billion to $572.7 billion – a 20-month low – as of July 15, due to spiraling costs of imports, the Reserve Bank of India (RBI) has said.

The forex reserves fell following heavy intervention by the central bank in the forex market as it continued to sell greenback to prevent a sharp depreciation of the rupee, Times of India reported.

On July 22, RBI Governor Shaktikanta Das said that the central bank has zero tolerance for bumpy movements in the rupee and assured that India's forex reserves are adequate.

"In recognition of the fact that there is a genuine shortfall of supply of forex in the market relative to demand because of import and debt servicing requirements and portfolio outflows, the RBI has been supplying dollars to the market to ensure that there is adequate forex liquidity," Times of India quoted Shaktikanta Das as saying.

The RBI chief's remarks came at a time when the rupee has been touching new record lows against the dollar in the last few sessions, with its value having depreciated by around 7 percent since January.

According to experts, this is an outcome of strong demand for dollar among oil importers due to high crude oil prices.

The interbank forex market saw Indian rupee close 10 paisa stronger at 79.85 on Saturday compared to 79.95 as on Thursday, according to the Times of India report.

The forex reserves were last at $572 billion in November 2020. Since then, the reserves had risen to a high $642 billion in October 2021.

The Indian central bank is likely to have sold over $50 billion to stem the volatility in the forex market.

The dollar index was up by 0.2 percent at 107.1.

"It is more of a story of the dollar strengthening than the rupee weakening," Pronab Sen, former chief statistician of India, told Times of India.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments