A lender to the poor

Thirty-two-year-old Mukter Hossain ran a small roadside stall at West Shaorapara in Mirpur, Dhaka, selling packets of low-cost cigarettes, biscuits and tea. He struggled to pay Tk 1,000 in monthly rent, as he stacked only a limited number of items.

That was Hossain only six months back. He now stacks a good number of daily consumer items and spends a busy day at work.

The father of two, living in a shanty in Pirerbagh, says: "I needed some money to expand the range of products I could offer in my shop. I approached my relatives and neighbours in January, but they could not help me."

One morning, a friend suggested going to a cooperative society for the money.

“I went to a cooperative society located at Shewrapara and sought Tk 10,000. They inspected my shop and the rent agreement copy. Later, I had to deposit Tk 50 a day for 20 days to become a member of the society,” Hossain explains.

By the end of January, he got the money in his hands. He had to pay the loan in 108 instalments, in an equivalent number of days, with each instalment amounting to Tk 100.

This is how low-income people benefit from the cooperative systems. In fact, Bangladesh has a long history of cooperatives. The late Dr Akhter Hameed Khan had tried to change the fate of the rural poor by developing cooperatives in Comilla in the fifties. Even before then, there is evidence that cooperative activities were present in rural Bangladesh.

Earlier, the idea centred around agricultural practices alone. Now it has spread to all other sectors of the economy, including small industries, marketing, housing, fisheries, women entrepreneurship, transport, and insurance.

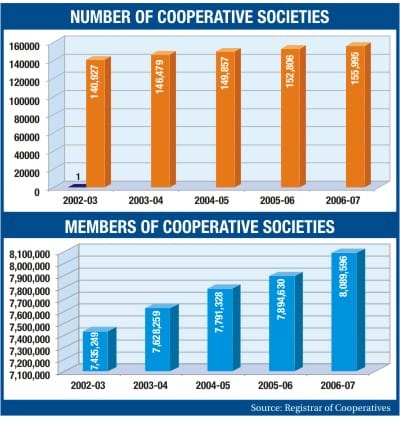

Nearly one crore people are members of different samabay samitis (cooperative societies), according to data from the Registrar of Cooperatives, a government wing authorised to give registration.

There are three types of cooperative societies -- primary, central and national. At least 20 members constitute a primary society, some primary form a central one and some central societies form a national one.

The total number of societies neared 180,000 at the end of fiscal 2007-08, Registrar of Cooperatives data shows. Additionally, working capital of these societies stood at Tk 3,000 crore at the time.

“The number of societies and members are increasing at a rate of 10 percent annually," a senior official of the Registrar of Cooperatives told The Daily Star.

Amena Khatun, an officer of the Dhaka Mercantile Cooperative Bank (although use the word 'bank' is not legally allowed) at Shewrapara branch said they are facing an increasing demand for credit from people everyday.

“We disburse Tk 50 lakh a month on an average as credit,” Amena, who has been working with the organisation for the past eight years, said.

She said they do not lend to floating traders. “A trader with a permanent structure is eligible to receive a loan."

Amena said they have to work hard to recover the loan. In the branch where she is stationed, some 12 field officers work to recover the loan from the members, she added.

“The default rate is quite insignificant. It is less than five percent,” she added.

Registrar of Cooperatives Suraiya Begum said demand for cooperative registration is growing constantly. But the challenge lies in monitoring and auditing.

“We have to audit thousands of organisations with a limited number of manpower,” she added.

Like Muktar Hossain, there are thousands of beneficiaries of the cooperatives across the country.

Mohammad Shafique, 27, who sells vegetables at the Karwan Bazar kitchen market, also became member of a cooperative society in 2007. He took loan from the society three times to run his business.

“No bank is willing to provide us with loans. We are getting credit from a society at an affordable rate," he says. "The best part is that I can have repay the loan in small instalments from my daily sales."

[email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments