Sonali Bank: A sleeping giant?

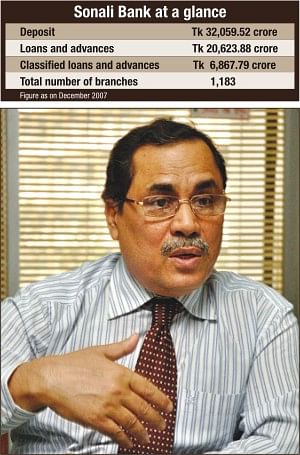

SA Chowdhury, managing director of Sonali Bank, says the management needs at least 60 months or five years to turn the bank into a profitable institution.Photo: Amran Hossain

With an unrivalled network of branches and huge assets and deposits, Sonali Bank is the country's largest commercial bank. It is also the one that has suffered the biggest losses.

As of September last year, the state owned bank incurred an accumulated loss of Tk3976 crore and each year it is witnessing its leadership being eroded by the rapid growth of the private commercial banks. And there is no shortage of critics eager to point out the bank's weak service, inadequate capital, and the scale of its non-performing loans.

SA Chowdhury walked into such a scenario in January, when he was appointed as managing director and chief executive officer of the bank. His appointment followed a decision by the government to convert the bank, along with the two other nationalized banks, Janata and Agrani, into a public limited company.

His is expected to make the bank profitable, but Chowdhury seems reluctant to promise a quick turnaround.

"We need at least 60 months or five years to turn the bank into a profitable one," he said with caution.

This is not Chowdhury's first time as the head of Sonali bank. He was CEO of the bank in 2001/02, but at the time the bank was under the direct control of the finance ministry and the bank's management had only limited authority. One observer once commented: “Any junior official at the finance ministry could phone up and dictate policy.”

Since becoming a public limited company late last year, the new management has formulated strategies to improve render quality, give faster services to customers and to hold ground against the growing competition.

"We have already formed three task forces to submit plans on three broad issues -- human resources, branches and automation -- to sustain the operation of the bank in a highly competitive business environment," Chowdhury said, adding, "The moves could change the way the bank operates its business."

He believes that state-owned banks can make profits if the management quality is improved. Chowdhury cited the example of India, which has 22 public sector banks.

"If the state-owned banks in India and Pakistan can make profits, why not Bangladeshi state-owned banks," he stated emphatically.

Sonali Bank has a huge edge over other banks in Bangladesh. The bank has asset (excluding off-balance sheet item) worth Tk 35,137 crore and a mammoth deposit of Tk 35,000 crore. The bank has about 15 million customers, a massive network of branches (1,183), and an established goodwill. As on September 2007, the bank's total outstanding loans and advances, and classified loans stood at Tk 23,295 crore and Tk 7,065 crore, respectively.

The bank aims to earn more from remittances this year by providing faster services to its clients, eying to increase remittances to $1.5 billion from last year's $1.2 billion.

During the first quarter of 2008, the bank's investment has increased by Tk 600 crore, recovery stands at Tk 200 crore and the non-performing loans down to 32 percent of the total loans instead of 33 percent of the previous quarter.

But the bank has to focus on market-oriented products instead of providing services to the public sector only, the CEO said.

" We pay salaries to about five lakh teachers of private educational institutions. We also provide collateral-free loans to women entrepreneurs," Chowdhury said.

The CEO believes with improvement of its existing capacity, asset quality, and services the bank can be the leading bank of the country.

Regarding the number of branches of the bank, a task force will submit its report by June this year.

"Only 45 branches, or less than 4 percent of the bank's total branches, do 70 percent of the bank's businesses," Chowdhury said.

He said one of the branches that has made losses for the last five years must breakeven this year. If not, management would consider its relocation, increased investment in the branch, its merger to some other branch or even closure.

Sonali Bank, with a capital shortfall of over Tk 4,000 crore, has plans to increase its capital. "One of these plans is to raise the capital by offloading shares in the capital market," Chowdhury told The Daily Star.

Four recovery agents have been appointed as an initiative to improve the status of non-performing loans. But he said the bank is not pressurising the defaulters, especially the big ones.

The bank has also initiated moves to develop electronic banking services. Some 15 new automated teller machines (ATM) will be set up and 60 new branches will be brought under online banking this year, Chowdhury said.

Will it work? Economist Dr Atiur Rahman, who was a director in Sonali Bank's board between 1996 and 1999, believes the measures could provide the bank's only chance for revival, provided there is no government interference. “The board of the bank must run independently by professionals without any pressure from the government,” he said.

“Lack of human resource and poor financial incentives are two other major problems of the bank,” he added.

Surely, SA Chowdhury faces a tough job of awakening the sleeping giant.

[email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments