Reining in Loan Default: Central bank now ‘ineffective’

The central bank has become an ineffective entity in containing defaulted loans due to immense political pressure and illegal intervention by some large business groups, finds a research by Transparency International Bangladesh.

Vested groups influenced the recent amendment to the Banking Companies Act 1991, appointment of deputy governors of Bangladesh Bank, and bank inspections by BB officials.

Amid such a situation,the entity that enjoys autonomy on paper now faces a lack of corporate governance, and also a section of its officials are involved in corruption, said the TIB.

The entire banking sector is now at the edge of a cliff and the authorities concerned should take immediate measures to avert a probable collapse in the days ahead, it noted.

The graft watchdog yesterday unveiled the research paper titled "Banking Sector Supervision and Regulating Defaulted Loans: Governance Challenges of Bangladesh Bank and Way Forward" at a webinar.

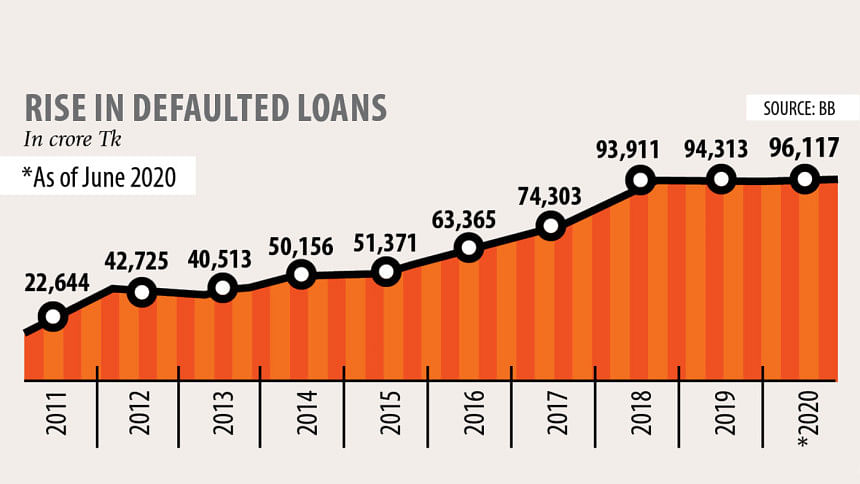

Reading out the summary of the research paper, TIB Director (research and policy) Mohammad Rafiqul Hassan said defaulted loans in the banking sector went up sharply over the last one decade due to a lack of monitoring by the central bank.

For instance, non-performing loans (NPLs) stood at Tk 116,288 crore as of September last year against Tk 22,481 crore in 2009.

Quoting an International Monetary Fund report, Rafiqul said the actual delinquent loans stood at Tk 240,167 crore during the period given the volume of restructured and rescheduled loans, and the amount of NPLs shown as unclassified ones because of higher court's stay orders.

The amount of defaulted loans was brought down artificially after September last year as the BB offered a relaxed rescheduling facility that allowed delinquent borrowers to regularise NPLs by making a down payment of only 2 percent of the outstanding amount with a repayment period of 10 years.

This helped the habitual borrowers carry on their misdeeds, leaving depositors in dire straits.

The BB now faces two types of governance challenges -- one is external pressure and the other is internal crisis, the TIB observed.

It described limitation of acts, political intervention and business groups' influence as external pressure. Weakness in monitoring the banking sector, corruption in supervising banks and unskilled management are the major internal challenges for the BB.

There has also been a lack of transparency and accountability in the central bank's activities, the TIB said.

The BB has yet to come up with any definition of habitual defaulters, helping them enjoy the relaxed policy and its stimulus programmes taken to recover defaulted loans.

The Banking Companies Act 1991 stipulates that a client would be allowed to borrow up to 35 percent of a bank's capital. But it does not say how much money a borrower can take from the entire banking sector.

The TIB noted that since 2009, the BB allowed 14 new lenders to run banking operation, which is excessive and unnecessary given the country's business volume. Ministers, parliament members, and leaders and activists of the ruling party and student organisations were the sponsors of the new banks.

There have been allegations that black money was invested in the paid-up capital for setting up the new banks. Besides, a large business conglomerate now controls nine banks and it bought 28 percent shares of a lender in favour of its 14 companies, said the TIB.

The finance ministry is now controlling the state-run banks, weakening the BB's autonomy. Managing directors now get appointed in these banks on political consideration, and the ministry, in some cases, ignores the BB's recommendations.

For instance, the BB recently objected to extending the tenure of a managing director in a state-run bank as it received allegations against the person. But the ministry rejected the recommendation and extended the tenure, said the TIB.

Directors of private banks have taken loans of Tk 171,616 crore from 55 banks on mutual understanding.

A large portion of such loans often becomes defaulted and then the directors regularise the loans by way of using the relaxed rescheduling and restructuring facility. This creates a burden of defaulted loans on the banking sector, the TIB mentioned.

The BB had earlier tried to take action against the delinquent borrowers, but its efforts proved futile due to political pressure.

As per the best global practice, the government can appoint only one official to the central bank board but that policy is not followed in Bangladesh.

Three government officials and two former bureaucrats are now serving as BB directors, which has helped the government hold sway over the central bank.

Besides, there are no specific rules for recruiting the BB governor or deputy governors. The government appoints persons of its choice as the governor and deputy governors so that there is no opposition to its policy.

There have also been allegations that some influential business groups play a big role in the appointment of deputy governors. A good number of directors of banks are directly involved with the ruling party, and this helps them avoid facing action despite their involvement in corruption, mentioned the TIB.

The quality of BB inspection has been on the decline as the inspection teams are not allowed to take action against the scamsters. But in the past, they had the authority to do so.

They now have to take prior approval from a deputy governor to take any measures.

Moreover, the number of BB inspections is decreasing. BB teams carried out 1,917 inspections in fiscal year 2017 against 2,783 in 2015.

In some cases, the important parts of the inspection reports are removed to protect influential borrowers as they have strong links with the BB policymakers, noted the TIB.

A section of the BB high-ups doesn't take adequate measures to implement the recommendations in the inspection reports as part of efforts to maintain a good relationship with the influential quarters. They hope such activities will help them get suitable jobs in government institutions after retirement.

RECOMMENDATIONS

The TIB has recommended forming a banking commission comprised of experts to protect the banking sector from defaulted loans.

Articles of 46 and 47 of the Bank Companies Act should be discarded so that the BB can supervise state-run banks. And the government should formulate regulations on appointment and withdrawal of the BB governor and deputy governors.

The BB should be allowed to appoint more directors from the private sector to its board, and bring down the number of government officials in it.

A search committee should be set up for appointing directors -- both for state-run and private banks -- and persons involved in politics should be barred from holding such posts.

TIB Executive Director Dr Iftekharuzzaman said the depositors would face dire consequences if the policy makers do not take necessary measures right now to protect the banking sector.

"The existing rules and regulations to ensure good governance in banks are not effective as these have a lot of loopholes. All stakeholders must come forward to protect the banking sector," he noted.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments