BASIC Bank, BDBL merger on cards

The troubled BASIC Bank is heading for a merger with the better-performing Bangladesh Development Bank Limited (BDBL) as part of the government's efforts to improve the overall health of the country's state banks, which have historically been sitting on a heavy pile of soured credit.

"They are both state banks, so the merger should not raise any objection from anyone," Finance Minister AHM Mustafa Kamal told The Daily Star in an interview this week.

Once a model for state-owned banks, BASIC Bank's fortune took a turn for the worst when the present government came to power in 2009 and appointed Abdul Hye Bacchu as its chairman.

Between 2010 and 2013, more than Tk 4,500 crore flew out, leaving the state bank in financial quicksand. The government had to keep pouring in funds to keep the bank standing.

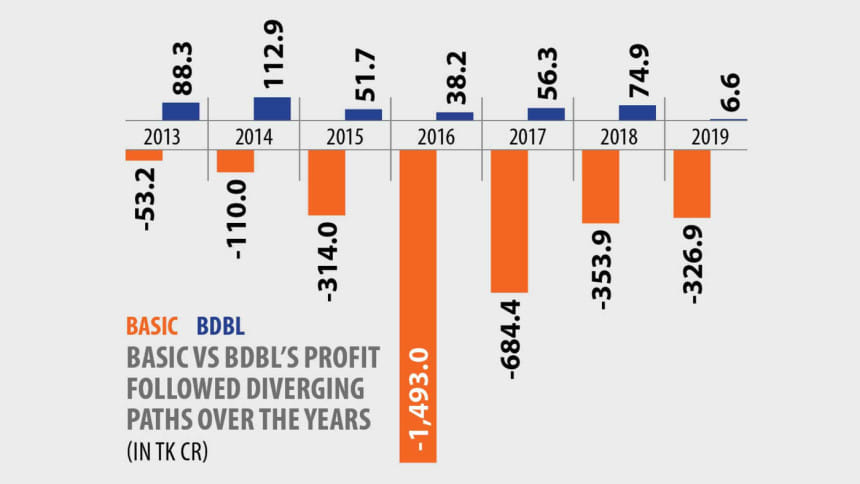

In 2020, BASIC Bank's net loss widened to Tk 366 crore from Tk 326 crore in 2019, according to data from the Bangladesh Bank.

At the end of last year, as much as 51 percent of its outstanding loans were bad: Tk 7,502 crore. As of March, the bank has a capital shortfall of Tk 1,072 crore, down 28 percent from a quarter earlier.

BASIC Bank alone accounted for 17.7 percent of the default loans attributed to the state banks at the end of 2020.

As of last year, which is the latest available data of the central bank, the total defaulted loans in the banking sector stood at Tk 88,734 crore -- and the six state-owned commercial banks accounted for 47.6 percent of the amount.

The BDBL, born out of the merger of Bangladesh Shilpa Rin Sangstha and Bangladesh Shilpa Bank in 2010, is a rare instance of a sound state bank.

The bank has always been in the green, and last year, logged in a profit of Tk 4.5 crore.

At the end of last year, the bank had no provisioning shortfall and a capital surplus of Tk 605 crore. Its defaulted loans stood at Tk 595 crore, which is 34 percent of its total outstanding loans.

The law to allow the merger will be in place over the next six months, according to Kamal.

Last month, the cabinet has approved in principle the amendment to the Bank Company Act, which includes the provision to merge weak banks with strong ones as well as a clear outline of habitual defaulters and the actions that can be taken against them.

The draft law has now been sent to the law ministry for vetting, after which it will be returned to the cabinet. The cabinet will further scrutinise it before sending it to the parliament.

Banks that go from bad to worse to worst will be "forcibly merged" with the sounder ones, Kamal said.

The proposed merger of BASIC and BDBL has synergies.

For instance, BASIC Bank has branches and the BDBL does not.

The BDBL has management acumen and their expertise will be put to use to turn around the fortune of BASIC Bank, Kamal said.

The merger though is not final -- yet.

"We have not scrutinised their financials and their equity structure yet. We are yet to seek the two banks' managements' opinion on the merger."

Kamal though is sanguine about the future of BASIC Bank.

"They are trying their best to recuperate -- it is a good sign. I think this bank will be able to get back on its feet."

Kamal also touched upon the habitual and wilful defaulters: they will not be let off scot-free as per the provision of the draft Bank Company Act.

As is practice, once the banks file cases against the defaulters after exhausting all options to recover the funds.

But the defaulters tend to file writ petitions one after another to drag the case for years and to prevent them from being officially classified as defaulters.

Under the new rules Kamal has prepared, defaulters will not be able to file any writs without furnishing 20-25 percent of the amount owed to banks.

"It is not that we are not doing anything," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments