Sonali Bank UK fined £3.25m for money laundering offences

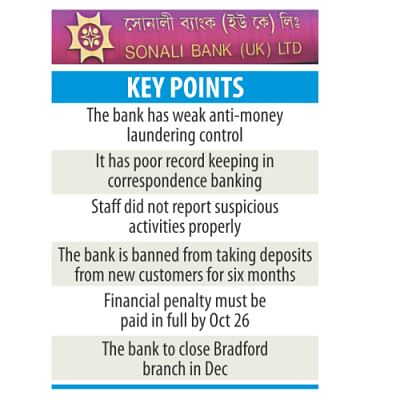

Sonali Bank (UK) Ltd maintained transactions in favour of politically exposed persons without doing adequate due diligence and allowed suspicious money transfers from branches.

The irregularities at the government-owned bank's subsidiary in the UK were exposed by the Financial Conduct Authority on Wednesday.

The financial watchdog also slapped a fine of £3.25 million (Tk 31 crore) on SBUK. The financial penalty must be paid in full by 26 October, 2016.

Finance Minister AMA Muhith said he has not seen any document on the issue and only came to know about it from media reports.

“If there is any fine, it has to be paid,” Muhith told reporters at the secretariat, adding that it is solely a matter of Bangladesh whether it will take steps against the people responsible.

The government of Bangladesh owns 51 percent of the company, while the remaining 49 percent is held by Sonali Bank Ltd.

The FCA has imposed a restriction, preventing the bank from accepting deposits from new customers for 24 weeks.

It found the serious and systemic weaknesses affected almost all levels of its anti-money laundering control and governance structure, including its senior management team, money laundering reporting function, oversight of branches and AML policies and procedures.

For example, one customer who was identified by SBUK as a politically exposed person (PEP) and whose income had been noted in 2007 as £20,000 per year had made a number of significant cash and cheque deposits.

SBUK had failed to consider whether these deposits were commensurate with his earnings and, accordingly, whether the account activity posed increased AML risks.

Until 2014, SBUK did not conduct routine screening of its customer list to identify PEPs.

Although checks were carried out for new customers, SBUK failed to identify some customers who should have been assessed as PEPs.

Even when SBUK identified a customer as a PEP, it did not always carry out adequate due diligence.

In one case, the bank failed to identify that several PEPs sat on the board of one of its clients and failed to consider publicly available information concerning corruption investigations involving the customer.

The FCA said staff did not report suspicious activity appropriately although it was the responsibility of SBUK staff members to refer any suspicious activity to the MLRO department by completing a suspicious activity report (SAR).

Throughout the primary relevant period, from August 20, 2010 to July 21, 2014, the bank's staff made very low levels of SAR submissions.

The bank accepted the explanation given as sufficient without any challenge.

SBUK was notified following the 2010 visit that its correspondent banking files contained very poor records.

Then later in October 2012, the MLRO identified that the files were “in a mess”.

Despite this, a full review of correspondent banking relationships was not carried out until December 2013, at which point four relationships with correspondent banks were suspended as a result of AML issues. Following the 2010 Visit, the FCA had alerted SBUK about the deficiencies in its customer due diligence (CDD) processes.

Despite this, when the FCA examined 16 files during the 2014 visit, it found a failure to carry out adequate CDD, including a lack of documented evidence of the purpose and intended nature of the business relationship and information relating to the expected turnover or transactional activity.

The FCA said SBUK operated two separate systems for money remittances throughout the primary investigation period.

However, the MLRO department was unaware that it only received daily reports of one of the systems. As a result, a significant number of transactions were not subject to monitoring.

In 2012, the internal auditors recommended that the parameters for the daily reports be reviewed and that all transactions on the reports investigated. However, SBUK did not follow the recommendation.

SBUK's systems were unable to detect linked transactions or transactions from a number of remitters to a single beneficiary.

Moreover, individual branches could not access the remittance history of a customer from other branches and the MLRO department could not access remittance histories from branches other than the head office.

For example, an expert appointed by the FCA examined a remittance transaction of £10,000.

When assessing the risk of the transaction and of the customer, SBUK did not document any considerations regarding the fact that the customer's stated income was £28,000 and that, in less than 18 months, he/she had remitted over £25,000.

As a result, the transaction was not considered by SBUK to be suspicious and no documented assessment of the risk posed by the customer was made.

In 2010, as part of the remediation plan, SBUK informed the FCA that it had appointed an external firm to carry out its internal audit functions and that it will pay close attention to whether the AML procedures are being correctly followed.

The FCA said the firm failed to comply with its operational obligations in respect to CDD, the identification and treatment of politically exposed persons, transaction and customer monitoring and making suspicious activity reports.

“SBUK's failures are particularly serious because they left the firm open to the risk that it might be used to further financial crime,” the FCA said in the final notice issued on Wednesday.

Seeking anonymity, a senior official of the banking division in Dhaka said the government would pay the fine.

He said the implementation of the remediation plan has already been started. Once it is completed all issues will be solved, he added.

Steven Smith, SBUK's former MLRO, was fined £17,900 and has been prohibited from performing MLRO or compliance oversight functions at regulated firms.

The FCA said it acknowledges that SBUK has invested in improving its AML systems and controls and has appointed an independent non-executive director who has specific AML skills.

In addition, it has retained the services of external consultants to assist it in its review of AML systems and controls, updated the AML staff handbook and other AML policies and procedures, and revised the risk assessments for the on-boarding of its retail customers, politically exposed persons and high risk accounts.

The FCA said SBUK and its senior management have cooperated and engaged with the investigation and has made a strategic decision to streamline its retail banking operations by closing all but two of its branches by the end of 2016.

Both SBUK and Smith agreed to settle at an early stage and qualified for a 30 percent discount.

Earlier in 1999, the bank was shut down on charges of irregularities, but was permitted to resume operations two years later.

In 2014, SBUK had 2,457 live customer accounts and 85,625 registered remitters, of which 11,268 had been active in the preceding 12-month period. Its turnover was £10,113,368.

Currently, Sonali Bank has three branches in Britain -- in London, Birmingham and Bradford -- that are aimed at serving the expatriate Bangladeshis.

But the bank has already published notice on its website, saying it would close the Bradford branch on December 30. Earlier, it closed its branches in Luton and Camden.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments