Prime Bank changing business model

Prime Bank is bringing major changes to its business model for wholesale, retail and SME banking in order to diversify its operations by 2021.

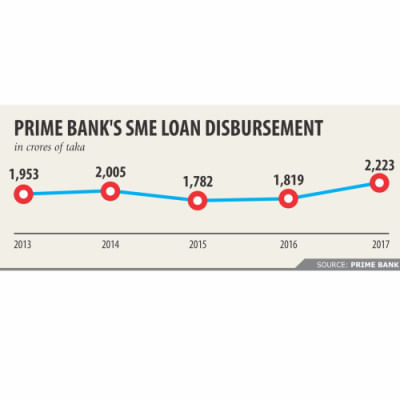

Under the plan, the second generation bank will raise its investment in retail and small and medium enterprises (SMEs) to 40-45 percent in the next four years from 20 percent now.

“We will double our loan disbursement in retail and SMEs as part of the bank's roadmap for 2021,” Rahel Ahmed, managing director of Prime Bank, told The Daily Star in an interview recently.

Last year, SME and retail loans accounted for 9.29 percent and 10.90 percent respectively of the bank's total disbursed loans.

“We will disburse loans to the dealers, distributors and suppliers of the corporate groups under our SME programme,” said Ahmed, who took charge of the bank last year at the age of 47, became the youngest CEO in Bangladesh's banking sector.

Previously, he worked for two big multinational banks in Bangladesh—ANZ Grindlays Bank and Standard Chartered—for more than a decade.

He also worked for two major regional banks—Emirates NBD Banking Group and First Gulf Bank—in senior roles for about seven years in Dubai.

Ahmed said Prime Bank has also rolled out a supply chain financing initiative to bring the hundreds of distributors of the bank's corporate clients under its network.

The corporate groups will benefit from the supply chain financing initiative as their distributors will get necessary financing to run businesses, he said.

Historically, the bank, which started operations in 1995, attached priority to the wholesale and commercial banking, but has now started focusing on the SME and retail banking.

The bank also plans to strengthen its corporate and commercial banking wings to cater large and mid-level businesses.

The bank has recently launched a relationship model for corporate banking and appointed a relationship manager for every corporate group following in the footsteps of global banking models.

It created different divisions to support clients of different genres with customised products.

For example, the corporate and institutional banking division is supporting companies with annual turnover of more than Tk 800 crore.

Companies with annual turnover of Tk 100 crore to Tk 800 crore—considered as the mid-size corporate firms—are getting support from the commercial banking division.

The transaction banking division is offering cash management and trade solutions to the clients under the two wings.

“No local private bank has yet to offer such services to businesses,” said Ahmed.

He said Prime Bank is now enjoying an excellent financial health as it has not faced any liquidity crunch in recent months like most of its peers.

“Our loan-deposit ratio is 82 percent now, which indicates our strong and balanced liquidity base. We have not faced any hardship in disbursing loans when the banking sector plunged into the liquidity crisis.”

Now the bank's major challenge is to get rid of the inherited non-performing loan (NPL), which has created a burden for the lender.

“We are now looking forward to giving a boost to the recovery of the NPL and the bank has already achieved a good outcome from the initiative,” he said.

Four years ago, the private bank had about 7.50 percent in default loans, which came down to 5 percent last year.

The bank's default loan stood at 5.33 percent of its total disbursed amount of Tk 17,386 crore last year, down from 7.49 percent of Tk 13,756 crore in 2014, according to data from the central bank.

Ahmed has targeted to bring the NPL below 4 percent in the next three years, as it has been a drag on the bank's profit.

The net profit halved in 2017 from a year ago as it had to keep aside a large amount as the provision against the default loans.

“We have aggressively tried to clean up the NPL to strengthen the profit base,” Ahmed said.

The profit after tax dropped to Tk 106 crore in 2017 from Tk 219 crore in the previous year.

The fall in the net profit also put a negative impact on the earnings per share, but Ahmed called it a temporary phenomenon.

“We have brought major changes to the bank's working methods by restructuring the operational process,” he said.

The bank has 146 branches across the country, which used to carry out the works related to the opening of letter of credit, corporate and SME banking before 2015.

The bank has recently created a central department to deal with sanctions and disbursement of loans.

The department now oversees all credit-related processes, including verification of loan documentation, to avoid any laps and corruption.

Ahmed also touched upon a number of issues confronting the banking sector.

The CEO said the government has recently allowed the state-owned enterprises to park 50 percent of their funds with private banks, but it is not binding.

So, private banks will have to strengthen their financial health to attract government deposits, he said.

“I don't think all of the 57 banks will be able to attract the deposits from the state-owned enterprises right now.”

He said the core deposit—which mainly comes from small and medium entrepreneurs and common depositors—would play a vital role in the business for banks in the months to come.

The cost of core deposit is relatively lower compared to those of other deposits and the low-cost deposit helps banks bring down the lending rate, said Ahmed, who obtained an MBA in international business from the Maastricht School of Business in the Netherlands.

Some unscrupulous people had diverted loans to unauthorised areas, creating a liquidity crisis, he said.

Banks had to purchase the dollar at a higher rate because of the rising commodity prices in the last eight months in the global market, which also fuelled the crisis, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments