Union Capital barred from giving loans over Tk 1cr

The Bangladesh Bank yesterday ordered Union Capital Ltd not to disburse any loans exceeding Tk 1 crore after the non-bank financial institution repeatedly failed to repay depositors despite their funds reaching maturity.

The central bank has recently asked the NBFI a number of times to return the funds to the depositors, but the order went unheeded.

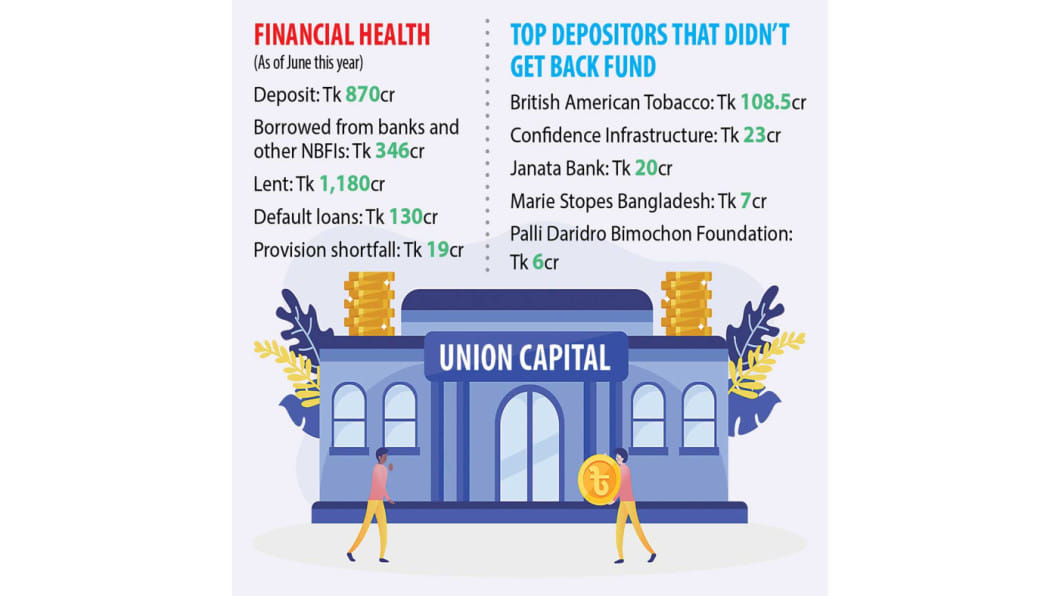

For instance, British American Tobacco Bangladesh (BATB) had kept a deposit of Tk 100 crore with the NBFI, but the company did not get back the fund though it has matured.

The multinational company requested Union Capital multiple times to return the fund, which now stands at Tk 108.52 crore, including interest. The NBFI has recently repaid Tk 50 lakh.

Against this backdrop, the MNC has recently lodged a complaint with the central bank.

Responding to a good number of pleas from depositors, the central bank issued a letter to Union Capital, imposing a number of restrictions, which included a ban on the disbursement of new loans exceeding Tk 1 crore.

The central bank asked the non-bank to settle the issue within 10 working days through talks with BATB.

Sheikh Shabab Ahmed, head of external affairs of BAT Bangladesh, said the money kept with Union Capital as investment belonged to the workers.

"It is the portion of the workers' profit participation fund, and that is why we are more concerned."

Ahmed said Union Capital was not paying the money as promised in the last two years.

"We issued multiple letters and had a couple of meetings with them. However, they haven't kept any promises so far," he said.

The multinational company urged the relevant authority to get involved and help it recover the fund as earliest.

Janata Bank has deposited Tk 20 crore with Union Capital and has not got back the fund.

Md Abdus Salam Azad, managing director of the state-run commercial bank, said that Union Capital even had not paid the interest against the principal amount.

"Funds getting stuck with the NBFI is frustrating. This is public money," he said, calling the BB step time-befitting as it would help depositors recover their money.

Among others, Confidence Infrastructure, Marie Stopes Bangladesh, and Palli Daridro Bimochon Foundation are also struggling to retrieve funds from the NBFI, although their deposits have matured.

Union Capital has been asked to submit a plan to the central bank within a month detailing how it would repay depositors.

The central bank has also unearthed that the NBFI had waived loans given to its subsidiary. The total outstanding loans extended to the subsidiary stood at Tk 500 crore.

"Waiving a loan is a gross violation of banking norms as it reduces the asset of a lender. Union Capital has followed the practice that is eroding its capacity to repay depositors," said the central bank in the letter.

The BB asked the lender not to give out any loan in favour of its subsidiary or persons involved with the NBFI.

The audit committee of Union Capital has been ordered to form an "investigation committee" to verify whether it follows the loan classification rules set by the central bank appropriately.

The non-bank has been instructed to submit the report of the committee to the BB within a month.

Chowdhury Manzoor Liaquat, managing director of Union Capital, said that the lender had been facing problems since the beginning of the coronavirus pandemic.

Many borrowers have failed to repay instalments, hitting the cash flow of the NBFI and hurting its capacity to pay back to depositors on time, he said.

"We are now in a difficult situation as no client parks funds with us."

Liaquat claimed that the NBFI had paid Tk 3.50 crore to BATB this year and Tk 6.34 crore last year.

"We are repaying to other top depositors in phases," he said, adding that the economy had opened up, and it would help the NBFI return funds to the depositors.

Asked why the lender had waived loans disbursed to the subsidiary, he said that the decision came from the board.

Default loans at Union Capital stood at Tk 130 crore, which is 11 per cent of its outstanding loans. But BB officials say the amount of the actual bad loans might be higher.

It faced a provision shortfall of Tk 19 crore as of June.

Shares of Union Capital closed 0.93 per cent down at Tk 10.60 on the Dhaka Stock Exchange yesterday.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments