Meghna Condensed Milk drowning in losses

A steep rise in debt and a fall in sales have sent Meghna Condensed Milk, a listed concern of Meghna Group of Industries-KA (MGOLD) Ltd, into the stock market's non-performing category.

Besides, the company's auditor was unable to secure enough documentation to provide any opinion on its future.

But despite all that, the company's share price soared by 189 per cent to Tk 20 per share in a three-month span until September 2, when its value began to fall.

Stocks of Meghna Condensed Milk declined 4 per cent to Tk 22 yesterday.

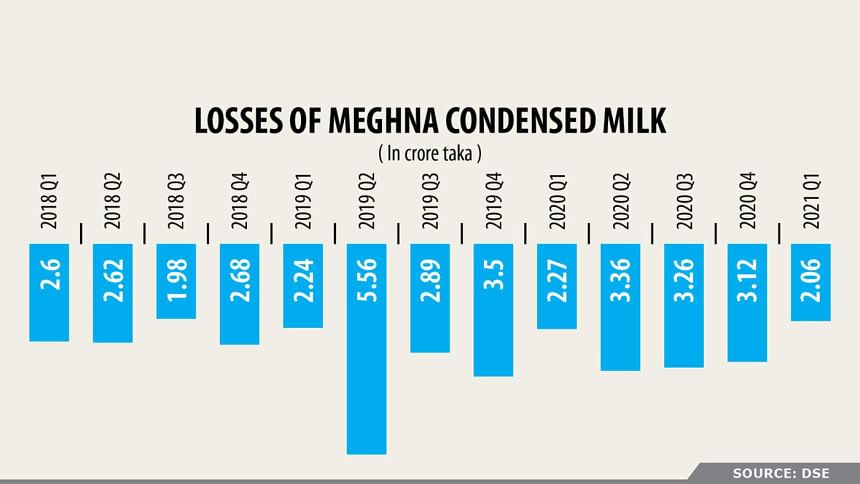

The condensed milk maker, which was listed on the Dhaka Stock Exchange in 2001, has been incurring losses since 2011. Its loss was Tk 12.1 crore in 2019-20 while it was Tk 12.4 crore a year earlier.

Its sales nosedived 44 per cent to Tk 3.61 crore in 2019-20, the same year that the company spent Tk 10.40 crore to pay back loans, according to the audited financial report.

"The company was in deep trouble due to its huge debt but the share price rose due to manipulation," a stock broker said.

Meghna Condensed Milk owes about Tk 64 crore to banks, the financial report shows.

And due to its huge debt, its net asset value per share was around Tk 59.5 in the negative, it said.

The DSE listed it as a Z-category company because of its poor dividend records.

The auditor of Meghna Condensed Milk gave a qualified opinion in its financial report, which is given when the auditor feels there is a limitation on the scope of the audit examination or the auditor disagrees with the disclosure of a matter regarding financial statements.

The company's cash, credit and overdrafts was Tk 35 crore, of which the audit firm did not find any bank statement against Tk 22.7 crore to confirm the amount as loans were classified, the auditor said in its report.

"We did not get any bank statement to confirm the amount of its finance cost as those loan accounts were classified," it said.

"The company lent Tk 2.5 crore to its sister concern but there was no financial gain from this investment. Besides, we could not find any valid documents against this investment," the auditor added.

Officials of Meghna Condensed Milk could not be reached over phone for comments by the time this report was filed.

In addition, Meghna Condensed Milk did not provide any mobile contact number of its company secretary on the DSE website even though this is compulsory.

On the issue, Mohammad Rezaul Karim, spokesperson of the Bangladesh Securities and Exchange Commission, said the regulator has been working on low performing companies.

"And we are taking steps on a case-to-case basis," he added.

Some of the low performing companies are sent to the OTC market while others go to the ATB or face board restructuring.

"This company is also on our radar so we will take decisions in serial fashion," Karim said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments