EBL, Visa team up to help banks cut card operations cost

Visa Worldwide Pte Ltd has partnered with Eastern Bank Ltd to roll out a solution to offer trustee services to its member banks, the first of its kind in Bangladesh.

The arrangement will help banks operate card transactions by maintaining cash collateral.

A virtual signing ceremony was held yesterday between EBL and Visa to introduce the solution.

"This is the first time a local commercial bank in Bangladesh is going to provide such a service," said M Khorshed Anowar, deputy managing director of the private commercial bank, at the programme.

Only one international bank provides the national net settlement service for Visa in Bangladesh, he said.

"With the improvement in technological infrastructure in our country, I firmly believe that there exists scope for local banks to provide the national net settlement service."

Currently, Visa has 29 member banks in Bangladesh and the total collateral amounts to about $25 million.

Currently, such collateral, both for domestic and cross-border settlement obligations, is provided by the way of USD-denominated standby letters of credit (SBLC) issued by the international bank in favour of Visa.

An SBLC is a legal document that guarantees a bank's commitment of payments to a seller in the event the buyer, or the bank's client, defaults.

In exchange for the SBLC facility, member banks of Visa give commission to the foreign bank, which makes payments to merchants if the card-issuing lender fails to repay the sellers.

But the arrangement between Visa and EBL will help the banks avoid the SBLC for settlement for domestic card transactions.

Subscriber banks will keep collateral with EBL to avail of the service. EBL will provide a certain amount of interest against the deposits as well.

But thanks to the new initiative, banks will largely be able to sidestep the SBLC and thus charges since around 80 per cent of total card transactions routed through Visa are domestic. The member banks will, however, have to follow the SBLC facility to settle foreign transactions.

"From now on, EBL will be engaged as the trustee for this structure of Visa. With the introduction of the service, the collateral execution structure of Visa member banks will get a new dimension," Anowar said.

Ahmed Jamal, a deputy governor of the Bangladesh Bank, hailed the initiative, saying it would reduce the outflow of foreign exchanges from the country.

He believes most banks will be interested in signing up for the alternative arrangement for domestic settlements instead of subscribing to the SBLC.

Ali Reza Iftekhar, managing director of EBL, described the deal as a new chapter in the EBL-Visa relationship and a historic one for the local banking industry.

EBL has always been a pioneer in product and service innovation.

"This alternative solution to the USD-denominated standby letters of credit is not only a cost-effective option for Visa member banks in Bangladesh but has also other additional benefits for its stakeholders," Iftekhar said.

Soumya Basu, Visa's country manager for Bangladesh, Nepal and Bhutan, thanked EBL for partnering with Visa in rolling out the collateral arrangement and urged Visa's member banks to take advantage of the seamless and cost-efficient business arrangement in the market.

The EBL-Visa tie-up will help the partner banks of Visa cut card operations costs, said an official of a commercial bank.

The arrangement will be hassle-free since banks have to have their subscription to the SBLC facility renewed every year. Besides, if card transactions go up, more money will be spent in the form of charges, he said.

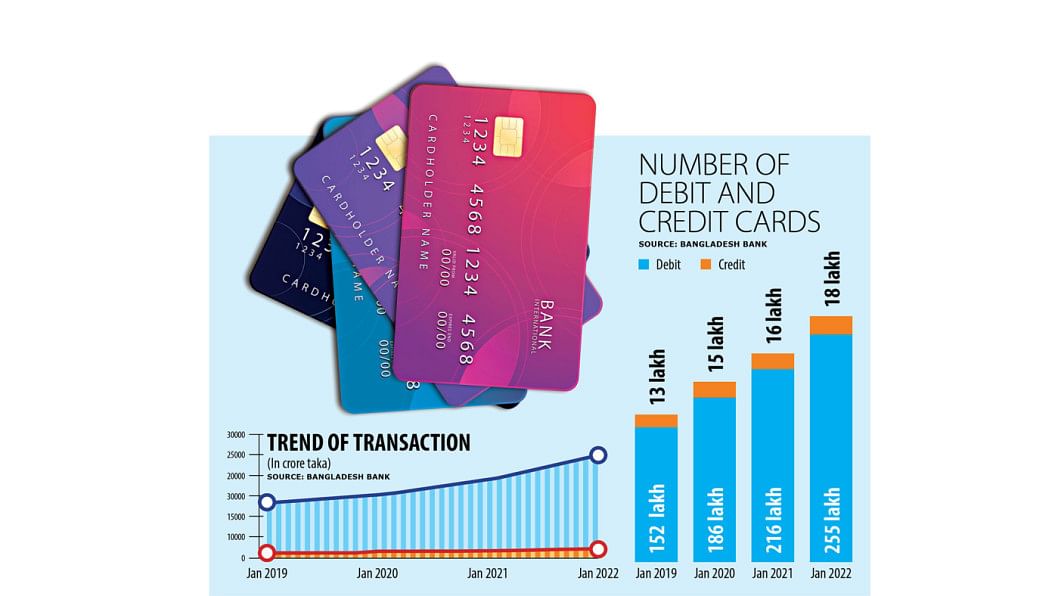

What is more, the banker says, the initiative will promote Visa cards in Bangladesh where the company currently has around 90 lakh card users.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments