Why stocks keep falling

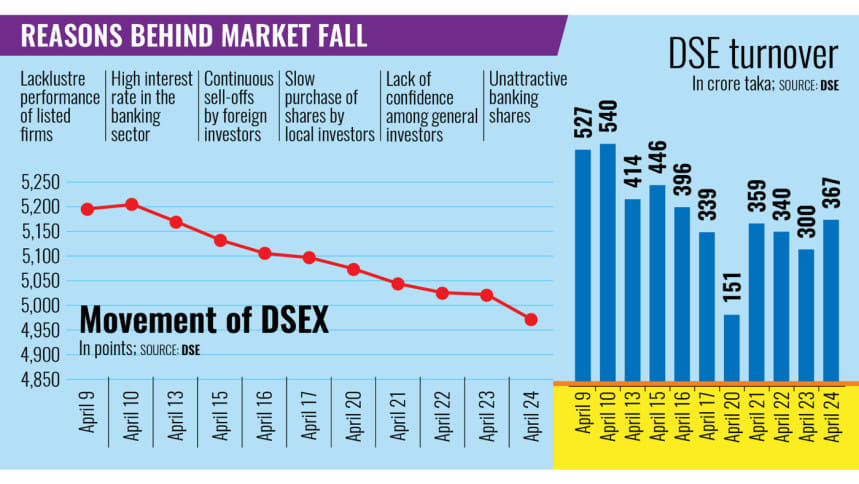

The stock market extended its losing streak for a ninth consecutive session yesterday, dragging the benchmark index of the Dhaka Stock Exchange (DSE) to a six-month low.

Analysts say a combination of factors, such as lacklustre corporate performance, a dearth of new listings by good companies, and weakening investor confidence, is responsible for the persistent downturn.

The DSEX yesterday shed 49 points, or nearly 1 percent, to close at 4,972. Over the past nine trading sessions, the index has plunged by 233 points, or 4.4 percent. This marks the first time since late October last year that the index has fallen below the 5,000 mark.

The market started to rally last year following the ousting of Sheikh Hasina-led government in August, amid widespread expectations of sweeping reforms. Investors were optimistic that promising companies would soon list.

This optimism pushed up the DSEX by 723 points, or 14 percent, to 5,952 in just seven trading days.

But the rally proved short-lived. Disappointment crept in as investors noticed a drop in profits among listed firms in fiscal year (FY) 2023-24.

The situation worsened in the July-September quarter of FY25, reinforcing the downward trend.

"There was a huge expectation after August 5 that company earnings would rise in a reformed Bangladesh," said Shekh Mohammad Rashedul Hasan, managing director and CEO of UCB Asset Management.

"But many sectors struggled due to high inflation, rising interest rates, and lower government spending. The expectation was sentiment-driven," he commented.

According to an analysis of financial reports, listed firms across all sectors recorded an average year-on-year profit decline of around 24 percent during the January-September period last year.

High inflation has led to reduced household consumption, hitting consumer-focused and construction-related companies particularly hard. Besides, government cutbacks on infrastructure projects have further weakened the construction sector.

"As a result, stocks dropped," said the CEO of UCB Asset Management.

Hasan said, "The stock market is also closely linked to interest rates. When interest rates rise, stock prices usually fall, and vice versa. We've seen this pattern before, in 2017, 2021, and earlier."

He said that the current high interest rates are contributing to the market's decline.

Hasan said the role of foreign and institutional investors in any market is very important, as they usually provide "patient capital" during down markets.

The asset management firm CEO said their absence in the market has been conspicuous.

"Deterred by the artificial overvaluation of the local currency and the imposition of a floor price, foreign investors have been consistently selling for several years," he commented.

"When foreign investors see a country propping up its currency and introducing price floors, they rush to sell to protect their capital. It's normal," he said.

Hasan urged local institutional investors to take advantage of the downturn, calling it "a high time to invest" in quality stocks, as he expects a rebound in "the near future."

Yesterday, the Shariah-compliant DSES index dropped 1.47 percent to 1,104.70, while the DS30, comprising blue-chip companies, slipped 1.20 percent to 1,845.

In a slight silver lining, turnover rose by 22 percent to Tk 367.14 crore, suggesting a slight increase in investor activity despite the ongoing bearish mood.

Out of 395 issues traded, 52 advanced, 300 declined, and 46 remained unchanged.

Energypac Power Generation topped the gainers' list, jumping 9 percent, while Eastern Bank shares tumbled by 20 percent.

Shakil Rizvi, a director of the DSE, expressed concerns over high interest rates, saying they have driven investors towards safer options such as bank deposits, savings certificates, and treasury bonds.

"The stock market has slowed, and with no IPOs in the past eight months, investors are earning very little from their holdings," he said.

"On top of that, they must pay an annual BO account fee of around Tk 500. Many are exiting the market, selling shares and closing their accounts," Rizvi added.

According to data from the Central Depository Bangladesh Ltd (CDBL), around 1 lakh BO accounts were closed in the past year — a 5.5 percent decline.

Rizvi said that bank and non-bank financial institution shares remain unattractive due to large volumes of non-performing loans and questionable lending practices. Some companies have not even published their financial statements for 2023.

According to him, given the weight of banking stocks on the index, their poor performance has had a broad impact.

"The only bright spot is that no poor-quality companies have listed over the past eight months," Rizvi added. "But with turnover this low, even strong companies will hesitate to enter the market."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments