WB identifies four sectors ripe for reform

Bangladesh has the potential to attract significant investment and generate millions of jobs by carrying out key reforms in four promising sectors -- green readymade garments (RMG), housing for the middle class, paint and dyes, and digital financial services, according to a new report by the World Bank Group.

The Bangladesh Country Private Sector Diagnostic (CPSD), unveiled yesterday at the Bangladesh Investment Summit 2025, identifies the sectors as ripe for reform due to their relative maturity and the political feasibility of implementing change.

Although not the only drivers of growth, these industries were singled out for their capacity to stimulate investor confidence, both domestic and international, and to signal that Bangladesh is ready to do business, the report said.

It said that by improving the business climate in these areas, Bangladesh could trigger a ripple effect, encouraging reforms in interconnected sectors.

This, the report suggests, could set off a virtuous cycle of structural transformation to help address the country's pressing challenges around employment and productivity.

The World Bank estimates that targeted interventions could create up to 2.37 million jobs each year in the construction sector by supporting new housing developments for middle-income families.

A further 664,000 formal jobs could be generated by expanding local production of paint and dyes. Reforms in digital financial services could yield between 96,000 and 400,000 additional jobs.

The report lays out a roadmap of actionable reforms aimed at boosting investment, generating employment and ensuring competitiveness in a post-LDC context.

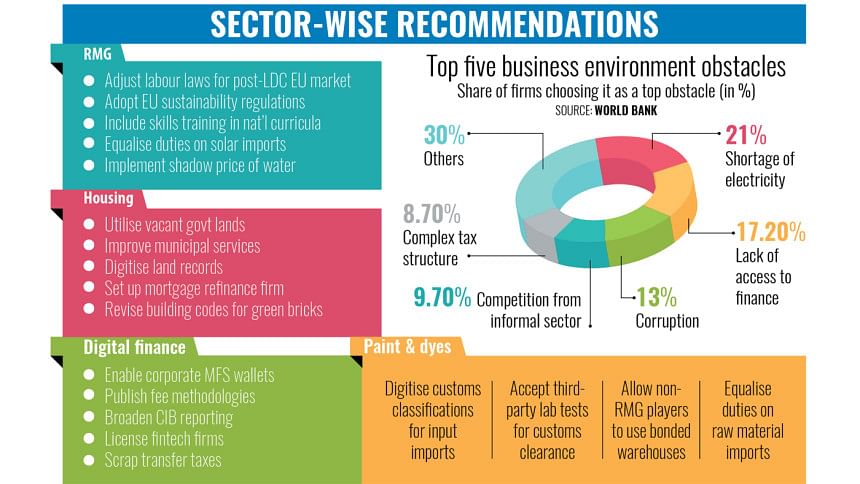

However, several long-standing issues and obstacles must be worked out first. Businesses continue to grapple with unreliable electricity, limited access to finance, corruption and intense competition from the informal sector.

Besides, the report calls for modernising customs procedures and rationalising tariff structures, saying that prolonged clearance times often force importers to stockpile goods at great cost.

At a panel discussion during the launch of the report, bKash CEO Kamal Quadir pointed to quick wins that could significantly boost private investment.

"There are many low-hanging fruits that can be solved easily and promote private sector investment," he said. "Make sure that the challenges would not repeat."

In the report, the World Bank proposed several sector-specific reforms.

For the RMG sector, it recommended upgrading production to meet EU standards, with a focus on sustainability, labour conditions and environmental impact.

In housing, it urged the government to improve the regulatory framework around digital mapping and property registration to ensure market-based property valuations, an essential step towards expanding access to mortgages.

In the paint and dyes industry, digitising customs classifications for imported raw materials would speed up clearance and help firms comply more easily with regulations, according to the report.

To encourage digital payments and financial inclusion, the report suggested allowing mobile financial service providers to offer merchant wallets with higher transaction limits, thereby facilitating wholesale transactions and expanding business use of digital platforms.

With a growing population and changing economic landscape, the report said that Bangladesh must urgently remove bottlenecks to private investment and unlock new engines of growth.

It emphasised that the proposed reforms have wider applicability and could serve as a blueprint for improving the overall investment climate, protecting jobs and building on existing development achievements.

During the panel discussion, Chowdhury Ashik Mahmud Bin Harun, executive chairman of the Bangladesh Investment Development Authority (Bida), said that the World Bank's recommendations could help lay the foundation for private sector-led growth.

"The interim government is dedicated to fostering growth by creating a more conducive business environment and supporting the expansion of emerging industries," he said. "Bida is also prioritising these sectors as the country urgently needs job creation."

He also called on the World Bank and IFC for both funding and diplomatic backing to implement the recommended reforms.

Gayle Martin, the World Bank's interim country director for Bangladesh, also advocated for reform.

"With new and emerging challenges, Bangladesh needs urgent and transformative policy and institutional reforms to help firms expand domestically, compete globally, and create millions of jobs for its youth entering the labour market each year," she said.

"This report recommends concrete policy actions to overcome barriers to private sector growth and job creation. The World Bank Group stands ready to work with the government and all stakeholders to keep Bangladesh on a strong and inclusive growth path," she added.

Martin Holtmann, country manager of the International Finance Corporation (IFC) for Bangladesh, Bhutan, and Nepal, said, "As part of the World Bank Group, IFC is committed to supporting Bangladesh in strengthening its private sector and driving economic growth."

He said, "The report offers a strategic roadmap to make these sectors more competitive and attract investment. By working together, we can create jobs and improve livelihoods, accelerating sustainable development."

Lutfey Siddiqi, chief adviser's envoy for international affairs, invited the private sector to engage in dialogue on the challenges and opportunities within these four sectors so the interim government can take swift action.

The report launch concluded with a panel discussion where Arun Mitra, head of Operations at Nippon Paint; Selim R.F. Hussain, managing director of BRAC Bank; Sharif Zahir, managing director of Ananta Group; and Srabanti Datta, managing director of ABC Real Estate, were present.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments