Wage growth slips again, squeezing low-income households

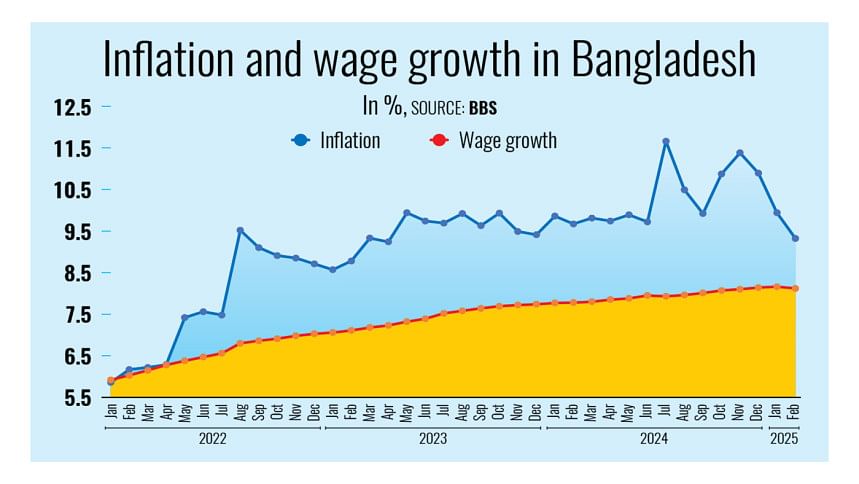

Wage growth slowed in February and was outpaced by inflation for the 37th consecutive month, further eroding real incomes and making low-income groups increasingly vulnerable amid rising costs of living.

According to the Wage Rate Index (WRI) of the Bangladesh Bureau of Statistics (BBS) -- which tracks the wages of informal workers paid daily across 63 occupations in the agriculture, industry, and service sectors -- the wage rate grew 8.12 percent in February, down from 8.16 percent a month earlier.

This was the second time the growth rate was low compared to the previous month since January 2021, as per BBS data.

This left the gap between inflation and wage growth at 1.2 percentage points last month, forcing low-income and unskilled workers to cut consumption, according to analysts.

A recent report on Bangladesh by the Food and Agriculture Organization of the United Nations (FAO) supports this assertion.

The FAO stated that the number of people in Bangladesh facing high levels of acute food insecurity increased by 70 lakh to 2.36 crore in December last year, compared to 1.65 crore at the end of October 2024.

"The decline in wage growth will further impact low-income groups," said Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development.

"This will force them to compromise on balanced diets, with protein-rich and essential foods being excluded from their meals."

However, Mujeri believes this decline is a result of the ongoing economic downturn.

In a healthy economic environment, wage growth typically aligns with overall economic expansion. However, given the current economic reality, the economy is not functioning dynamically, he said.

"Growth is stagnant across most sectors, and where it exists, it's minimal. In this situation, wage growth seems highly unlikely," he said.

Echoing those sentiments, Mohammad Lutfor Rahman, a professor of economics at Jahangirnagar University, said the slowdown in development spending has contributed to the lower growth rate.

After the ouster of the Awami League government in August last year, development activities in the country, including those in the private sector, declined significantly.

For example, the implementation of the Annual Development Programme (ADP) stood at just 21.52 percent in the first seven months of fiscal year 2024-25 as public works were hindered by political unrest, according to planning ministry data.

Due to the decrease in demand, day labourers are not receiving higher wages, Rahman said.

However, inflation has eased slightly in each of the past three months.

Last month, the Consumer Price Index (CPI), which measures changes in the prices paid by consumers, dropped to 9.32 percent from January's 9.94 percent, according to the BBS data.

"The recent decline in inflation appears to be seasonal rather than policy-driven. Prices of vegetables and some essentials have fallen due to increased winter supply, but whether this trend will continue after Ramadan remains uncertain," said Mujeri, also a former chief economist of Bangladesh Bank.

"By mid-year, we may see inflationary pressures rising again unless proactive measures are taken."

He said simply monitoring retail markets would not be enough to curb inflation.

"Take the case of edible oil. Many argue that market syndicates or influential groups that control supply chains play a key role in keeping prices high," he said.

"So, reducing its price requires intervention at the distribution and supply chain levels, not just in retail markets."

Another prime example is rice remaining persistently high. Despite a good Aman harvest and large-scale government and private-sector imports, there has been no significant decrease in rice prices, he said.

This suggests weaknesses in market management, allowing dominant market players to maintain high prices, he alleged.

"If inflation remains persistent, it will continue to weigh heavily on low-income groups, further exacerbating economic hardship," said Mujeri.

The government needs to address inflation at its root, including by addressing supply chain inefficiencies and market syndication, he suggested.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments