US loses cotton market share in Bangladesh

The United States is losing its market share in cotton exports to Bangladesh amid concerns about logistics and the lengthy shipment duration for American cotton, according to a recent report by the US Department of Agriculture (USDA).

Bangladesh's millers imported 7.8 million bales of cotton in the marketing year (MY) 2023-24, beginning in August.

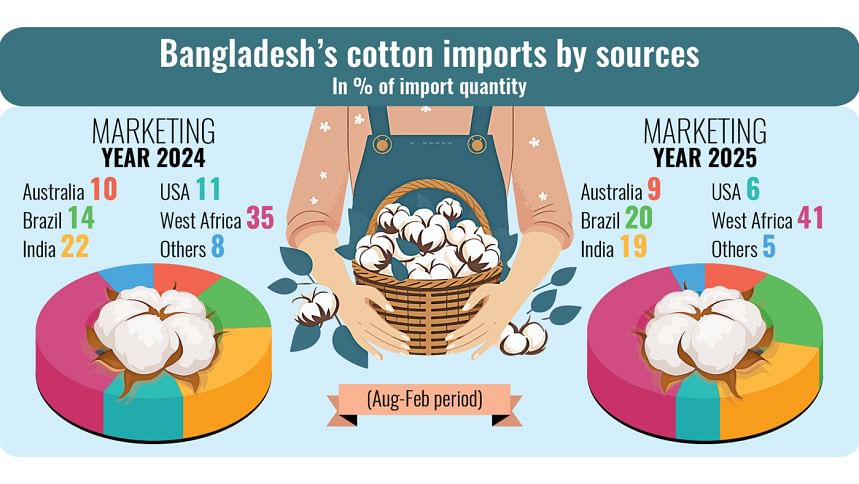

Of that, the share of US cotton, a key raw material for the country's apparel industry, was 9 percent. A year ago, in MY23, the share of cotton imported from America was 10 percent.

During the first seven months of MY25, local importers bought 286,056 bales of cotton from the US. The amount was only 6 percent of the total import of the item, down from 11 percent during the same period a year ago.

The USDA's report came just days before the Trump administration hiked tariffs on goods from 60 countries, including Bangladesh, entering the American market.

Bangladesh's exports will face a 37 percent higher tariff in the US market following Trump's tariff hike, which has created worries among exporters. It also prompted Chief Adviser Muhammad Yunus to write to the US President, promising to significantly increase imports of US farm products, including cotton.

The government is also finalising a dedicated bonded warehousing facility in Bangladesh, where US cotton will have duty-free access, according to the letter.

Citing its industry contacts, the USDA said the quality of US cotton is better than cotton from other sources.

"Many spinning mills in Bangladesh prefer US cotton; however, they always express concerns about the logistics and lengthy shipment duration required to obtain US cotton," it said in its Cotton and Products Annual report released on March 31.

The agency said many cotton merchandisers sell South American and West African cotton while it is afloat.

"This practice helps to reduce the shipment duration. However, US cotton is not sold afloat. Merchandisers also store their cotton in nearby warehouses in ports in Malaysia, Singapore, and Sri Lanka. Cotton from these warehouses can be delivered to Bangladesh in just seven days."

As per the report, West African countries and Brazil gained market share in cotton exports.

The West African countries collectively supplied 1.9 million bales, 41 percent of Bangladesh's total imports during the first seven months of this marketing year, the USDA said.

The US agency said the market share of West African and South American cotton is gradually increasing based on these logistical benefits, which allow importers to take advantage of price shifts.

"As a single country, Brazil emerged as the major raw cotton supplier to Bangladesh during this period," it said. Brazil exported 970,487 bales, comprising 20 percent of the market share, followed by India with 887,600 bales and a 19 percent share.

"Spinners prefer to buy Brazilian cotton due to its competitive pricing, increased availability during the harvesting season, and supply stability. The shipment period is also shorter for Brazilian cotton as it is often sold while it is afloat."

Cotton imports to rise

The US agency forecast an increase in cotton imports by Bangladesh to 8.2 million bales in MY26, up 1.2 percent year on year.

The report, citing industry contacts, said the RMG sector has shown resilience and growth despite recent political upheavals that led to the ouster of Sheikh Hasina's government in August 2024. The unrest led to factory shutdowns and a decline in international work orders. However, the industry has rebounded.

"With law and order restored, international clothing brands have resumed placing new orders since mid-January 2025, fostering optimism among garment exporters, with an increase in work orders from early 2025 boosting the demand for cotton."

"As the RMG industry is expecting a resurgence in work orders, the demand for raw materials, including cotton, will increase," it said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments