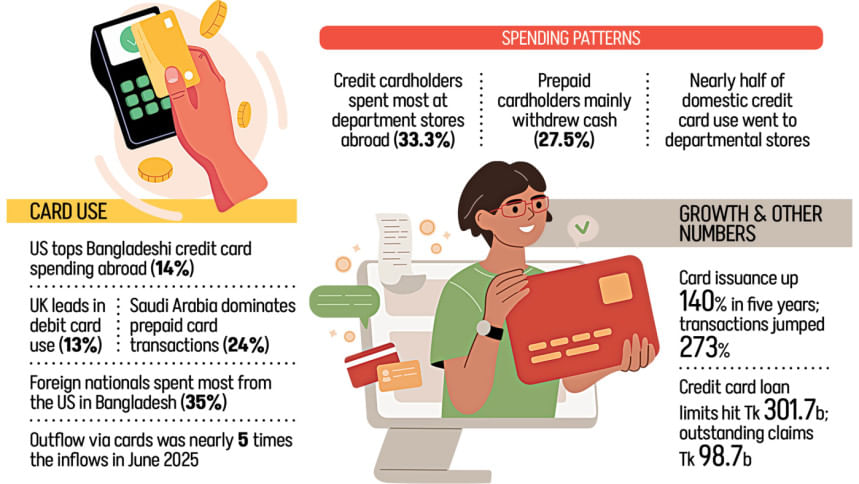

US leads in Bangladeshi credit card spending abroad

Bangladeshi nationals spent the most on credit cards in the United States, debit cards in the United Kingdom, and prepaid cards in Saudi Arabia in June this year, according to a recent report by Bangladesh Bank.

The central bank report, titled "An Overview of Cards Usage Pattern Within and Outside Bangladesh", shows that 14 percent of Bangladeshi credit card transactions abroad took place in the US.

In comparison, 13 percent of debit card spending occurred in the UK and 24 percent of prepaid card transactions in Saudi Arabia.

According to the report, foreign nationals in Bangladesh also relied heavily on cards. The largest share of their spending came from US-issued cards, which made up 35 percent of total inflows.

The report highlights how Bangladeshis used their cards overseas.

Department stores accounted for the biggest share of credit card spending at 33.3 percent. Other categories included retail services, transport, pharmacies, business services, clothing, and a range of other sectors.

Prepaid card users showed a different pattern. In June, they withdrew cash most often, which represented 27.5 percent of all transactions.

This was partly because credit card acceptance among merchants, such as street vendors and small roadside stores in Saudi Arabia, where Bangladeshi prepaid card users generally transact, is limited.

"This is one reason why prepaid card users prefer to withdraw cash for the sake of convenience," said Sabbir Ahmed, country manager of Visa for Bangladesh, Nepal and Bhutan.

The use of cards has expanded rapidly in recent years. Over the past five years, the number of debit, credit, and prepaid cards issued rose by 140 percent, while the total transaction volume grew by 273 percent.

Between June 2024 and June 2025, domestic credit card use rose steadily. Cross-border transactions fluctuated during the period but ended slightly higher, up 4.8 percent in June 2025 compared with a year earlier.

The central bank report also noted frequent swings in card spending by foreign nationals in Bangladesh.

Their card use fell between June and October 2024, returned to normal levels in November, climbed steadily until February 2025, dipped in March, rose in April, then fell sharply again in June.

At home, nearly half of all credit card transactions in June 2025 were at department stores, showing a clear preference for retail shopping.

Meanwhile, debit and prepaid cards used abroad showed distinct patterns.

Debit card spending reached Tk 3.47 billion across 631,671 transactions, with department stores, cash withdrawals, and government services accounting for almost half of all payments.

Prepaid card spending totalled Tk 593 million from 125,002 transactions. Cash withdrawals dominated at 27.5 percent, followed by department stores and business services.

Overall, the combined outflow from all three card types reached Tk 9.57 billion in June this year. Inflows during the same month stood at Tk 1.95 billion.

This means Bangladeshis spent nearly five times more abroad using cards than foreign nationals spent within the country.

According to Visa, foreign travellers, particularly business travellers, were fewer in number in June this year due to the long Eid holidays.

The report also said that by June this year, 44 scheduled banks and one non-bank financial institution had sanctioned Tk 301.7 billion in disbursable credit card loans. The total outstanding balance, or claims on cardholders, stood at Tk 98.71 billion.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments