Unilever Consumer Care’s profit hits 3-year low

Unilever Consumer Care Ltd yesterday reported a profit drop to its lowest level in three years, affected by factors, including a decline in revenue.

The nutrition, hygiene, and personal care company, a subsidiary of Unilever, recorded a 31 percent decline in its earnings per share (EPS) to Tk 34.62 in 2024, compared with Tk 49.89 the previous year.

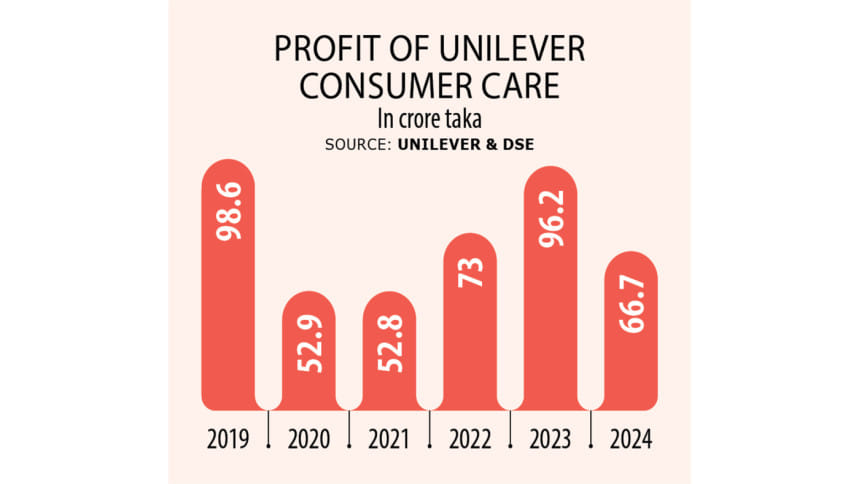

As a result, its profit after tax for the period stood at Tk 66.7 crore, down from Tk 96.2 crore in the financial year 2023.

Majority-owned by Unilever Overseas Holdings BV, the company attributed the profit decline to a "lower one-off benefit resulting from the reassessment of past liabilities and obligations, as well as the reimposition of technology and trademark royalty by the parent company from the third quarter of 2024 onwards."

"The increase in expenses was partially offset through operational efficiency and the effective investment of cash, resulting in higher net finance income," Unilever Consumer Care said in a price-sensitive disclosure yesterday.

Despite the earnings drop, the company declared a 520 percent cash dividend, or Tk 52 per share of Tk 10 each, for its shareholders—the highest in five years.

Yet, shares of Unilever Consumer Care dropped by 0.51 percent to Tk 2,501.90 yesterday on the Dhaka Stock Exchange.

Unilever noted that although its profit declined, its net operating cash flow per share—an important indicator of a company's liquidity—rose to Tk 25.62 in 2024 from Tk 25.43 the previous year.

Its net asset value per share also increased, primarily due to a rise in cash, cash equivalents, and short-term investments.

At the end of January this year, the company's sponsors and directors held 92.80 percent of shares, while institutional investors owned 3.60 percent, and general shareholders held 3.49 percent.

In 2020, Unilever Consumer Care acquired 82 percent of GlaxoSmithKline's health food and drinks business in Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments