Transport operators to face higher tax

Road and water transport operators are set to face 25 percent higher taxes on their earnings from next fiscal year as the revenue authority feels tax collection from the transport sector is not up to the mark.

“We get insignificant amount of taxes, especially from the land transport sector, although its share in GDP is quite high,” said a senior official of the National Board of Revenue requesting anonymity.

The spike in taxes, which comes five years after the NBR had increased the presumptive tax from road and water transport owners, is expected to fetch higher revenues, he said.

Land and water transport accounts for nearly 8 percent of the country’s GDP in fiscal 2018-19. Yet, tax collection from all vehicles, including personal cars, hover around Tk 1,000 crore, according to data from the Bangladesh Bureau of Statistics and the NBR.

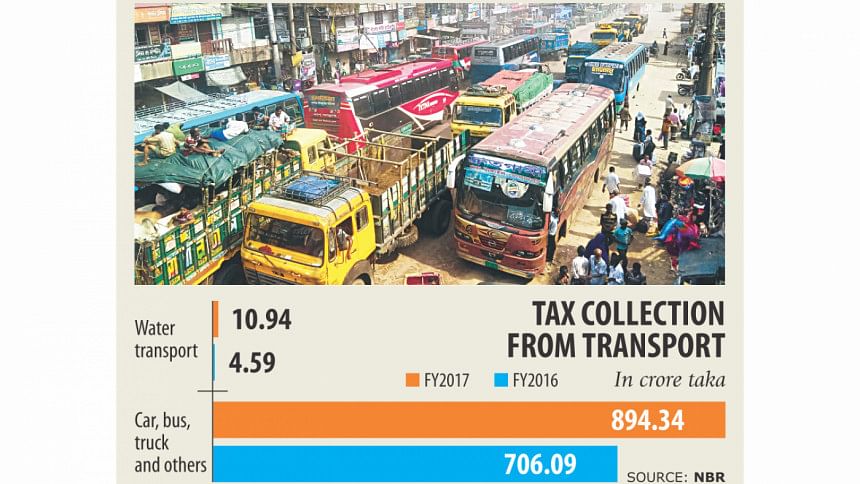

The latest data on tax collection from vehicles, including buses and trucks, is not available. The recently released NBR’s annual report for fiscal 2016-17 showed that the tax collector got Tk 894 crore, up 21 percent year-on-year.

It got Tk 10.94 crore in tax from inland water transport, up 58 percent from fiscal 2015-16.

Currently, a bus owner has to pay Tk 9,000 for a 52-seater bus as tax every year and Tk 12,500 for a vehicle with more than 52 seats. The same Tk 12,500 tax is applicable for a five-tonne capacity truck.

Owners of luxury and air-conditioned buses have to count Tk 30,000 for each bus.

Inland water transport operators have to pay tax based on the carrying capacity of passengers and cargoes.

Owners of passenger carrying vessels have to pay Tk 100 for each passenger.

Transport operators have to pay the tax for each regardless of their income per bus, truck or vessel, the NBR official said.

The decision to increase the tax followed meetings with representatives of transport owners associations. It means if tax is hiked 25 percent, the total amount of presumptive tax for a below 52-seater will be Tk 11,250.

A notification will be issued in this regard soon, the official added.

To avail the scope to pay presumptive tax owners of vehicles and vessels will have to submit their income tax returns.

Presumptive tax for transport sector has been on for more than three decades, said Khondaker Enayet Ullah, secretary general of Bangladesh Road Transport Owners Association (BRTOA). And a 25 percent hike in fixed tax would affect the transport sector that has approximately 3 lakh bus, truck, minibus and other commercial vehicles.

“It would not be logical to hike tax to such an extent in one go. New entrepreneurs will not feel encouraged to invest in this sector.”

Despite the increase, there would be no impact on fares of passenger for the tax hike, he said.

However, Ramesh Chandra Ghosh, chairman of Bangladesh Bus Truck Owners’ Association, declined to comment on whether the fare would be increased for the higher tax. “It cannot be said without examining the notification.”

The transport sector is not in a good financial health, with operators functioning by borrowing from banks at high rates of interest.

“Now we are being burdened with increased tax,” said Ghosh, who is also the managing director of Shyamoli Paribahan, a major inter-district bus operator.

Md Badiuzzaman Badal, senior vice-president of Bangladesh Inland Waterways Passenger Carrier Association, said they had a meeting with the NBR high-ups regarding the tax hike.

“We have no disagreement with the 25 percent increase,” he said. He, however, said the imposition of 5 percent value-added tax on passenger vessels would affect budget passengers. “We were told that VAT would be imposed on AC cabin passengers,” he said. As a result of 5 percent VAT fares will increase.

“From where do we get the money if we do not take the tax from passengers?”

Overall, the NBR will have to collect Tk 325,600 crore in fiscal 2019-20, Tk 113,912 crore of which should come from income tax.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments