Tea production falls amid bad weather, quality push

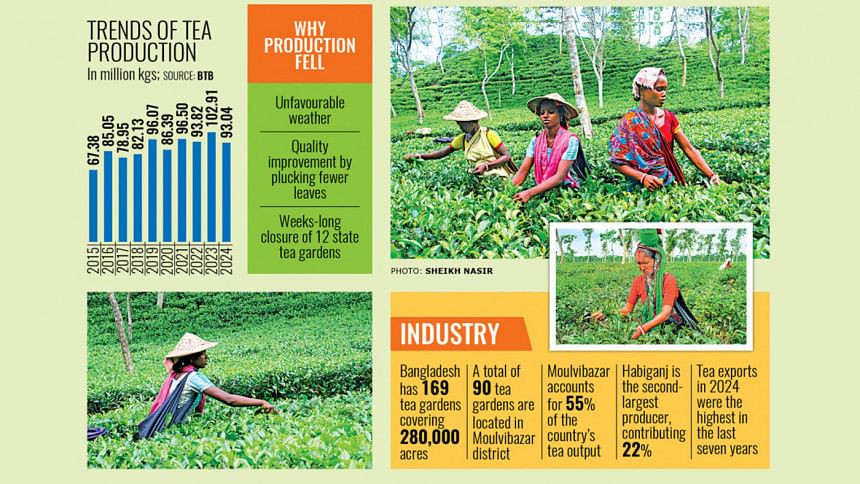

After a record high output in 2023, the country's tea production declined last year because of unfavourable weather conditions and tea estates opting for quality improvement to secure better rates.

Tea production stood at 9.30 crore kilogrammes in 2024, down from 10.2 crore kilogrammes the previous year, according to the Bangladesh Tea Board (BTB).

Pijush Dutta, a member of research and development at the BTB, said the decline was mainly due to erratic rainfall last year, which made weather conditions unsuitable for tea cultivation.

The tea industry in Bangladesh dates back 184 years. Most tea gardens are located in the north-eastern swathe of Bangladesh, while many northern districts have also started growing tea in recent years.

However, the quality of tea produced in the northern region is lower than that of its north-eastern counterparts.

According to Dutta, tea estates, including those in the north, focused on quality improvement last year, which could have contributed to the lower production.

Another factor behind the decline was the prolonged closure of 12 state-owned tea gardens under the National Tea Company for more than 10 weeks in 2024 after the August political changeover, he told The Daily Star.

Dutta said the board was working to ensure that both quality and quantity improve simultaneously.

Meanwhile, tea garden owners see no potential shortage in the domestic market despite the decline, as the surplus from the record production in 2023 can cover the shortfall.

According to them, the country also does not need to import tea, as local demand has decreased.

Similar to the tea board, the Bangladesh Tea Association, a platform for garden owners in the greater Sylhet and Chattogram districts, blamed inconsistent rainfall and climate change for the production decline.

Kamran Tanvirur Rahman, chairman of the association, said that tea cultivation requires moderate rainfall, but higher-than-usual rainfall during the monsoon season last year adversely affected the yield.

Bangladesh has 169 tea gardens spanning more than 280,000 acres.

Of these, 90 are in Moulvibazar district in Sylhet, which accounts for 55 percent of the country's total production. The second-largest producer, Habiganj, contributes 22 percent.

The peak tea production season in Bangladesh is from June to November, and the country's annual tea demand is currently 8.5–9 crore kg, according to industry sources.

EXPORTS HIT 7-YEAR HIGH

In 2024, Bangladesh's tea exports reached their highest level in seven years, as competitive pricing gave the country an edge over major exporters like India and Sri Lanka.

Exporters said a key driver of the increase was the preference of Bangladeshi diasporas for tea sourced from their homeland.

As of December 2024, Bangladesh exported 24.5 lakh kilograms of tea — the highest annual volume since 2017, when exports stood at 25.6 lakh kg — according to the BTB.

Last year's exports fetched the country Tk 382.52 million. However, tea exports have fluctuated widely in recent years.

BTB data shows that exports stood at 6.5 lakh kg in 2018 before falling to 6 lakh kg in 2019. While exports rebounded to 21.7 lakh kg in 2020, they plummeted to 6.8 lakh kg in 2021.

The volume has been rising since, reaching 7.8 lakh kg in 2022 and 10.4 lakh kg in 2023.

Industry insiders attributed the recent growth to competitive pricing, as Bangladesh offers tea at lower prices while Indian and Sri Lankan brands cater to premium segments.

Bangladesh is currently the world's ninth-largest tea producer, accounting for around 2 percent of global production, according to the BTA.

China is the largest producer, followed by India, while Sri Lanka, Kenya, South Korea, and Japan are also among the top tea-producing nations.

After independence in 1971, Bangladesh had been exporting tea to several countries, including the UK, until 1990.

Despite recent export fluctuations, the BTB has set an ambitious export target of more than 1.5 crore kg for 2025 — far higher than trends in the past two decades.

The highest amount of tea exported in a single year was 1.5 crore kg in 2002, according to the BTB.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments